After nearly ten years of European Union (EU) opposition to certain controversial Swiss tax structures, Switzerland’s government agreed a deal in 2014 to do away with such arrangements. Under current rules Swiss cantons can offer preferential tax rates to certain companies, mostly multinationals with most of their activity abroad. This is now changing. What are preferential tax deals? They are special low tax deals Swiss cantons offer only to specific companies. In the canton of Vaud, the regular company tax rate is 21.65%. Companies on special low tax deals on the other hand are paying around 11% according to Anne-Sophia Narbel at Centre Patronal. These deals are part of a package of things that encourage companies to base their operations in the canton, and they have worked well. According to Anne-Sophia Narbel, 218 Vaud-based companies employing more than 9,200 people, benefit from one of these deals. In addition to providing work, these companies paid CHF 447 million of company tax in 2011. Further tax revenue is generated on the more than one billion francs they pay in salaries. In total it is estimated these firms generate more than 5% of Vaud’s GDP and account for 25,000 jobs once all the spin-off jobs are included, according to the supporters of a new plan to change the way companies are taxed.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, Personal finance, RIE III, Swiss company tax changes, Swiss tax reform, Tax reform in Vaud, Vaud company tax changes, Vaud tax changes

This could be interesting, too:

Investec writes Swiss to vote on tenancy laws this weekend

Investec writes Switzerland ranked second in digital competitiveness

Investec writes Swiss wages set to rise in 2025

Investec writes Federal Council hopes to boost savings with pension change

After nearly ten years of European Union (EU) opposition to certain controversial Swiss tax structures, Switzerland’s government agreed a deal in 2014 to do away with such arrangements. Under current rules Swiss cantons can offer preferential tax rates to certain companies, mostly multinationals with most of their activity abroad. This is now changing.

What are preferential tax deals?

They are special low tax deals Swiss cantons offer only to specific companies. In the canton of Vaud, the regular company tax rate is 21.65%. Companies on special low tax deals on the other hand are paying around 11% according to Anne-Sophia Narbel at Centre Patronal.

These deals are part of a package of things that encourage companies to base their operations in the canton, and they have worked well. According to Anne-Sophia Narbel, 218 Vaud-based companies employing more than 9,200 people, benefit from one of these deals. In addition to providing work, these companies paid CHF 447 million of company tax in 2011. Further tax revenue is generated on the more than one billion francs they pay in salaries. In total it is estimated these firms generate more than 5% of Vaud’s GDP and account for 25,000 jobs once all the spin-off jobs are included, according to the supporters of a new plan to change the way companies are taxed.

Why are these arrangements in the firing line?

An EU commission decided in 2007 that these preferential deals were a form of state aid, gave Switzerland an unfair advantage, and were not compatible with agreements signed between Switzerland and the EU.

Time is up on Swiss tax deals – © Aleksandar Dickov | Dreamstime.com

Along with EU pressure, an OECD project with similar aims called the Action Plan on Base Erosion and Profit Sharing (BEPS), wants tax rule changes that will reduce profit shifting, a practice where multinational companies shift profits from high tax countries to low tax ones.

Switzerland is not the only country in the firing line. The EU is instigating change across Europe, while the OECD project has even wider geographic reach.

What is changing in Switzerland?

Most cantons are responding by replacing preferential deals with lower standard corporate tax rates. Neuchatel was an early mover. It started reducing its company tax rate from 22.17% in 2012 to 15.61% in 2016. According to Centre Patronal, the experience has been positive. There has been a 3.56% annual increase in the number of companies setting up in the canton.

What is Vaud’s plan?

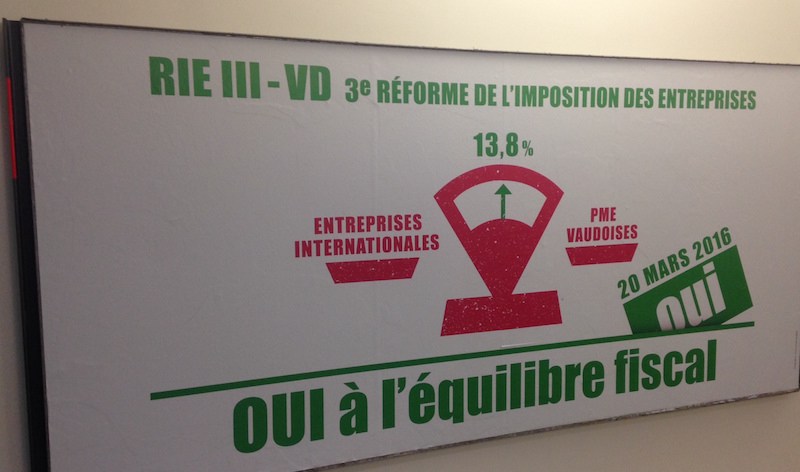

Vaud has hashed out a plan, called RIE III-VD, to move to a lower standard company tax rate of 13.79%, applicable to all companies. Concessions have been made to get various political parties on board, among them, more money for child care and increased social payments for children. Extra funding will come from an increased levy of 0.08% of salaries, which is to be paid by employers. Payments made to parents with children will increase from CHF 230 per child per month to CHF 330.

The new standard tax rate will be phased in starting in 2017, and completed by 2019, when the related federal tax reforms come into force. Special tax deals will end in 2019. Increased child based payments will phased in from 1 September 2016 and be completed by 2022.

The 13.79% rate chosen will put the canton of Vaud in a competitive position. The lowest tax rate in Switzerland in 2015 was 12.32% in Lucerne. It compares well other european rates in countries such as Ireland (12.5%), the UK (20%), the Netherlands (25%), Belgium (33.99%), France (33.33%), Germany (29.65%), Italy (31.4%) and Luxembourg (28.8%).

All of the main political parties and the majority of the canton’s parliament and the grand council are behind the planned changes. The Socialist party also supports it, however some politicians on the far left oppose it.

Supporters of the plan, fear losing the companies that were attracted to the canton by low taxes. They are keen to see a standard tax rate that is low enough to retain the majority of these firms. They argue the risk of losing jobs, company tax and the tax on the salaries these companies pay their staff, is greater than any pain brought by lower company tax receipts.

Vaud’s Grand Council – Source: Wikipedia – Photo by Ludovic Péron

Those against the plan, such as the Parti Ouvrier et Populaire Vaudois (Popular workers’ party), say supporters have miscalculated the loss of tax revenue that will come with the new lower standard tax rate. They fear this large hole in the canton’s finances will be filled by cuts in public services and higher taxes on workers. In an interview with 24 Heures, David Gygax, secretary of Vaud’s public services union (SSP) estimates an annual drop of CHF 520 million in company tax revenue.

Other concerns include sharp falls in tax revenue in certain communes. Communes that are predominantly home to companies on preferential tax deals could see their tax revenues rise as these companies pay higher taxes. Those with few or no such companies on their soil will see there company tax income decline. An article in Le Courrier talks of a CHF 13 million gap in the commune budget in La Chaux-de-Fonds in the canton of Neuchatel.

Vote on 20 March 2016

The plan will be put to a public vote on 20 March 2016.

The following video (in French) presents the arguments put forward by those support the plan, urging voters to vote ‘yes’.

POP’s arguments for voting ‘no’ are presented here (in French).

More on this:

‘No’ campaign website (in French)

Yes campaign website (in French)

Canton of Vaud website (in French)

Take a 5 minute French test now

For more stories like this on Switzerland follow us on Facebook and Twitter.