The clear winners in inflation are those who require little from global supply chains, the frugal, and those who own their own labor, skills and enterprises. As the case for systemic inflation builds, the question arises: who wins and who loses in an up-cycle of inflation? The general view is that inflation is bad for almost everyone, but this ignores the big winners in an inflationary cycle. As I’ve explained here and in my new book Global Crisis, National Renewal, the two primary dynamics globally are 1) scarcity of essentials and 2) extremes of wealth/power inequality. Scarcities drive prices higher simply as a result of supply-demand. Conventional economics holds that there are always cheaper substitutes for everything and hence there can never be scarcities

Topics:

Charles Hugh Smith considers the following as important: 5) Global Macro, 5.) Charles Hugh Smith, Featured, newsletter

This could be interesting, too:

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Ryan McMaken writes A Free-Market Guide to Trump’s Immigration Crackdown

Wanjiru Njoya writes Post-Election Prospects for Ending DEI

Swiss Customs writes Octobre 2024 : la chimie-pharma détermine le record à l’export

The clear winners in inflation are those who require little from global supply chains, the frugal, and those who own their own labor, skills and enterprises.

As the case for systemic inflation builds, the question arises: who wins and who loses in an up-cycle of inflation? The general view is that inflation is bad for almost everyone, but this ignores the big winners in an inflationary cycle.

As I’ve explained here and in my new book Global Crisis, National Renewal, the two primary dynamics globally are 1) scarcity of essentials and 2) extremes of wealth/power inequality.

Scarcities drive prices higher simply as a result of supply-demand. Conventional economics holds that there are always cheaper substitutes for everything and hence there can never be scarcities enduring long enough to drive inflation: if steak gets costly, then consumers can buy cheaper chicken, etc.

But the conventional view overlooks essentials for which there is no substitute. Salt water may be cheap but it’s no substitute for fresh water.

There are no scalable substitutes for oil and natural gas. There are no scalable substitutes for hydrocarbon-derived fertilizers or plastics. As energy becomes more expensive due to the mass depletion of the cheap-to-extract resources, the costs of everything from fertilizer to plastics to steel to jet fuel rise.

This price pressure generates a number of effect. Rising costs embed a self-reinforcing feedback as prices are pushed higher in expectation of higher costs ahead, and these price increases generate the very inflation that sparked the pre-emptive price increase.

Second, increasing costs either reduce profits or force price increases. Neither is ideal, as higher prices tend to lower sales which then lowers profits.

Third, prices rise easily but drop only stubbornly, so sharp increases in prices aren’t reversed as cost pressures ease: enterprises and workers quickly become accustomed to the higher prices and pay and are extremely resistant to cutting either prices or pay.

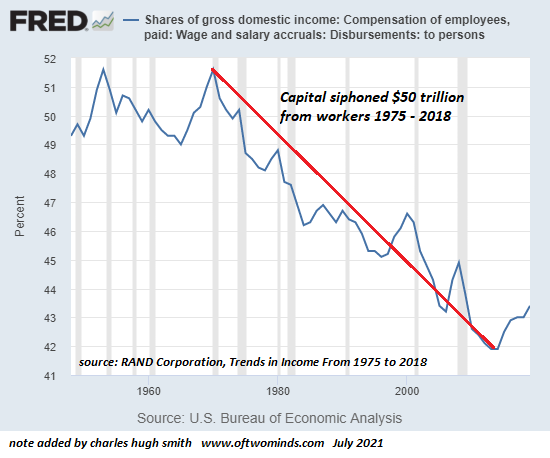

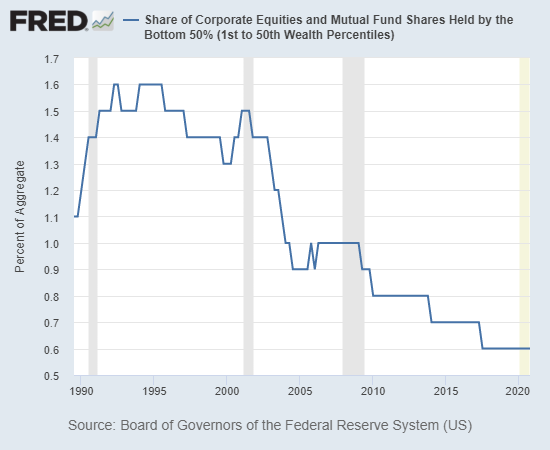

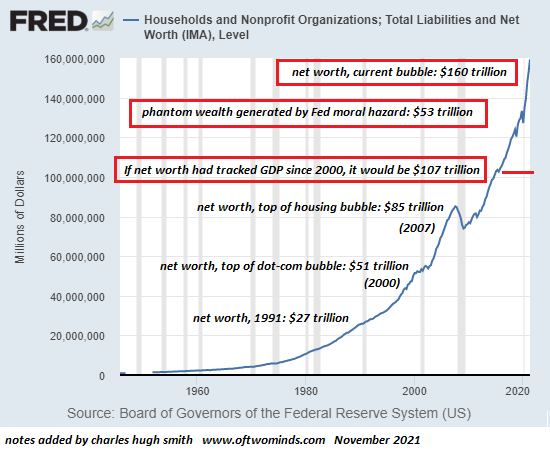

As I’ve outlined here before, extremes of wealth-power inequality are systemically destabilizing. Extremes generate reversals as the pendulum reaches its maximum and then reverses direction and gathers momentum to the opposite extreme. In terms of wealth-power inequality, the pendulum is finally swinging back toward higher wages for labor and higher taxes for the super-wealthy, and increasing regulation on exploitive monopolies.

