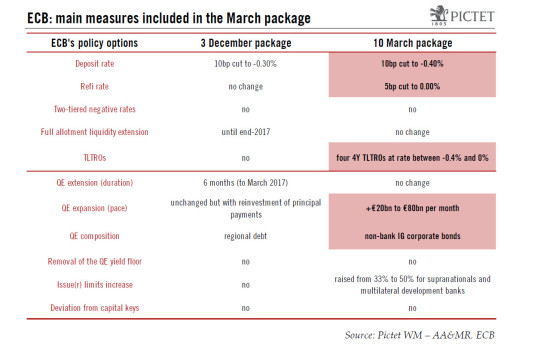

The ECB announced measures that exceeded expectations, targeting the refi rate, its monthly asset purchases, a new corporate bonds purchase programme, new TLTROs and a negative rate. The deposit rate was cut as expected, but Draghi said that “no more cuts” were anticipated at this stage. The ECB’s Governing Council delivered a comprehensive policy package that exceeded market expectations by a large margin. The 10bp deposit rate cut to -0.40% was expected but other measures were not, including a 5bp ‘refi’ rate cut (to 0%), a EUR20bn increase in the pace of monthly asset purchases (to EUR80bn), the inclusion of non-bank corporate bonds in the QE universe (starting in Q2), or the launch of four new Targeted Long-Term Refinancing Operations (TLTRO II) with a 4-year maturity and a negative rate. At the same time, Mario Draghi said that the ECB “does not anticipate more rate cuts” at this stage, pushing the EUR higher. Market volatility may also echo the large revisions to the ECB’s staff forecasts, including a long-term (2018) projection for HICP inflation at 1.6%, well below target.

Topics:

Frederik Ducrozet considers the following as important: ECB, Euro, euro area, Eurozone, Macroview, QE, Quantitative Easing, TLTRO

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

Marc Chandler writes Ueda Lifts Yen, Leaving Euro and Sterling Pinned Near Lows

The ECB announced measures that exceeded expectations, targeting the refi rate, its monthly asset purchases, a new corporate bonds purchase programme, new TLTROs and a negative rate. The deposit rate was cut as expected, but Draghi said that “no more cuts” were anticipated at this stage.

The ECB’s Governing Council delivered a comprehensive policy package that exceeded market expectations by a large margin. The 10bp deposit rate cut to -0.40% was expected but other measures were not, including a 5bp ‘refi’ rate cut (to 0%), a EUR20bn increase in the pace of monthly asset purchases (to EUR80bn), the inclusion of non-bank corporate bonds in the QE universe (starting in Q2), or the launch of four new Targeted Long-Term Refinancing Operations (TLTRO II) with a 4-year maturity and a negative rate.

At the same time, Mario Draghi said that the ECB “does not anticipate more rate cuts” at this stage, pushing the EUR higher. Market volatility may also echo the large revisions to the ECB’s staff forecasts, including a long-term (2018) projection for HICP inflation at 1.6%, well below target.

We draw three main messages from these announcements: 1) the ECB wanted to act boldly and pre-emptively to address the risks of second-round effects on inflation and the stress on the banking sector; 2) the ECB favoured the bank credit channel over the FX and rates markets, which in our view is a positive for growth; 3) the ECB made it clear that it was not running out of ammunition in terms of unconventional measures. Should more stimulus be required, we believe that the next logical step for the ECB would be to adjust QE parameters again, in terms of composition rather than in size.

Time will tell if those measures will be successful in boosting economic growth and inflation. On balance, though, we believe that such a policy package designed to boost bank lending and to improve QE implementation should lead to a significant easing of monetary and financial conditions. We are positive on the net impact of those measures on economic growth and bank credit and we retain our constructive outlook at this stage, including a 1.8% expansion in euro area GDP growth for this year.

March policy package: a first assessment

The ECB delivered a comprehensive package of new policy measures, which were announced altogether in a joint press release, although some technical details will require further clarification:

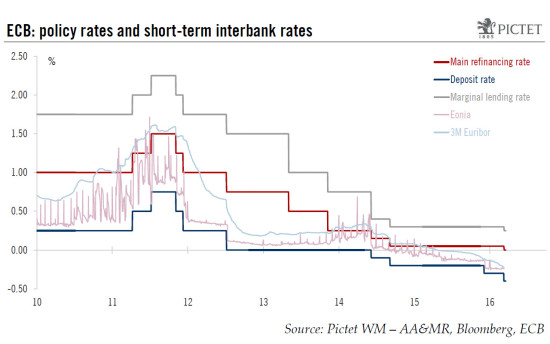

- A 10bp deposit rate cut, to -0.40%, but no more cuts for now.

