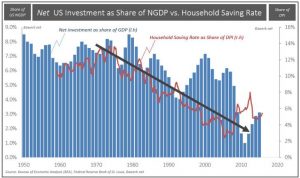

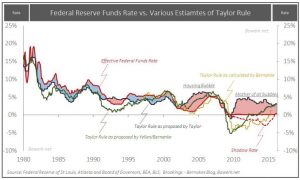

Ben Bernanke’s creativity inspired a generation of economists and central bankers. QE, ZIRP and NIRP established a new class of economics that is mathematically sound but practically disastrous. Billions of dollars were transferred from savers to investors to boost the economy, but the wizards of quant forgot that something has to give. In this case, it was the formation of a pension crisis that threatens the golden years of millions of retirees across the world. None of the econometrics models provide a solution for the growing gap in pension funding, other than unsustainable debt accumulation.

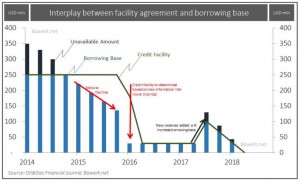

Creativity cascaded to the less sophisticated pension fund managers. In a desperate reach for yields they increased

Read More »