Every product now has an "extended warranty" admission of the collapse of quality and durability. There's a great uplifting hope swirling around the potential to fix what's broken, and so here's my question: how do we fix the collapse of quality and durability that we now take for granted? What do I mean by the collapse of quality and durability? Here are a few examples of many. 1. Appliances that were once built to last 70 years now fail in 7 years (or less). A...

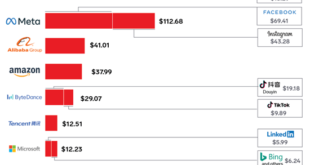

Read More »Is Social Media Actually “Media,” Or Is It Something Else?

By placing search/social media in the bucket of newspapers, radio and TV networks, perhaps we've obscured their true nature as "Digital Marketing Mechanisms." Language is a funny thing. If we don't have a word for something, in some way it doesn't exist. When we find a word in another language that describes this something, we borrow the word, for example schadenfreude from German and tsunami from Japanese. If we use an existing word to describe something...

Read More »Welcome to the Circular Firing Squad

If you find my scribblings upsetting, there's an easy solution: stop reading it. We'll both benefit. I'm never more than one inch away from converting my site from essays to photos of kittens and puppies as the only means to gain respite from being hammered for my many failings as a human being. But alas, were I to do so, some readers would detect an insufferable air of elitist superiority in my selection of kitten photos, others would trash me for my worthless...

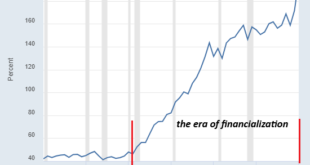

Read More »Can We Rein In the Excesses of Financialization Without Crashing the Economy?

Or we can let the bubble implode under its own weight and have a plan ready to clean house when the dust settles. Thanks to recency bias, we tend to think the world has always been more or less as it is today. Tectonic shifts beneath the veneer of everyday life escape us unless we make a concerted effort to peel back the veneer of normalcy. For example, consider the rise of finance as the dominant force in our socio-economic / political status quo. Statistics...

Read More »Why Political “Solutions” Don’t Fix Crises, They Make Them Worse

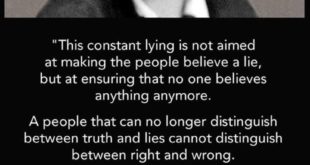

The system has reached the limits of its adaptability. Everything else is entertainment. A great many people have immense faith in political solutions to looming crises: if only we elect new leaders, if only we replace current policies with new policies, everything would be fixed and the crises will all dissipate. There are powerful reasons for this faith and equally powerful reasons why political solutions fail in crisis. Our faith in politics is nurtured by...

Read More »What If All the Conventional Models Fail to Predict What Happens Next?

The 'novel, apocalyptic situation which has now arisen' goes largely unrecognized. A truly staggering quantity of content is aimed at predicting what happens next, a.k.a. the future, and justifies their prediction by referencing models that are presented as rock-solid predictive tools. The majority of these models are based on historical examples that have been distilled into models of "how the world works," i.e. claims that these were not one-offs or outliers...

Read More »If AI Is So Great, Prove It: Eliminate All Surveillance, Spam and Robocalling

AI is for the peons, access to humans is reserved for the wealthy. Judging by the near-infinite hype spewed about AI, its power is practically limitless: it’s going to do all our work better and cheaper than we can do, replacing us at work, to name one example making the rounds. It’s going to revolutionize everything from science to marketing, all the while reaping trillions of dollars in profits for those who own the AI tools, apps, etc. All these extravagant...

Read More »Financial Forecast 2025-2032: Please Don’t Be Naive

Rather than attempt to evade Caesar’s reach, a better strategy might be to ‘go gray’: blend in, appear average. Let’s start by stipulating that I don’t “like” this forecast. I’m not “talking my book” (for example, promoting nuclear power because I own shares in a uranium mine) or issuing this forecast because I favor it. I simply see it as the most likely trajectory of the global financial system, based on history and the dynamics of human systems. “Liking” it or...

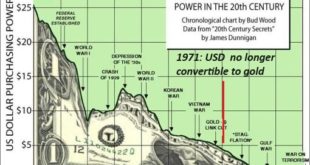

Read More »Sound Money Vs. Fiat Currency: Trade and Credit Are the Wild Cards

We need to start thinking outside the current system, which has no solutions. Our convictions about money are quasi-religious: heretics are burned at the stake. I'm not sure which stake I'll be tied to, because all the conventional choices--fiat currency, sound money (gold, Bitcoin) or debt-free currency (a.k.a. MMT)--are all fatally flawed. To understand why, consider the wild cards in any monetary system: global trade and credit. Let's start with credit, which...

Read More »Global Recession’s Winners and Losers

The few winners of global recession will use the decline as a means to break the chokehold of unproductive BAU elites. That the global economy is slipping into recession is self-evident. What's not yet known is the eventual depth and length of the recession. Given that the extreme policies needed to avoid recession over the past 15 years have reached extremes that are now the problem, not the solution, there won't be any more fiscal-monetary "saves" this time...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org