Get beyond endless Latin American headlines burning column inches and you come to far broader strategic conclusion: The seven ‘ugly Latino sisters’, namely Brazil, Venezuela, Ecuador, Bolivia, Colombia, Mexico and Argentina are all deep political trouble from collapsed benchmark prices. It’s merely a case of who’s in more advanced states of political decay where left leaning governments’ can’t hang on much longer vs. those trying to buy a bit of time with more ‘centrist’ positions. In either case, it’s going to be a classic example of too little too late where the seven ugly sisters have committed at least seven deadly sins when it comes to resource mismanagement over the past decade. This isn’t about whether crisis can be avoided, but how bad the impacts will be. Another ‘lost Latino decade’ beckons. The ugliest twins are obviously Brazil and Venezuela right now. We firmly expect Rousseff to be impeached next month on the back of endless corruption scandals, and the drastically ill-judged return of Lula that poured far more oil on corruption cover up flames. Watch for Michel Temer to take over the reins of a coalition PMDB government, busily negotiating posts behind closed doors with other players to tee up a formal Worker’s Party split to form a caretaker government through to 2018.

Topics:

Eugen von Böhm Bawerk considers the following as important: Bawerk, emerging markets, Energy, Featured, Latin America, newsletter, Politics

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

Get beyond endless Latin American headlines burning column inches and you come to far broader strategic conclusion: The seven ‘ugly Latino sisters’, namely Brazil, Venezuela, Ecuador, Bolivia, Colombia, Mexico and Argentina are all deep political trouble from collapsed benchmark prices. It’s merely a case of who’s in more advanced states of political decay where left leaning governments’ can’t hang on much longer vs. those trying to buy a bit of time with more ‘centrist’ positions. In either case, it’s going to be a classic example of too little too late where the seven ugly sisters have committed at least seven deadly sins when it comes to resource mismanagement over the past decade. This isn’t about whether crisis can be avoided, but how bad the impacts will be. Another ‘lost Latino decade’ beckons.

