Overview: The US dollar is consolidating with a slight downside bias ahead of the June CPI report. The euro held above .00 but is still pinned in the trough. The rate hike by the Reserve Bank of New Zealand failed to have much impact. On the other hand, the JP Morgan Emerging Market Currency Index is lower for the fourth consecutive session. Most of the large markets in the Asia Pacific region rose, led by a 2.7% rally in Taiwan after the government promised to support local equities. However, in Europe, the Stoxx 600 is off about 0.5%, giving back yesterday’s gains. US futures are firmer, but the CPI will be released before the local opening. The US 10-year yield is slightly softer near 2.91% today, while European yields are 2-4 higher with wider spreads.

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Bank of Canada, Chile, China, Currency Movement, Featured, inflation, newsletter, RBNZ, Recession, South Korea, U.K., USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Overview: The US dollar is consolidating with a slight downside bias ahead of the June CPI report. The euro held above $1.00 but is still pinned in the trough. The rate hike by the Reserve Bank of New Zealand failed to have much impact. On the other hand, the JP Morgan Emerging Market Currency Index is lower for the fourth consecutive session. Most of the large markets in the Asia Pacific region rose, led by a 2.7% rally in Taiwan after the government promised to support local equities. However, in Europe, the Stoxx 600 is off about 0.5%, giving back yesterday’s gains. US futures are firmer, but the CPI will be released before the local opening. The US 10-year yield is slightly softer near 2.91% today, while European yields are 2-4 higher with wider spreads. Gold posted an outside down day yesterday and initially saw a little follow-through selling that pushed it to almost $1722 before some bids returned. It is slightly higher in Europe (~$1728-$1730). August WTI fell to almost $93.65 today, its lowest level in nearly three months. It has recovered a little through $97. US natgas is up almost 3% after falling 4% yesterday. Europe’s natgas benchmark is up 4.25% today after a 6.75% gain yesterday. Iron ore snapped a three-day fall and rose almost 3.90%, today, the most since late June. Copper is slightly firmer after falling more than 8% over the past three sessions. September wheat is up almost 1%. It has fallen nearly 9% over the past two sessions.

Asia Pacific

China reported a much larger than expected June trade surplus, helped by the re-opening of Shanghai. The trade surplus swelled to almost $98 bln from $79 bln as exports rose faster than expected and imports slowed. Exports rose by nearly 18% (16.9% in May) and imports slowed to 1% (4.1% in May). The US accounted for about 42% of China's trade surplus. Of note, news that China's imports from Russia soared by more than 56% will catch attention too.

US Vice President Harris announced the latest effort by Washington to fill the vacuum left by the withdrawal for the Trans-Pacific Partnership and moves by China at the Pacific Island's Forum. China has been advocating a regional trade pact, which would exclude the US. However, it was the deal China struck with the Solomon Islands that seemed to have caught the Americans and Australians wrongfooted and now they are trying to make up for it. The US had previously closed its embassy in the Solomon Islands, seemingly sending a signal of the lack of interest. Harris announced that the US will open embassies in Kiribati and Tonga. Kiribati withdrew from the forum. The US plans also call for a renewed presence of the Peace Corp region as well as $900 mln for fishing assistance over the next decade. The United States Agency for International Development (USAID) will be established in Suva and will work with Partners in the Blue Pacific network, launched last month on climate change.

As widely expected, the Reserve Bank of New Zealand delivered its second consecutive 50 bp hike to bring the cash rate to 2.50%. It is seen as the first central bank from a high-income country to bring its policy rate above neutral. Another 50 bp hike is nearly fully priced into the swaps market for the next meeting on August 17. Separately, after hiking its 7-day repo rate five times by 25 bp, the central bank of South Korea raised by 50 bp today to 2.25%. The swaps market is not convinced that it will continue at this accelerated pace, but it does have around 100 bp priced in over the next 12 months.