The size of the rate cut was in line with expectations, although we thought that the door would remain open to further cuts. Taking everyone by surprise, Mario Draghi said that the ECB “does not anticipate more rate cuts” at this stage, although he added that the ECB’s stance could change under new economic circumstances. Policy rates are expected to remain at present or lower levels “for an extended period of time, and well past the horizon of our net asset purchases”, strengthening the ECB’s forward guidance. We no longer forecast another deposit rate cut to -0.50% in June.

In the absence of a tiered deposit system, the direct cost of negative rates will increase steadily under the new policy rates as the (bigger) QE programme is implemented, up to around EUR6bn by 2017 in our estimations. However, the cost will be skewed towards core banks while the new TLTRO II should help mitigate the cost, especially for peripheral banks (see below).

- A 5bp main refinancing rate cut, to 0.0%.

This was a surprise as the ECB seemed so far reluctant to cut its main refinancing rate further. The new 0% policy rate will apply to all refinancing operations (1-week MRO; 1-month and 3-month LTROS; and the TLTROs) for which banks will be able to borrow from the ECB for free against collateral.

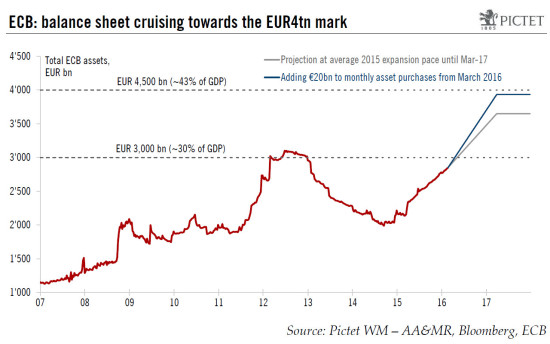

- A EUR20bn increase in the pace of monthly asset purchases (QE), to EUR80bn.

This was in line with our call, though more aggressive than market expectations. Total asset purchases will increase to EUR80bn per month from April 2016, adding EUR240bn until March 2017, “or beyond, if necessary, and in any case until the Governing Council sees a sustained adjustment in the path of inflation” consistent with its mandate.

The ECB’s holdings of securities under its Asset Purchase Programme (APP) stood at EUR775bn as at end-February, including EUR598bn under the Public Sector Purchase Programme (PSPP), EUR158bn under the third Covered Bond Purchase Programme (CBPP3) and EUR19bn under the Asset-Backed Securities Purchase Programme (ABSPP). At the projected rate, total asset purchases would reach EUR1.8tn by March 2017, or 17% of euro area GDP, and possibly more, unless the ECB tapers its purchases, a very unlikely option at this stage. The ECB’s balance sheet could reach (or exceed) the EUR4tn mark by 2017, over 40% of euro area GDP, not even accounting for the new TLTROs (see chart below).

Draghi expressed his confidence over a smooth implementation of the increased QE programme, including after the inclusion of corporate bonds (see below). Still, the shortage of (core) assets to buy may remain an issue, especially if markets anticipate another extension of the programme beyond March 2017, potentially translating into to an even flatter yield curve.

The ECB did not change other rules: it can only buy sovereign debt with a residual maturity between 2 and 30 years, a yield above the deposit rate (now -0.40%), no more than 33% of each security and no more than 33% of any country’s total debt on aggregate, with only limited exceptions. Those constraints could still be hit before long in Germany or in some smaller countries, forcing the ECB to adjust QE parameters again in the future.

We stick with our view that the most efficient option would be to set a broader definition of ‘substitute purchases’, allowing national central banks to purchase assets from other jurisdictions, if not tolerating an explicit deviation from the capital keys at least for any surplus of assets in the event that the monthly target could not be reached in some countries.

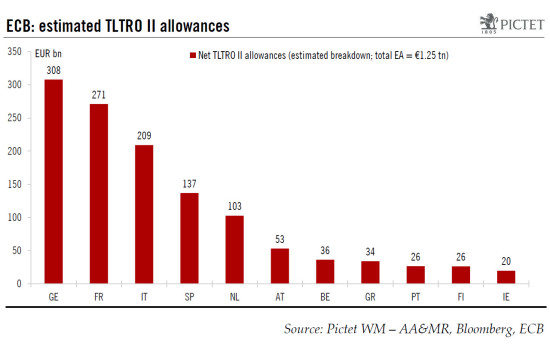

- Four new Targeted Long-Term Refinancing Operations (TLTROs), to be conducted each quarter between June 2016 and March 2017, each with a 4-year maturity and a rate comprised between the deposit rate (-0.40%) and the refi rate (0%).

