The strength of the Swiss franc (CHF) has been the topic of countless “expert” analyses for over a year and it has received considerable coverage in the mainstream financial press. In fact, the last time the currency garnered this much interest was probably in 2011, when its celebrated “safe haven” status backfired, as investors fled to it in droves and pushed the price to levels that forced the Swiss National Bank (SNB) to intervene and peg it to the euro....

Read More »The Swiss franc’s “phenomenal” bull run

The strength of the Swiss franc (CHF) has been the topic of countless “expert” analyses for over a year and it has received considerable coverage in the mainstream financial press. In fact, the last time the currency garnered this much interest was probably in 2011, when its celebrated “safe haven” status backfired, as investors fled to it in droves and pushed the price to levels that forced the Swiss National Bank (SNB) to intervene and peg it to the euro. Or perhaps it was when...

Read More »Swiss Franc worth more than a Euro

This week, the Swiss franc rose to beyond parity with the euro as traders sought safe haven assets as concerns about risks to global growth grew. © Cameracraft8 | Dreamstime.comThe Euro-Swiss Franc pair fell below 1.00 franc per euro during the morning of 29 June 2022 and remained below 1.00 until the morning of 1 July 2022 when the value of a euro exceed that of a franc. The pair has not been this low since 2015. The rise has been driven by the franc’s haven status and the Swiss...

Read More »Swiss National Bank intervenes heavily to weaken Swiss franc

Official data recently released by the Swiss National Bank (SNB) show it sold 51.5 billion Swiss francs while acquiring US dollar and euro-denominated assets in a bid to weaken the franc over the first quarter of 2020. © Michael Müller | Dreamstime.comThe data followed comments by SNB President Thomas Jordan signalling that even larger interventions may be on the cards in the future. Switzerland’s long-running battle with its overvalued currency has drawn criticism from the US. In...

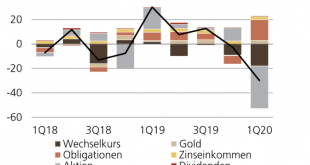

Read More »SNB dürfte im ersten Quartal 30Milliarden Franken verlieren

Die SNB dürfte im ersten Quartal des laufendenJahres einen Verlust von rund CHF 30 Mrd.ausweisen. Die Coronakrise führte zu einem Kurssturz anden Aktienmärkten und zu einer Aufwertung desFrankens auf breiter Basis, beides schadete demErgebnis der SNB. Tiefere Zinsen und ein stärkererGoldpreis wiederum verhinderten einen nochhöheren Verlust Angesichts einer Ausschüttungsreserve von fast CHF85 Mrd. sind die Auszahlung an Bund und Kantoneselbst nach diesem Rückschlag...

Read More »Will CHF/GBP Be a Good Currency Pair for Investment in the Future?

Sponsored link anchor: transferring money from Switzerland to UK Trade between the UK and Switzerland is robust these days and it’s not going to get any worse for a long time. Even with the economic turmoil resulting from Brexit, the trade between these two countries was set to stay strong due to the special deal signed by them in 2019. As the situation stands now, trade agreements are solid, so these business relationships should only strengthen. Of course, this...

Read More »Swiss Central Bank under Pressure as Franc Rises

Yesterday, the Swiss franc reached its highest level against the euro in two years. The EUR/CHF exchange rate reached 1.097 on 24 July 2019, a rate not seen since early 2017. Source: Valeriya Potapova - Click to enlarge Upward pressure on the franc is partly being driven by expectations of interest rate cuts by eurozone and US central banks. In addition, the franc is considered a safe haven currency and...

Read More »Swiss central bank under pressure as franc rises

Yesterday, the Swiss franc reached its highest level against the euro in two years. © Valeriya Potapova | Dreamstime.comThe CHF/EUR exchange rate reached 1.097 on 24 July 2019, a rate not seen since early 2017. Upward pressure on the franc is partly being driven by expectations of interest rate cuts by eurozone and US central banks. In addition, the franc is considered a safe haven currency and typically rises when global risk perceptions rise. The Swiss National Bank (SNB) has...

Read More »All this borrowing to consume is unsustainable and the bill is overdue

INTERVIEW WITH KEITH WEINER June has been an interesting month for gold, as geopolitical events, market fluctuations and developments on the monetary policy front fueled an exciting ride for the precious metal. As long-term investors with a strict focus on the big picture, short-term moves and speculative angles are largely irrelevant in and of themselves, but they do provide important signals that, without fail,...

Read More »All this borrowing to consume is unsustainable and the bill is overdue

INTERVIEW WITH KEITH WEINER June has been an interesting month for gold, as geopolitical events, market fluctuations and developments on the monetary policy front fueled an exciting ride for the precious metal. As long-term investors with a strict focus on the big picture, short-term moves and speculative angles are largely irrelevant in and of themselves, but they do provide important signals that, without fail, confirm the strategic superiority of precious metals holdings in this...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org