The dollar is consolidating against the yen in what appears to be still constructive price action. The greenback is trading within yesterday's range (~JPY136.50-JPY137.50), which itself within Monday's range (~JPY135.90-JPY137.75). The price action is often seen as a continuation pattern. The Australian dollar did manage to rise through yesterday's $0.6780 high but marginally and is also consolidating. It, too, is in Monday's range ($0.6715-$0.6860). Despite the rate hike, the New Zealand dollar remained within yesterday's range against the US dollar (~$0.6145-$0.6200). After gapping higher against the Chinese yuan yesterday, the dollar eased slightly to fill the small gap that extended to CNY6.7195. The PBOC set the dollar's reference rate at CNY6.7280, while the median projection (Bloomberg survey) was CNY6.7290.

Europe

The latest Bloomberg surveys found economists have boosted their odds of a eurozone recession. In the May and June surveys, the median response gave a 30% chance of a recession over the next 12 months. It now stands at 45% chance. The risk of a German recession increased to 44.5% from 32.5% in June's survey. It was 20% at the end of last year. The odds of a French recession stand at 50%, but it had been at 60% for the past three months. The risk of a recession in Italy is seen at 65% down from 80% in June. In Spain, the risk of a recession appears to have fallen to 40% from 70%. The caveat is that while the Germany survey had a dozen responses, the probability of a recession for other EMU members was based on three responses. The UK's survey has 17 forecasts and the median saw a 45% chance of a recession over the next 12 months, up from 35% in May and June.

The UK's May GDP surprised on the upside, and that is not something that could have been said recently. The economy expanded by 0.5% in May, well above the 0.1% expected. The April contraction was revised to -0.2% from -0.3%. Most of the details were better than expected. Industrial output jumped 0.9% and the April's 0.6% decline was revised to only 0.2%. Construction output rose 1.5% and April's 0.4% fall was revised to a 0.3% gain. Services rose by 0.4%. Nevertheless, some of the consumption measures showed weakness including hospitality, retail services, sports, and amusement. This is consistent, it would seem, with the cost-of-living squeeze. Nevertheless, Bank of England Governor Bailey appeared to be confirming what the market has large discounted and that is a 50 bp hike at the August 4 MPC meeting. Meanwhile, eight Tory candidates to succeed Johnson have made it to today's first round of voting.

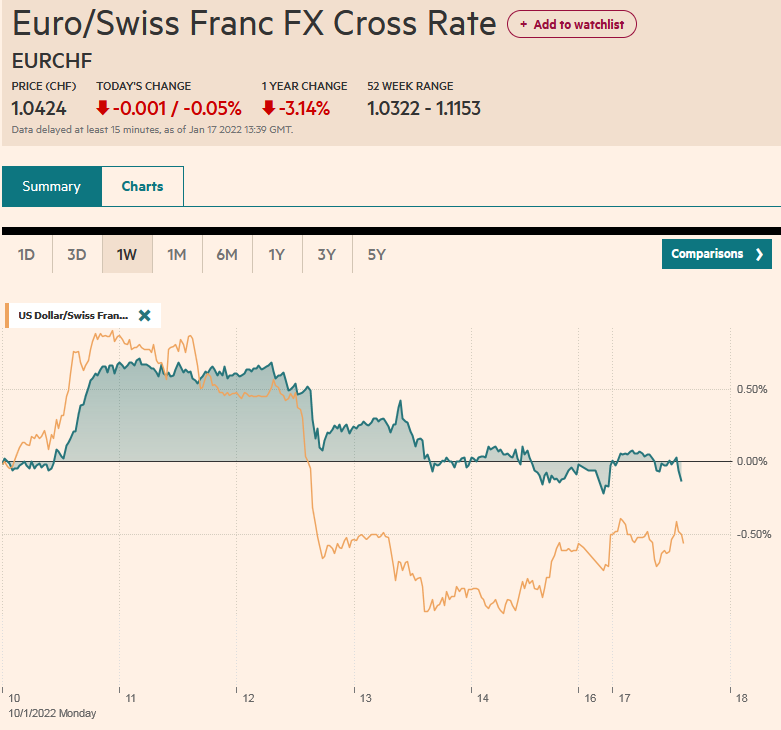

The euro continues to hold above parity, but barely. After yesterday's probe it snapped back to around $1.0075. Today, it briefly traded above $1.0050 before sellers appeared. It still looks vulnerable. The intraday momentum indicators appear neutral prior to the US open. Sterling fell to two-year lows yesterday, slightly ahead of $1.18. It staged a modest recovery yesterday and extended it to around $1.1935 today. However, despite the better GDP figures, sterling is better offered in the European morning. Initial support is seen in the $1.1850-$1.1870 area.

