Macroview Several factors have led us to revise downward our target 10-year U.S. Treasury rate for end 2016. Read full report hereAs we arrive close to the end of the first half of 2016, it is time to revisit our 2016 scenario for US Treasuries. Since we formulated our scenario in October 2015, giving a target 10-year US Treasury yield of 2.7% for the end of 2016, many things have changed. First, the beginning of the year saw considerable turmoil in financial markets, with negative performances across the board up to February 2016, except for safe-haven sovereign bonds. Worries about a China hard-landing, a global recession and an implosion of US high yield due to low oil prices drove the US 10-year Treasury yield as low as 1.66% from a high of 2.3% in December when the US Federal Reserve decided to hike the federal funds rate for the first time in nine years. Second, US real GDP growth disappointed in the first quarter of 2016, with the +0.8% figure (q-o-q annualized) pushing our US economist’s average 2016 growth forecast down to 1.8% from the 2.3% he had predicted when we formulated our previous scenario. Third, at the end of 2015, markets and our US economist anticipated two hikes from the Fed in 2016, and these anticipations have now been revised down to one hike. The US 10-year Treasury yield had risen back up to 1.81% by 2 June, 2016.

Topics:

Laureline Chatelain considers the following as important: Macroview, US bond yields, US TIPS yields, US Treasuries, US Treasuries forecast

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Several factors have led us to revise downward our target 10-year U.S. Treasury rate for end 2016.

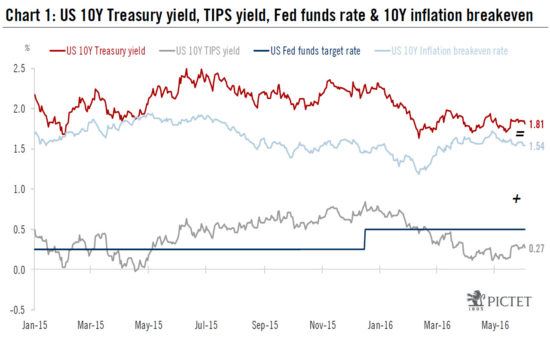

As we arrive close to the end of the first half of 2016, it is time to revisit our 2016 scenario for US Treasuries. Since we formulated our scenario in October 2015, giving a target 10-year US Treasury yield of 2.7% for the end of 2016, many things have changed. First, the beginning of the year saw considerable turmoil in financial markets, with negative performances across the board up to February 2016, except for safe-haven sovereign bonds. Worries about a China hard-landing, a global recession and an implosion of US high yield due to low oil prices drove the US 10-year Treasury yield as low as 1.66% from a high of 2.3% in December when the US Federal Reserve decided to hike the federal funds rate for the first time in nine years. Second, US real GDP growth disappointed in the first quarter of 2016, with the +0.8% figure (q-o-q annualized) pushing our US economist’s average 2016 growth forecast down to 1.8% from the 2.3% he had predicted when we formulated our previous scenario. Third, at the end of 2015, markets and our US economist anticipated two hikes from the Fed in 2016, and these anticipations have now been revised down to one hike.

The US 10-year Treasury yield had risen back up to 1.81% by 2 June, 2016. But this remains well below our former end-of-the-year target and the changes cited above necessitate a downward revision of our target to about 2.2% from the previous 2.7% for the end of 2016.

Nonetheless, we still believe US bond yields will go up. Our expectation that US GDP growth will accelerate in the second quarter of 2016 should, we believe, enable the Fed to proceed with its tightening of monetary policy and push the 10-year US TIPS yield up to 0.5% by the end of 2016. We also believe the 10-year US breakeven rate could rise to 1.7% by end-2016, according to our estimates—but still remain below its long-term average of 2%.