Swiss Franc The Euro has risen by 0.15% to 1.082 EUR/CHF and USD/CHF, February 1(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities are snapping back today, while the greenback retained the strength seen last week that was attributed to safe-haven flows. The MSCI Asia Pacific Index snapped a four-day decline led by Hong Kong, South Korea, India, and Indonesia. Europe’s Dow Jones Stoxx is up around 1.1% after losing a little more than 3% last week. US shares are trading higher as well. Benchmark 10-year yields are firm, with the US near 1.07%. Yields in Europe are softer, with peripheral yields led lower by Italy, where a political crisis resolution is still anticipated. The dollar is higher

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brexit, Currency Movement, EMU, Featured, newsletter, PMI, treasuries, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

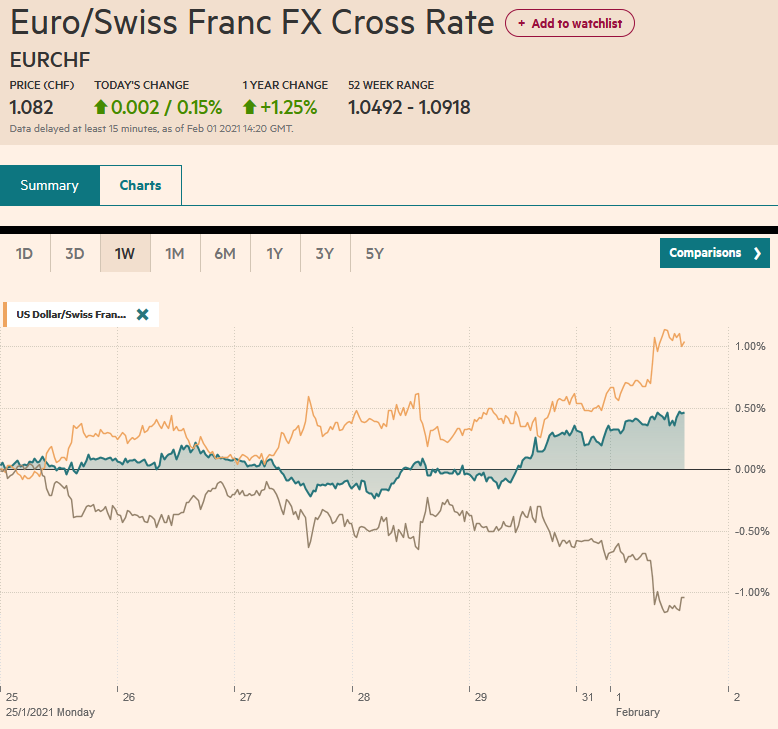

Swiss FrancThe Euro has risen by 0.15% to 1.082 |

EUR/CHF and USD/CHF, February 1(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

