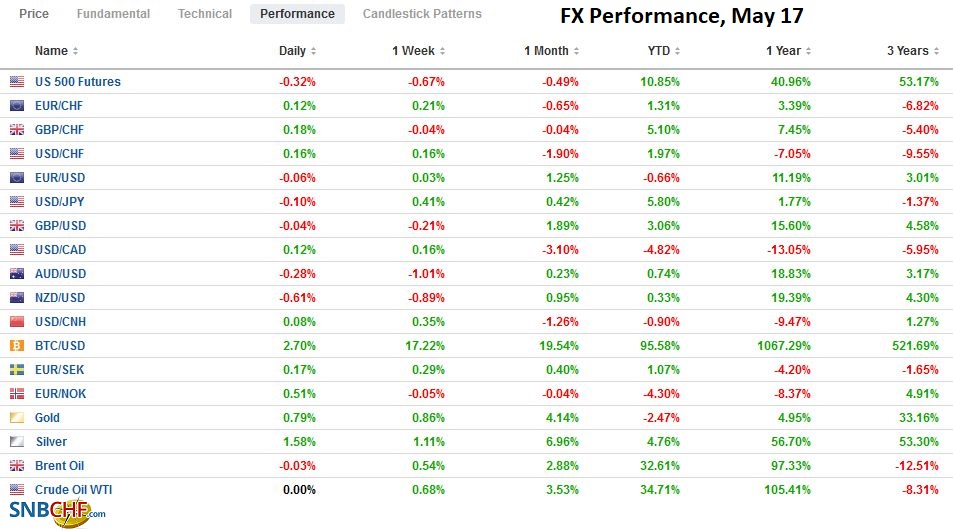

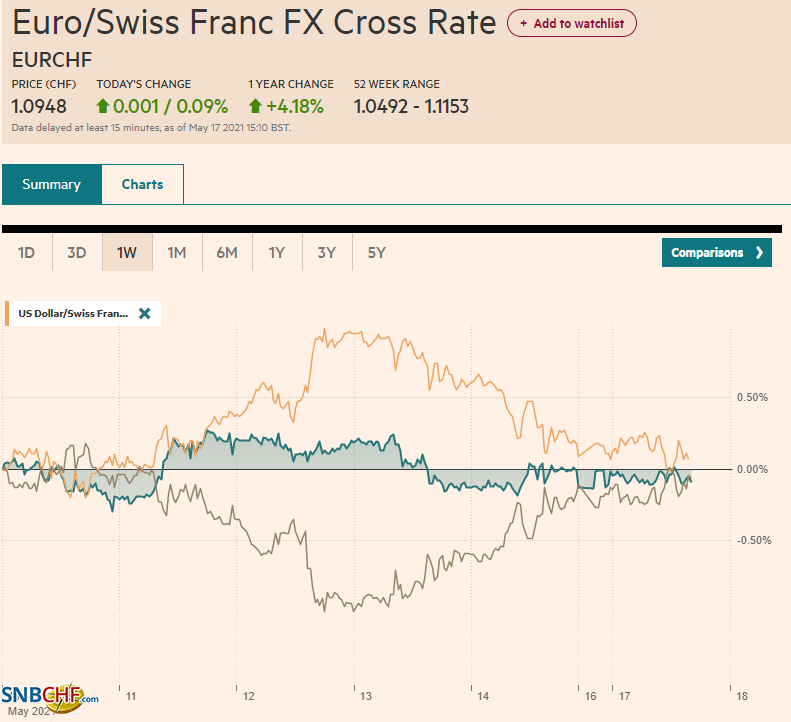

Swiss Franc The Euro has risen by 0.09% to 1.0948 EUR/CHF and USD/CHF, May 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There are two general developments as the busy week gets underway. First, despite accelerated price readings in the US (CPI, PPI, import prices, and University of Michigan survey), US rates are soft. The 10-year yield is near 1.61% after rising to 1.70% after the CPI surprise last week. This, in turn, appears to be limiting the dollar’s ability to recover much. However, it is trading a bit firmer against the dollar-bloc currencies and the Antipodeans. Emerging market currencies are consolidating the pre-weekend losses, while the Turkish lira and Hungarian forint are modestly higher.