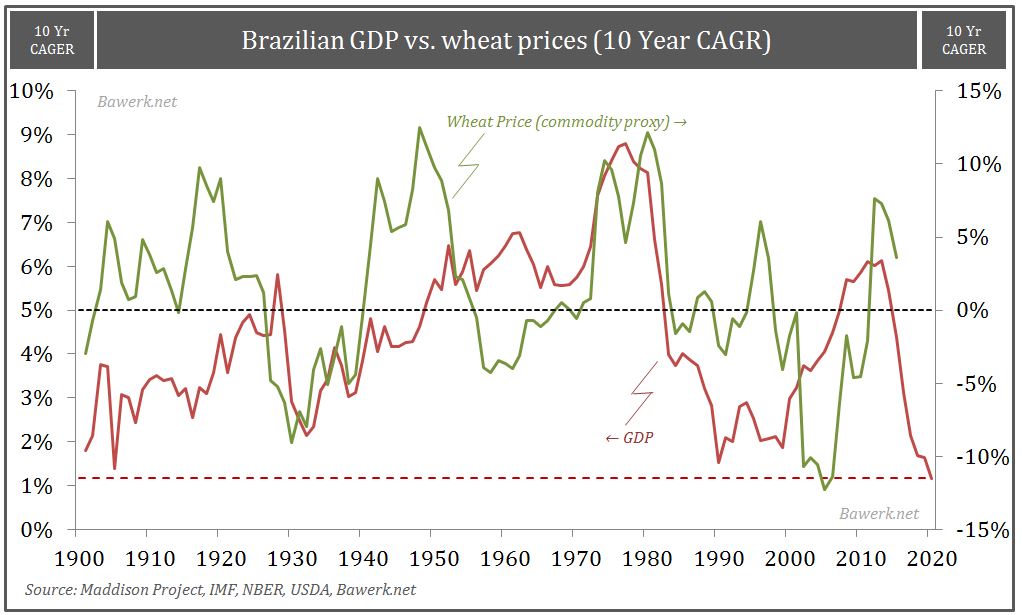

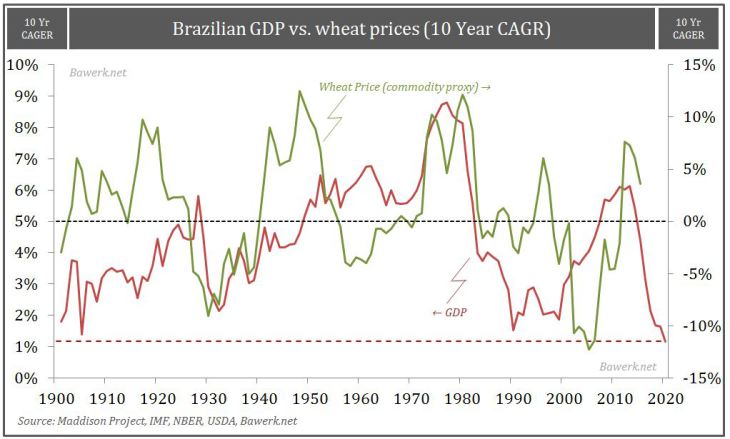

The ugliest twins are obviously Brazil and Venezuela right now. We firmly expect Rousseff to be impeached next month on the back of endless corruption scandals, and the drastically ill-judged return of Lula that poured far more oil on corruption cover up flames. Watch for Michel Temer to take over the reins of a coalition PMDB government, busily negotiating posts behind closed doors with other players to tee up a formal Worker’s Party split to form a caretaker government through to 2018. How much Temer can get done depends on how far the outstanding ‘car wash’ scandal still rubs off on PMDB factions for major economic reforms, where the rot still runs pretty deep. Initial rhetoric (and inevitable market lifts) on supposed ‘structural reforms’ and far broader liberalisation measures remain unlikely to play through. Although it’s possible Petrobras might push through 2017 licencing rounds purely for political appearances, it’s not going to deliver tangible results in current price environments. Dig just ‘under the salt’, and Petrobras leverage will remain high; local content even higher. Until Brazil can properly clear its electoral decks in 2018 Mr. Temer is going to have a very limited mandate. If anything, his core challenge is trying to make sure his caretaker outfit doesn’t end up ‘washed out’ day one, given Temer is by no means beyond political reproach, with the PMDB basically as corrupt as the ruling PT. The smart move for Brazil would actually be calling fresh elections with the TSE (electoral authority) invalidating the entire Rousseff-Temer 2014 ticket to put a line under what currently shapes up to be the worst commodity driven economic crash Brazil has ever experienced. Regrettably, Brazilian politics has nothing to do with national interests at this stage, and everything to do with narrow self-preservation societies.

Right on cue, that points us towards Venezuela where exactly the same PSUV dynamics are in play. Rather than trying to kick Maduro out of office, the PSUV is desperately trying to keep him in to take the interim pain (see Can Maduro Mayhem Last to 2017). The last thing they want is splintered opposition MUD forces launching a five month ‘recall referendum’ half way through Maduro’s term to remove him by the end of 2016. Not when the Party can actually ‘Constitutionally’ replace Maduro out of their own accord into early 2017 without needing a national election before 2019 to do so. As we’ve previously flagged, rear-guard PSUV tactics will include leaning heavily on the National Election Board (CNE) and various courts to undermine any referendum ballot. And continuing to extend ‘emergency rule’ for Maduro without the National Assembly’s (Parliamentary) blessing to do so. That debunks any notion Venezuela is even pretending to run its affairs by Constitutional strictures at this stage. Good old fashioned PSUV power grabs are back in vogue. But whether the Party can realistically drag things out that far depends on how much Chinese cash keeps coming Caracas’s way given $50bn sunk PSUV costs – and more importantly – whether economic collapse sparks mass social unrest. Short term power plant outages are getting Venezuela headlines as a potential supply problem of late, but the broader concern remains complete state collapse, and associated ‘transitional military rule’ for the generals to safeguard whatever’s left of dwindling economic rent, without being put behind MUD bars. Given structural default is now inevitable in Venezuela where the ‘government’is spending 90% of all oil exports purely to service debts, supply side losses are almost certain to accrue under Maduro’s remaining rule. Venezuela isn’t just ugly, it’s the proverbial ‘elephant man’ of Latino politics.