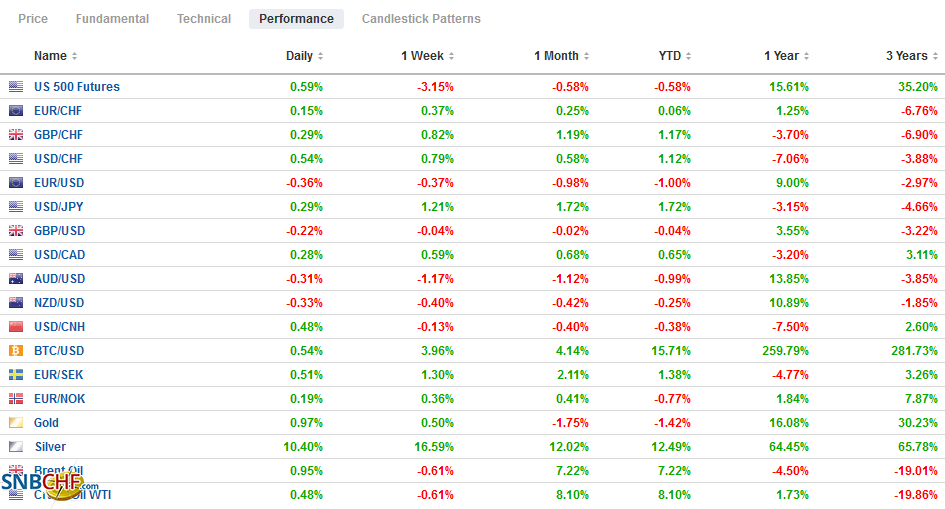

FX RatesOverview: Global equities are snapping back today, while the greenback retained the strength seen last week that was attributed to safe-haven flows. The MSCI Asia Pacific Index snapped a four-day decline led by Hong Kong, South Korea, India, and Indonesia. Europe’s Dow Jones Stoxx is up around 1.1% after losing a little more than 3% last week. US shares are trading higher as well. Benchmark 10-year yields are firm, with the US near 1.07%. Yields in Europe are softer, with peripheral yields led lower by Italy, where a political crisis resolution is still anticipated. The dollar is higher against most of the major currencies, though sterling’s resilience remains evident. The JP Morgan Emerging Market Currency Index is higher for its third consecutive session, led by the freely accessible currencies, including the Mexican peso, Turkish lira, South African rand, and Russian ruble. The weakest so far today has been the Chinese yuan, which is off nearly 0.6%. Gold is firmer but within the pre-weekend range, while the retail-led short squeeze in silver saw a gap higher opening in Asia, and follow-through buying lifted it to over $30, for the first time since 2013. It has come off the boil, but around $29.50 at pixel time, it is up about 9% after rising about 6.5% in the past two sessions. March WTI slipped through the 20-day moving average (~$52.15) for the first time in a month but has recovered smartly to hover around $52.50. |

FX Performance, February 1 |

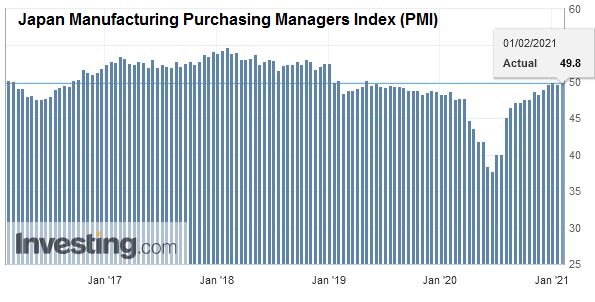

Asia PacificChinese growth shifted lower in January, and given the distortions around the Chinese New Year, the next clean read on the world’s second-largest economy may be several weeks away. The manufacturing PMI eased to 51.3 from 51.9, and the non-manufacturing PMI fell to 52.4 from 55.7. Both were lower than expected. New manufacturing orders slowed to 50.2, the weakest since August. The decline in new orders in non-manufacturing PMI fell below the 50 boom/bust level for the first time since last March. Caixin’s manufacturing PMI also disappointed, slipping to 51.5 from 53.0 at the end of last year. Japan’s preliminary manufacturing PMI was revised a touch higher to 49.8 from the initial reading of 49.7. In December, it was at 50, the highest since April 2019. However, we note that several others in the region report robust numbers outside of China and Japan. Taiwan and South Korea’s manufacturing PMIs are the strongest in around a decade. Indonesia and the Philippines are at multi-year highs. Separately, South Korea reported January trade figures. Exports fared better than anticipated (11.4% vs. 9.8%), though still slower than December’s 12.6% gain. Imports picked up to a 3.1% pace from 2.2%, which explains the narrowing of the overall trade surplus to $3.96 bln from December’s $6.77 bln. Australia’s manufacturing PMI was confirmed at 57.2, up from December 55.7. The Reserve Bank of Australia meets tomorrow and is expected to stand pat. |

Japan Manufacturing Purchasing Managers Index (PMI), January 2021(see more posts on Japan Manufacturing PMI, ) Source: investing.com - Click to enlarge |