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, China, Currency Movemeent, Featured, Hungary, Japan, newsletter, U.K., USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.09% to 1.0948 |

EUR/CHF and USD/CHF, May 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: There are two general developments as the busy week gets underway. First, despite accelerated price readings in the US (CPI, PPI, import prices, and University of Michigan survey), US rates are soft. The 10-year yield is near 1.61% after rising to 1.70% after the CPI surprise last week. This, in turn, appears to be limiting the dollar’s ability to recover much. However, it is trading a bit firmer against the dollar-bloc currencies and the Antipodeans. Emerging market currencies are consolidating the pre-weekend losses, while the Turkish lira and Hungarian forint are modestly higher. Second, equities are heavy. China’s data did not inspire, but Chinese equities led the mixed Asia Pacific session higher, along with Hong Kong and India. Japan, South Korea, and Taiwan equities fell. Both Singapore and Taiwan are tightening social restrictions, and although Singapore shares advanced, Taiwan’s nearly 3% decline adds to last week’s nearly 8.5% drop. Europe’s Dow Jones Stoxx 600 slipped 0.5% last week and is struggling at slightly lower levels today. The S&P 500 rose 2.7% in the last two sessions, but the futures are trading with a slightly heavier bias now. Even with the Colonial Pipeline re-opening, oil prices remain firm, and the July WTI contract is holding above $65. It has a three-week advance in tow. Lower rates and some suggest the sell-off in leading tokens in the crypto space is lifting gold prices above $1850 and the 200-day moving average for the first time since early February. |

FX Performance, May 17 |

Asia Pacific

China’s data is difficult to read as the year-over-year comparisons are distorted. Today’s flurry of data generally missed expectations, but the recovery seems intact and underscores the official recognition that the economy is “unbalanced and unstable.” April industrial output rose 9.8% after a 14.1% pace in March. Compared with the same period last year, fixed asset investment increased by 19.9% in the first four months of the year. It missed the median forecast in the Bloomberg survey barely. It had grown by over 25% in Q1 21 over Q1 20. Property investment remained strong, rising 21.6%, which was a little better than expected. Unemployment fell to 5.1% from 5.3%, which was also lower than economists anticipated. The biggest miss was retail sales, which rose by 17.7% year-over-year, well off the 25% pace that the median forecast projected. We suspect there is no major policy implication. Officials have curbed lending but do not seem to be in any hurry to raise rates.

Japan’s third state of emergency went into effect yesterday. The area covered by the emergency (Tokyo, Hiroshima, Okayama, and Hokkaido) covers roughly 40% of the world’s third-largest economy and runs to the end of the month. The seven-day average of infections is at a new high for Japan. There will be economic and political consequences. Japan reports Q1 GDP first thing tomorrow in Tokyo, and there is little doubt that the economy contracted after growing at an 11.7% annualized rate in Q4 20. The issue is Q2 growth, and the median forecast in the Bloomberg survey of a 4.5% annualized expansion appears optimistic.

A political consequence is Prime Minister Suga has a limited window to improve his standing ahead of the LDP conference in September and a possible leadership challenge ahead of the October general election. His support for the Olympics has not helped. It is not so much about it being a super-spreader event, it could be a costly and dangerous distraction, and it is terribly unpopular. The marathon, for example, is to be run in Hokkaido. The US nation track and field team canceled a workout nearby Tokyo for health concerns. Still, opposition to the LDP is weak and fragmented. Its leadership contest will likely decide the next prime minister.

The US dollar is trading slightly heavier against the Japanese yen for the third consecutive session. However, the losses have been modest. After peaking near JPY109.90 last Thursday, the greenback recorded a three-day low near JPY109.15 today. It appears to have found a bid in the European morning, and nearby resistance is seen in the JPY109.40-JPY109.50 area. The Australian dollar initially edged higher, reaching about $0.7785, before faded and slipping lower. There are options for around A$1.4 bln struck in the $0.7755-$0.7760 area that expire today. Initial support is seen around $0.7735. The Chinese yuan slipped marginally lower after snapping a five-week advance. The PBOC set the dollar’s reference rate at CNY6.4307, back in line with market expectations, after seemingly using it to lean against continued yuan strength. The PBOC money market operations rolled over maturing amounts, which seemed supportive of the interest-rate sensitive financial assets.

Europe

Although the vaccines appear to be effective against the rapidly spreading Indian mutation of Covid 19, it impacts the UK. It reportedly will cut the time between the first and second doses to eight weeks from 12. The next phase of the re-opening, though, goes into effect today with looser restrictions on indoor and outdoor activities. The UK plans are for economy-wide re-opening on June 21, and there is some fear that the mutation will change push it back. However, the political will is strongly in favor of going forward, and instead are encouraging to speed up the vaccine availability in hard-hit areas. Meanwhile, the DUP’s newly elected leader Poots vowed to strip away parts of the Brexit trade pact that imposes custom checks between Northern Ireland and Britain.