Ecuador doesn’t look all that much better as the ‘surrogate sister’ of the Latino left. The OPEC minnow has seen a spate of public protests against the Correa presidency amid bloating deficits, tighter payments and dire need to find new forms of external funding. Correa himself can’t stand in 2017 after serving three terms since 2006, and appears willing to go relatively quietly without attempting Constitutional coups to extend his terms any further having unsuccessfully played that card in 2014. That said, he’ll look to current VP, Lenin Moreno to protect AP interests that isn’t going to make for a particularly ‘free or fair’ ballot in 2017 for more centrist candidates, Guillermo Lasso to contend. Petroecuador will be the cash cow of choice to keep the AP in control, with an injudicious mix of poor governance and Chinese loans about all Quito has left in the locker. Bolivia is obviously more of a gas story, but exactly the same political direction of travel applies to Evo Morales in La Paz where the aging leader lost a referendum to eliminate presidential term paving the way for his exit in 2019. The result will see fierce internal infighting across the Movement for Socialism Party for a prospective replacement, with Morales trying to secure his rentier interests behind the scenes. The fact he’s come under intense criticism for ongoing corruption around his office, including embezzlement and awarding of contracts to Chinese companies where he has ‘personal links’ remain a far broader trend across the Americas. When money runs out, the dirty linen starts to show. The only question for Bolivia is whether Morales will ultimately go smoothly, and whether the MAS can start charting more credible policy paths post-2019. Prospects for that aren’t particularly good in our view.

That duly gets us onto some of the supposedly politically prettier sisters of Colombia, Mexico and Argentina that are already on a more centrist path. The problem here isn’t whether they start making smarter political choices, but whether they’re going to be able to stay the course under lower price pressures. Being fair, President Santos hasn’t done much wrong in Colombia beyond staking allhis political capital on securing a peace agreement with FARC up to 2018. That might ultimately come good given Santos can’t stand for re-election third time round, but broader militant activities from the ELN (National Liberation Army) has already becoming an additional problem. Parse that to the corrosive effect of bandas criminales, and Santos needs to make a critical choice whether he keeps going ‘all in’ on peace deals towards 2018, or starts pulling back to give his own Partido de la Unidad Nacional candidates a better electoral chance in a couple of years’ time. Everyone knows even if Santos strikes a FARC deal to cut the head of the ‘paramilitary snake’, splinter groups will almost certainly proliferate as a result, continuing to hit Ecopetrol operations across the board. Previous attacks on the flagship Bicentennial pipeline gives us a decent proxy for why the national champion will struggle to get much beyond 1mb/d production, irrespective of more stringent contractual terms on the table. Once Santos is gone, the chances of Colombia taking a hard-line turn for the worse back against paramilitary organisations actually remains acute. Under all core political scenarios, the 2000s Colombian supply growth story has had its day.

Meanwhile President Nieto has staked his entire house on PEMEX opening up along a more centrist path. Despite PEMEX still registering massive $30bn year on year losses, depletion setting in fast, with major midstream gaps and massive (circa $830bn) investment deficits, the prospects of this sticking over the longer term look increasingly slim. Beyond price collapse, the fundamental problem is Nieto can’t stand again in 2018 under six year limits, with broader PRI support for longer term openings far from secure. So called round zero in 2014 and P2 (probable) reserves (2015) might be enough to steady the ship on PEMEX depletion. But whether that’s really going to follow through onto Deep Water Gulf of Mexico acreage or the complex Chicontepec formations towards 2018 simply isn’t going to happen given Nieto won’t be around to see PRI initiatives through. If anything, the lower oil prices go, the more likely it becomes that Andres Manuel Lopez Obrador stands a serious chance of winning the 2018 election on a far left PRD ticket that’s going to ward off any prospective investment from 2017 on, given the clear political risk entailed. Nieto was brave jumping through a narrow window of political opportunity to open PEMEX up; but it’s looking increasingly likely to close long before his six year tenure is up. All that just leaves Argentina as the final Latino‘sister’ that’s applied plenty of Cambiemos (Let’s Change) lipstick under Mauricio Macri, who finally managed to overhaul incumbent FPV advantages to ease Kirchner out of Presidential office in October 2015. The problem is that Argentina’s problems now run so deep, Mr. Macri’s room for manoever is relatively limited. Congress is still stashed full of Peronist hardliners that will cling on for all their worth in 2017 mid-terms to stave off majority Cambiemos rule. Any initial economic medicine applied by Macri is also likely to plunge Argentina further into contraction, not growth. Measures that will come with blowback political consequences. More likely than not, YPF’s core task will be looking at restoring self-sufficiency once more sensible domestic pricing structures are in place, not going after dead, Vaca Muerta cows in the foreseeable future. We could probably go on with even more Latino examples, but bring that all together, and ‘seven ugly sisters’ is probably a bit unfair on Latin America. Seven dwarfs is probably a more fitting epithet, without snow white commodity prices to