The dollar remains firm against the yen. It is holding just below the JPY104.95 high from the end of last week and its best level since mid-November. The intraday momentum indicators are stretched. A marginal new high is possible, but the $500 mln option at JPY105.50 that expires today looks too far. Support now is seen around JPY104.60. Despite the heavy tone, the Australian dollar held a little above last week’s lows (~$0.7590) today. Perhaps it is linked to the A$1.2 bln option expiring tomorrow at $0.7600. Another expiring option tomorrow for A$1.1 bln is struck at $0.7685. The PBOC set the dollar’s reference rate at CNY6.4623, a little higher than the bank models surveyed by Bloomberg. The central bank did inject new liquidity into the banking system after last week’s punishing drains. The combination of the squeeze and weak PMI reports were seen as the main force weighing on the yuan. Its roughly 0.5% loss today is the largest in a few months. The greenback’s gains today recouped in full the losses suffered before the weekend.

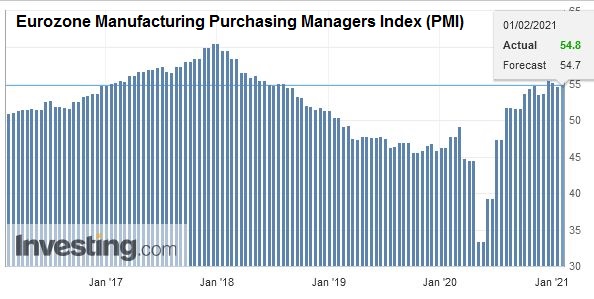

EuropeThe eurozone, January manufacturing PMIs, were generally better than expected, but Spain, not Italy, was the notable outlier. Germany’s PMI was revised to 57.1 from 57.0 of the flash reading, but still down from December’s 58.3. France’s was also revised slightly higher (51.6. vs. 51.5) and slightly improved from the 51.1 seen in December. Italy’s came in at 55.1, well above expectations and above December’s 52.8. Spain disappointed, slipping back below the 50 boom/bust level to 49.3 from 51.0. This all translated into an aggregate reading of 54.8, down from 55.2. |

Eurozone Manufacturing Purchasing Managers Index (PMI), January 2021(see more posts on Eurozone Manufacturing PMI, ) Source: investing.com - Click to enlarge |

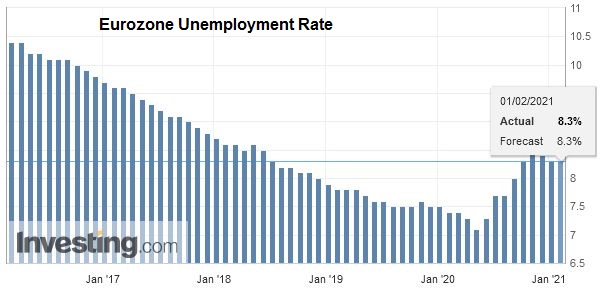

| While German manufacturing has been somewhat resilient in the face of social restrictions, retail sales weren’t. December retail sales plummeted 9.6% (the median Bloomberg forecast was for a 2% fall), and adding insult to injury, the November series was revised to 1.1% instead of 1.9%. Tomorrow, the eurozone aggregate Q4 GDP is reported, and a quarter-over-quarter contraction of around 1% is expected, and a stark contrast to the 4% annualized growth the US reported last week. |

Eurozone Unemployment Rate, December 2020(see more posts on Eurozone Unemployment Rate, ) Source: investing.com - Click to enlarge |

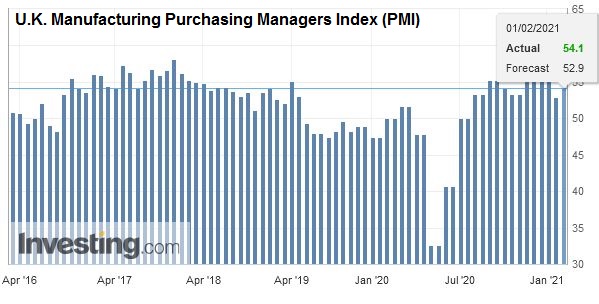

| The lockdown in the UK was less harmful to the manufacturing sector than initially thought. The final January PMI was revised to 54.1 from the preliminary reading of 52.9. In December, it stood at 57.5. The Bank of England meets on February 4, and the focus is mostly on the guidance about negative interest rates. |