The first pushback against the US support for a global minimum corporate tax appears to be coming from the UK. Chancellor of the Exchequer Sunak is concerned that the 21% rate may be too high, even though he has proposed raising the UK corporate tax rate to 25%. Instead, the UK’s Treasury wants the multinational companies to pay more taxes in the countries in which they sell their products and services.

The Deputy Governor of Hungary’s central bank put the market on notice today that it could raise rates as early as next month. It is not clear if Virag speaks for the majority. The central bank meets on May 25, and it should help clarify the outlook. However, the Deputy Governor also suggested that QE could continue and even at higher levels if necessary. April CPI was 5.1% higher than a year ago, well above the 2%-4% target range. It was a little above the central bank’s forecast and is the most in the EU. The Czech Republic is also expected to raise rates in August as it too deals with rising price pressures.

The euro is extended its pre-weekend gains as it turns better bid in the European morning. As it went through $1.2150, some demand, perhaps related to the expiration of a nearly 2 bln euro option there that expires today, helped the single currency edge closer to last week’s highs, a little above $1.2180. Still, that might be a bridge too far today as the intraday momentum indicators appear stretched. Sterling is straddling the $1.41-level in dull dealings. Last week’s high was set near $1.4165, which also does not seem to be under threat today. The euro had fallen to around GBP0.8560 last week but recovered in the last few sessions and today has held above GBP0.8600.

America

Two weeks before, Europe was going to double to 50% the retaliatory tariffs on US goods levied to counter the 2018 steel and aluminum tariffs Washington imposed on many countries on national security grounds. Brazil and South Korea cut separate deals, and the USMCA ended the tariffs on Canada and Mexico. A US-EU truce has been declared. The EU will not double its tariff and will enter talks with the US about excess capacity in the steel industry. Although many economists talk about surplus savings, they usually refer to the part that stays in the circulation of capital. Still, the redundant investment was classically understood as a form of surplus capital. A reduction in tariff schedules could theoretically help ease price pressures, but we are suspicious of how much would actually be passed on to the end-user. Still, April import prices were reported before the weekend and jumped more than expected. The 0.7% increase lifted the year-over-year rate to 10.6% from 7.0% in March. Through April, import prices have risen at an annualized rate of around 14.5%. Excluding oil, import prices have risen by around 9% at an annualized pace this year.

The University of Michigan’s consumer confidence survey was reported on the heels of the import price jump. The 5-10 year inflation expectation rose to 3.1%, to match its highest level since August 2008. After the earlier larger than expected rise in April CPI and PPI, some astute Fed watches emphasized the importance of inflation expectations in the Fed reaction function. It is true, inflation expectations/forecasts feature prominently in the official commentary. That said, we argue that there has been a subtle shift that has downgraded the role of inflation expectations/forecasts. This is not a normative claim (what ought to be the case) but a descriptive claim (what is the case). Various Fed officials have expressed this in different ways. Still, Chair Powell speaks for the Fed when he said, “The fundamental change in our framework is that we’re not going to act pre-emptively based on forecasts for the most part, and we’re going to wait and see actual data.” To us, this may be more important operationally than adopting an average inflation target, as the “average” has not been defined. Instead, it looks as if it is a ploy to preserve maximum flexibility for the Fed in this unprecedented time. But the emphasis on actual data (not eschewing expectations but downgrading them) helps explain the Fed’s patience now.

The US reports the May Empire State manufacturing survey, and late today the April TIC data. Neither are likely typically market movers, though the Empire State survey is one of the first data points for the new month, which is barely half over. Among Fed officials, Clarida, Bostic, and Kaplan speak, but no new insight is anticipated after all three have spoken recently. Canada reports housing starts, new home sales, and its equivalent of the TIC report. The highlights of the week include CPI on Wednesday and retail sales on Friday. Inflation is expected to tick up while retail sales are forecast to be strong even if half the 4.8% gain seen in February. The week’s highlight for Mexico comes at the end of the week in the form of March retail sales as well. A 1.6% gain would match the February increase.

Last Tuesday and Wednesday, the US dollar traced out a CAD1.2045-CAD1.2200 range. It subsequently has been confined to that range. Initial support now is seen around CAD1.2100, and a break could see CAD1.2080. Near-term consolidation seems to be the most likely scenario. The greenback fell to four-month lows against the Mexican peso before the weekend (~MXN19.7540). It is in around an MXN19.86-MXN19.95 range so far today. Within the consolidation phase, it can trade into the MXN19.98-MXN20.04 area without changing the technical tone. Recall Mexico holds local elections on June 6.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,China,Currency Movemeent,Featured,Hungary,Japan,newsletter,U.K.