Investec Switzerland. The SMI is set to finish flat this week (-0.12%), outperforming global equity market (MSCI World -0.68% ) with European stocks losing value after the long awaited ECB policy meeting. Stock markets around the world were mixed with risk appetite increasing ahead of Thursday’s European Central Bank (ECB) policy meeting and falling thereafter. The ECB lowered all its main interest rates and expanded its quantitative-easing purchase plan quantity (by €20 billion per month), and scope (including corporate bonds within its asset purchasing program). Overall, the program exceeded economists’ and the market’s expectations. Share prices climbed after the announcement; however, gains were short-lived, as President Mario Draghi said he didn’t see any need to reduce rates further. ECB distorts exchange rates – © Jorg Hackemann | Dreamstime.com The Swiss National Bank may avoid having to cut rates again in its policy meeting next week after a surge in the franc proved to be temporary. The Swiss currency appreciated past 1.09 per euro on Thursday after the ECB announcement. However, the gain was short lived as the comments by Draghi reversed the euro’s decline.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, Swiss Franc, Swiss franc news, Swiss franc reacts to ECB action

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

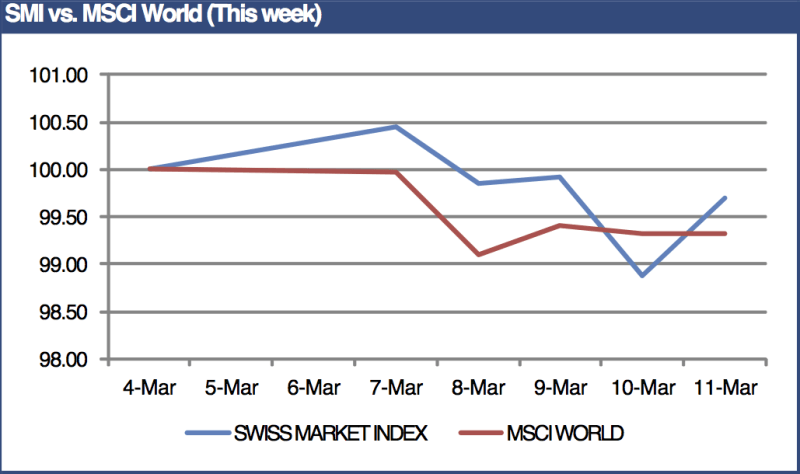

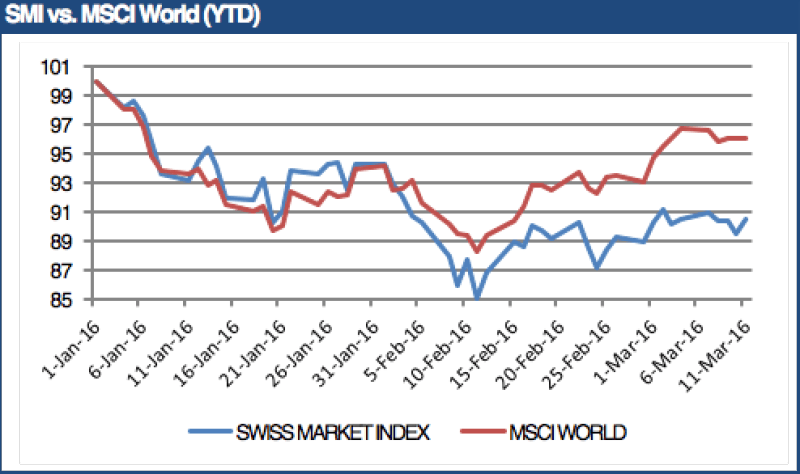

The SMI is set to finish flat this week (-0.12%), outperforming global equity market (MSCI World -0.68% ) with European stocks losing value after the long awaited ECB policy meeting.

Stock markets around the world were mixed with risk appetite increasing ahead of Thursday’s European Central Bank (ECB) policy meeting and falling thereafter. The ECB lowered all its main interest rates and expanded its quantitative-easing purchase plan quantity (by €20 billion per month), and scope (including corporate bonds within its asset purchasing program). Overall, the program exceeded economists’ and the market’s expectations. Share prices climbed after the announcement; however, gains were short-lived, as President Mario Draghi said he didn’t see any need to reduce rates further.

ECB distorts exchange rates – © Jorg Hackemann | Dreamstime.com

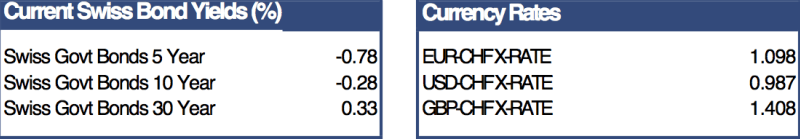

The Swiss National Bank may avoid having to cut rates again in its policy meeting next week after a surge in the franc proved to be temporary. The Swiss currency appreciated past 1.09 per euro on Thursday after the ECB announcement. However, the gain was short lived as the comments by Draghi reversed the euro’s decline. Thomas Jordan and his fellow policy makers in Switzerland, who for years have been contending with the fallout from euro-area decisions, will announce their monetary policy decision at 9:30 a.m. on March 17. Economists have previously speculated that the SNB could adapt its current policy by either stepping up currency market interventions or cutting the deposit rate, already at a record low of -0.75%, even further.

Swiss economic data was light this week, with Switzerland’s unemployment rate decreasing marginally in February, in line with expectations. The unadjusted jobless rate dropped to 3.7% in February from a near six-year high of 3.8% in the previous month, matching the consensus estimate. On a seasonally adjusted basis, the unemployment rate held steady at 3.4%. Last year, the Swiss economy was faced with uncertainties attributable to a strong Swiss franc, with manufacturing industries targeting the Eurozone recording reduced profits, leading to an increase in unemployment. Consumer spending was low in the fourth quarter 2015, but has improved significantly this year. The improvement on the unemployment rate can be attributed to bolstered market conditions in the manufacturing sector.

Company news from the SMI was also sparse with only the HR firm Adecco, reporting its 2015 annual results. The results reported overall so far have been disappointing, with 30% of SMI firms surprising analysts on the negative side. Moreover, sales decreased by 17%, with materials being biggest detractor with a decline of 42%. The Financials sector reported a staggering 86% fall in reported earnings, contributing heavily to the fall of 36% in earnings by the whole Swiss market index.