U.K. Manufacturing Purchasing Managers Index (PMI), January 2021(see more posts on U.K. Manufacturing PMI, ) Source: investing.com - Click to enlarge |

The proverbial ink was hardly dry on the EU’s effort to block the virus vaccine’s export when the miscalculation became obvious, and the EU quickly backed down. Its attempt would have left Northern Ireland on the wrong side of the ban, which would have achieved precisely what was worked so hard to avoid: A hard border between the Irish Republic and Northern Ireland is sacrosanct. The miscalculation was particularly ill-timed given the still strained feelings over Brexit and the fact that British financial institutions’ access has not yet been resolved.

The euro has been sold in the European morning and is approaching the $1.2055 area, which could be the neckline of a head and shoulders topping pattern. If valid, the pattern would project toward $1.1750. There is an expiring option for about 1.5 bln euros at $1.20 today. Tomorrow a 1.4 bln euro option at $1.2150 also expires. Sterling appears to have stopped about 1/100 of a cent below the high made last week (just shy of $1.3760) but could not sustain the upside momentum in the face of the firmer greenback tone. An option for about GBP235 mln at $1.3650 expires today. That is also where the 20-day moving average is found today. The pre-weekend low was near $1.3660.

AmericaThe US sees the final Markit PMI, the ISM, and construction spending. The highlight of the week is the jobs data on Friday. There has been a marked deterioration of expectations. The latest entries in the Bloomberg survey has halved the previous median to now stand at 50k. The preliminary manufacturing PMI surged to 59.1 from 57.1, which may overstate the case. The manufacturing ISM is expected to have slipped lower. The Q4 GDP figures showed substantial gains in construction (residential and non-residential), and today’s figures may contain some fresh details, but the firm number appears baked in the cake. With the FOMC meeting last week, and the end of the silent period, Fed officials take to the air again, beginning with Kashkari, Kaplan, and Bostic. |

U.S. Manufacturing Purchasing Managers Index (PMI), January 2021(see more posts on U.S. Manufacturing PMI, ) Source: investing.com - Click to enlarge |

While President Biden says he wants to promote bipartisanship, Democrat leadership in the Senate threatens to use the reconciliation process to push the bill through. In fairness, the reconciliation path would require removing several initiatives, including the minimum wage hike and aid to local government. A group of ten Republican Senators, the precise number needed to maintain the normal legislative procedures provided all the Democrats support it, have counter-offered with about a $600 bln proposal that includes funds for combatting the virus and around $1000 a person in a more targeted disbursement.

The quarterly refunding details will be announced mid-week, and Treasury is expected to raise $126 bln in coupons: $58 bln 3-year notes, $41 bln 10-year notes, and $27 bln in 30-year notes. Treasury is flush with cash, and any increase can wait, though some banks expect a small increase. How does it happen that the Treasury can go forward with the refunding when the new team is barely in place? What some misunderstand as a “deep state,” in this case, is a team of professional civil servants that manage the process.

Canada manufacturing PMI is on tap for today. It stood at a multi-year high of 57.9 in December. The week’s highlight is the employment report on Friday. After a robust recovery from the nearly 3 mln jobs lost last March and April, the surge in the virus saw a 52.7k loss of jobs in December, and economists expected another loss of jobs last month (median forecast in the Bloomberg survey is for a decline of nearly 46k). Mexico reports its manufacturing PMI and December worker remittances tomorrow.

The Canadian dollar does not appear to be getting much help from the rebounding equities. The greenback is straddling the CAD1.28 area. Recall that the lowest level in about 2.5 years was recorded on January 21, a little under CAD1.26. Resistance is seen initially near last week’s highs around CAD1.2880, which is also the (38.2%) retracement objective of the losses seen since early November. The US dollar posted an outside up day against the peso before the weekend, and it settled January at its highest closing since November 12. However, there has not been any follow-through dollar-buying, and the greenback has come back offered. Initial support is seen near MXN20.20, and the pre-weekend low was closer to MXN20.07.50.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,Currency Movement,EMU,Featured,newsletter,PMI,treasuries