The mechanics of the new TLTRO II are fairly complicated, and the ECB’s press release will be followed by a more detailed communication in due course. In summary, a new series of four targeted longer-term refinancing operations (TLTRO II) will be launched each quarter between June 2016 and March 2017. Each operation will have a fixed maturity of four years and a rate that will be fixed over the life of each operation, at the refi rate prevailing at the time of take-up (currently 0%), or lower for those banks whose net lending exceeds a benchmark similar to the previous TLTROs[1].

Banks will be allowed to borrow up to 30% of the stock of eligible loans (to non-financial corporations and households excluding loans for house purchase) as at 31 January 2016, or close to EUR1500bn, less any amount which was borrowed under the first two TLTRO operations conducted in 2014, or EUR212bn on aggregate. This would imply a maximum net allowance of around EUR1250bn under TLTRO II, for which we provide a tentative breakdown across countries, although national data are not available for the previous TLTRO take-up (see below).

Importantly, banks will be allowed to switch loans from TLTRO I to TLTRO II, benefitting from the more favourable terms. The key feature comes with the negative rates on those operations which should at least partly compensate for the cost of the negative deposit rate. From a broader macro perspective, this new framework is expected to (re-)create incentives for banks to lend to the real economy, in order to meet the programme benchmarks and benefit from even cheaper and longer funding. Lastly, the TLTROs will contribute to a strengthening of the ECB’s forward guidance.

- A new Corporate Sector Purchase Programme (CSPP) adding non-bank investment grade (IG) corporate bonds to the QE programme.

The inclusion of corporate bonds is not a surprise, or a game-changer, but the new CSPP should help QE implementation by broadening the universe of eligible securities. The technical details are rather scarce based on the ECB’s press release. CSPP will start “towards the end of the second quarter of 2016”. All securities that are eligible for collateral in ECB’s refinancing operations could be included in the CSPP in theory, “subject to further criteria”. No details were provided in terms of the breakdown of purchases across countries, sectors or ratings. Given investors’ concerns over poor liquidity conditions in some of those market segments, those technical rules should significantly influence the impact of the CSPP as well as the broader PSPP programme.

Euro-denominated non-financial IG corporate bonds amount to around EUR850bn in the iBoxx Corporate Index. Targeting one third of this universe would result in additional purchases up to EUR250-300bn.

- An increase in the issuer limits for sovereign bonds without Collective Action Clauses (CAC) to 50%.

The ECB decided to increase the issuer and issue share limits only for securities issued by eligible international organisations (SSA) and multilateral development banks, from 33% to 50%. In addition, the share of such securities purchased under the PSPP will be reduced from 12% to 10% while the ECB’s share of PSPP purchases will be increased from 8% to 10% in order to maintain a 20% risk-sharing regime.

Meanwhile there are some other measures which were expected by some observers, but that ECB ruled out at this stage:

- No QE extension beyond March 2017

- No multi-tiered deposit system

- No other change to QE modalities (issue limits; QE yield floor; capital keys.

ECB staff forecasts: surprisingly downbeat

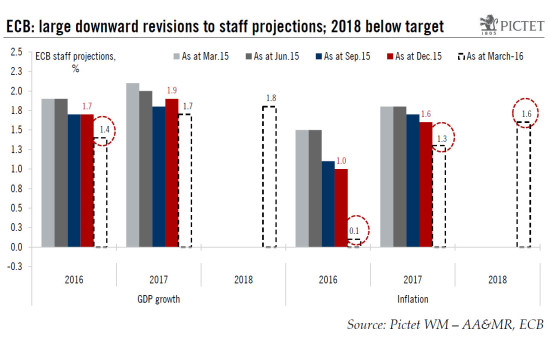

The ECB’s staff projections were surprisingly downbeat, reflecting weaker global activity but also growing concerns over the euro area outlook. Real GDP forecasts were lowered to 1.4% for 2016 (from 1.7% in December), to 1.7% for 2017 (from 1.9% in December), and set at 1.8% for 2018. Even accounting for external shocks and a roughly 5% stronger EUR in effective terms, those downward revisions appear surprisingly large, not fully consistent with domestic strength and the anticipated effects of new policy measures on financial conditions.