America

The US June CPI and the Bank of Canada meeting dominate today's agenda. There seems to be a risk that both are anti-climactic. First, it has been accepted for a few weeks at least that headline CPI likely accelerated from 8.6% in May toward 8.8% or a little higher. Second, the market has nearly fully discounted a 75 bp hike by the Fed later this month. The market is less sure of what the Fed does at the following meeting in September. It has about a 1-in-5 chance of another 75 bp move. Third, there is much wood to chop before that September 21 FOMC decision. There are two more CPI prints and two more job reports. The June CPI will not be a decisive factor in the FOMC's September decision. Third, headline inflation gets much of the attention, though Fed Chair Powell noted that the core measure is a better measure of where headline inflation is headed. The core measure of CPI is expected to have slowed for the third consecutive month. This means that despite the talk and some anecdotal evidence that price pressures have broadened, the rise in food and energy prices is the reason the headline rate is still rising. Fourth, largely uncommented upon the average price of retail gasoline has been falling. In fact, the last day it rose was June 13, when the peaked at $5.16 a gallon. It is now near $4.65, the lowest since late May.

The market has fully discounted a 75 bp hike from the Bank of Canada today. It will be the fourth hike in the cycle that began this year with a 25 bp move in March and two half-point moves subsequently. The Bank of Canada warned the market that it may need to act more forcefully and by that the market understood the central bank to signal a larger hike. The market seems to be pricing in a small chance of a 100 bp move. Canada is expected to be the fastest growing economy in the G7 this year (3.8% year-over-year, half again as much as the US's 2.4% pace seen by the median in Bloomberg's surveys). A strong labor market, where the more important development over the past two months is a shift from part-time work to full-time is underpinning domestic demand while a positive terms-of-trade shock has seen it report increasingly large goods trade surpluses. The May surplus of C$5.3 bln is the largest since 2008. This year's monthly average is almost C$3.2 bln. In the first five months last year, Canada recorded an average deficit of C$300 mln. In the Jan-May 2019 period, Canada recorded an average deficit of C$2.15 bln. The swaps market is pricing in about a 75% chance of another 75 bp hike at the next meeting on September 7.

On Monday, the bill auctions tailed but the 3-year note sale was well received. Yesterday, the $33 bln 10-year note sale was a dud. The auction was covered 2.34x, less than the average of the past six re-opening auctions. Direct and indirect interest was less than before, leaving dealers were left with the most in a year (almost 21%) and the auction produced a two-basis point tail (difference between highest yield accept and where it was in the when-issued market). Today, a few hours after the CPI figures, the US Treasury will sell $19 bln 30-year bonds. At the last auction, indirect bidders took 69%, while the bid-cover was 2.35. A key observation about the US Treasury market now is the volatility. The equivalent to the VIX for the S&P is MOVE for US Treasuries. The volatility reached 148.11 yesterday, its highest level since August 2009. Yes, that is above the high seen in March 2020 (~138.40). It reached 264 in October 2008.

The greenback is consolidating against the Canadian dollar and is in a narrow range above CAD1.30 ahead of the central bank meeting. It is still confined to the range seen Monday of roughly CAD1.2940-CAD1.3050. The inability of the New Zealand dollar to rally after the central bank delivered the as-expected hike warns that the Canadian dollar may need more than a 75 bp hike to rally. A recovery in US equities would help. The US dollar pushed slightly through MXN20.93 yesterday to reach a new four-month high. It is in a narrow range so far today of about three centavos on either side of yesterday's settlement around MXN20.85. It will likely be driven by the broader risk appetite after the US CPI report. Separately, Chile is expected to deliver a 50 bp hike later today that would lift the policy rate to 9.50%. That would be the smallest move since the 25 bp hike last July to initiate the tightening cycle. The swaps market has about another 150 bp of rate hikes discounted over the next 12 months.

Tags: #USD,Bank of Canada,Chile,China,Currency Movement,Featured,inflation,newsletter,RBNZ,recession,South Korea,U.K.