In other words, there is more driving systemic inflation than just “transitory” supply-demand issues. Speaking of supposedly “transitory” cost increases that are actually systemic, global supply chains that were deflationary (i.e. pushing prices lower) for 40 years are now inflationary (i.e. pushing prices higher) as costs rise sharply in exporting economies that are now facing much higher labor and energy costs, and also finally bearing the long-delayed costs of environmental damage caused by rampant industrialization.

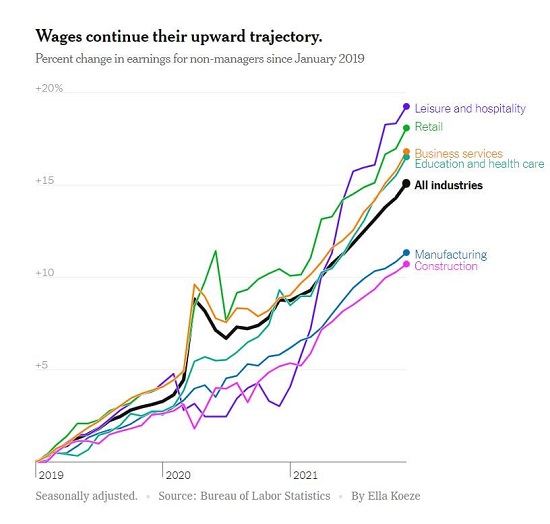

As noted here in The Real Revolution Is Underway But Nobody Recognizes It, labor has been stripmined for 45 years, and now the worm has turned. As much as corporate employers and governments would love outright indentured servitude where they could force everyone to work for low pay in abusive circumstances, people are still free to figure out how to simplify their lives, cut expenses and work less.

Scarcities of labor are enabling sharp increases in pay, especially in services. Anecdotally, I’m hearing accounts of service workers such as therapists, plumbers, accountants, architects, etc. raising their hourly rates by 20% overnight. In my own little sliver of the economy (writing / editing content), hourly rates are up as much as 30% for experienced independents.

So let’s highlight a few winners and losers in a self-reinforcing inflationary spiral.

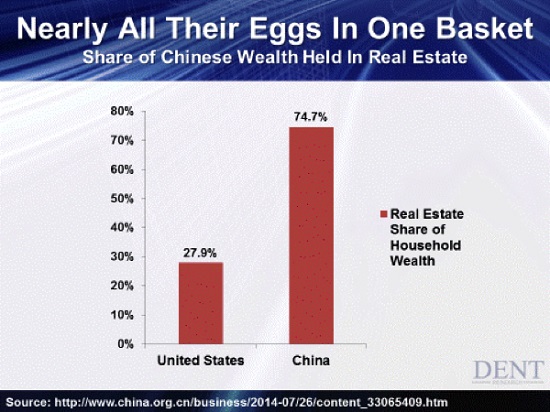

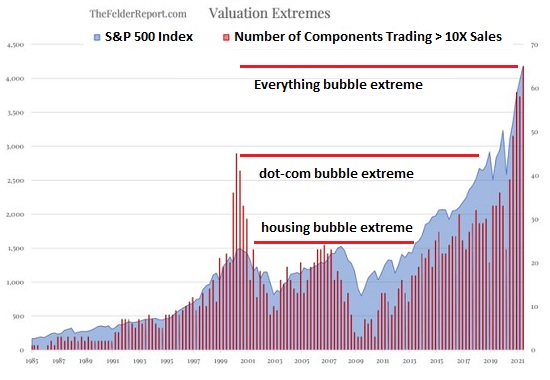

Asset inflation driven by zero interest rates and a tsunami of central bank liquidity will lose steam as rates rise and the liquidity spigots are turned off. As mortgage rates rise, already overvalued homes will become even less affordable as the number of buyers who can afford much higher monthly payments recedes toward zero.

Local governments dependent on skyrocketing real estate valuations driving higher property taxes will be losers.

Bonds paying 1% interest are losers once rates click up to 2% or 3%.

Stocks are a mixed bag, as the relatively few companies with unlimited pricing power may benefit from inflation, but the majority will be pressured by higher labor, materials, shipping and energy costs, plus higher taxes and fees as the claw-back from capital gathers momentum.

|

Consumers are losers as costs soar, but service workers with pricing power are winners. The Federal Reserve can print $1 trillion in an instant but it can’t print experienced welders, plumbers, electricians, accountants, therapists, etc., and very little of this labor can be replaced by low-level (i.e. affordable) automation / robotics. Farmers who have been decimated by decades of low-cost imports might gain some pricing power as adverse weather, higher shipping costs and other factors increase the cost of imported agricultural commodities. Corporations with quasi-monopolies on essential industrial minerals/metals such as magnesium, nickel, etc. will have pricing power due to scarcity and the wide moat around their businesses: it isn’t cheap to set up competing mines and acquire rights to the minerals. As a general rule, keep an eye on inelastic demand and supply. Elastic demand refers to demand which can ebb and flow with costs–the classic substitution mentioned earlier in which costly beef is replaced by cheaper chicken. Elastic supply is ranchers responding to much higher beef prices by increasing their herds. There is always some elasticity in demand and supply as conservation, new efficiencies, recessions, etc. can stretch or shrink supplies and demand. But demand for essentials such as fertilizer, energy and food can only drop so much, and supply can only increase by so much. The clear winners in inflation are those who require little from global supply chains, the frugal, and those who own their own labor, skills and enterprises in sectors with relatively inelastic supply and demand. The losers are those who are entirely dependent on global supply chains for essentials, wastrels who squander resources, food, labor and money and those gambling on the quick return to zero-interest largesse and endless trillions in liquidity. |

Tags: Featured,newsletter