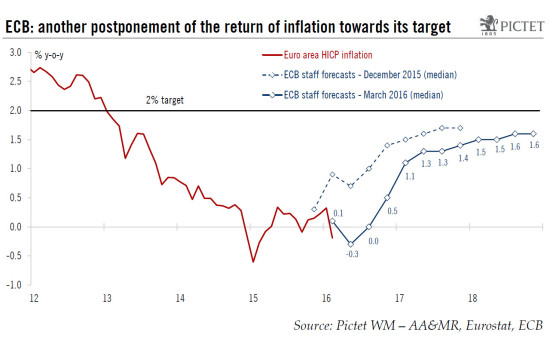

The real shocker came with inflation forecasts. The 2016 HICP projection was slashed to 0.1% (from 1.0% in December), largely due to a 35% drop in oil prices (core inflation was revised down to 1.1%, from 1.3%) and in line with our estimates of consumer prices’ elasticity to commodity prices and the currency. Meanwhile 2017 HICP was forecast at 1.3% (down from 1.1%) and the new long-term inflation projection (2018 HICP) was set at 1.6%, well below the ECB’s target of “below, but close to 2%”. This figure was surprisingly low considering that the ECB has been factoring in the anticipated impact of new policy measures since the launch of QE in Q1 2015.

In short, the revised ECB staff forecasts reflected another postponement of the return of inflation towards its target by one year, due to exogenous factors (lower oil, stronger EUR) but also as the result of weaker momentum in domestic prices. The threat of second-round effects on core inflation, however contained at the moment, is the main reason why the ECB decided to take bold action, in our view. For now the ECB’s staff continues to forecast a long-term (2018) core inflation rate at 1.6% as the output gap “narrow steadily over the projection horizon” although some concerns were visible in terms of employment, in particular, which should rise “at a slightly lower rate than previously expected”.

We see two possible interpretations of these downbeat staff projections. One possibility is that the ECB’s staff did not incorporate the full impact of newly-announced measures, via portfolio rebalancing, FX or other expectations channels, in a deviation from the methodology which was introduced in March 2015. After all, the new corporate bonds purchase programme and the new ‘TLTRO II’ will not start before June. The ECB may be willing to reassess monetary and financial conditions before a thorough analysis is conducted[2]. Another possible explanation is that the ECB has decided to set a lower bar in terms of economic forecasts, trying to avoid yet another disappointment after such a bold move. The hope could be that upcoming data finally start to surprise on the upside, reducing the need for additional action.

Conclusion: don’t fight the ECB (bis)!

At the very least the revisions to the staff forecasts suggests to us that the ECB stands ready to ease its monetary stance further if needed amid growing concerns over ‘lower for longer’ inflation rates.

We draw three main messages from these announcements: 1) the ECB wanted to act boldly and pre-emptively to address the risks of second-round effects on inflation as well as the potential adverse effects of financial stress on the banking sector – two red flags in the current economic context; in other words, the current situation did not warrant a monetary bazooka, but the deterioration in the balance of risks to the medium-term macro outlook did; 2) the ECB decided to favour the bank credit channel over the FX and rates markets, which in our view is a positive for growth despite a potential short-term cost; 3) the ECB made it clear that it was not running out of ammunition in terms of unconventional measures.

Should the ECB decide to add to its monetary stimulus, we believe that a first logical step would be to adjust the parameters of QE once again, skewing additional asset purchases towards peripheral debt and other riskier securities rather than increasing the programme’s size.

[1] The lower TLTRO rate will be calculated as follows: “counterparties will receive the maximum rate reduction equal to the difference between the MRO rate and the rate on the deposit facility applicable at the time of take-up if they exceed their benchmark stock of eligible loans by 2.5% in total as at 31 January 2018. Up to this limit, the size of the decrease in the interest rate will be graduated linearly depending on the percentage by which a counterparty exceeds its benchmark stock of eligible loans.” The lending benchmarks will be similar to previous TLTROs: “for counterparties that exhibited positive eligible net lending in the 12-month period to 31 January 2016, the benchmark net lending is set at zero. For counterparties that exhibited negative eligible net lending in the 12-month period to 31 January 2016, the benchmark net lending is equal to the eligible net lending in that period.”

[2] The first comprehensive assessment of ECB’s PSPP came more than six months after the programme was implemented.