Swiss Franc The Euro has fallen by 0.01% to 1.0635 EUR/CHF and USD/CHF, June 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It may be that a new surge in virus cases will elicit more policy support from officials, but the immediate focus may be on the economic disruption. The number of US cases is reaching records, and at least a couple of states are stopping their re-opening efforts. Several other countries, including parts of Australia, Japan, and Germany, are wrestling with the same thing, And some emerging markets, like Brazil and Mexico, have not experienced a lull. Asia Pacific markets followed the US lead and traded higher. Indices in Japan, South Korea, and Australia gained more than 1%. China and

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Currency Movement, EUR/CHF, Europe, Featured, Federal Reserve, FX Daily, Mexico, newsletter, U.S. Core PCE Price Index, U.S. Personal Income, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.01% to 1.0635 |

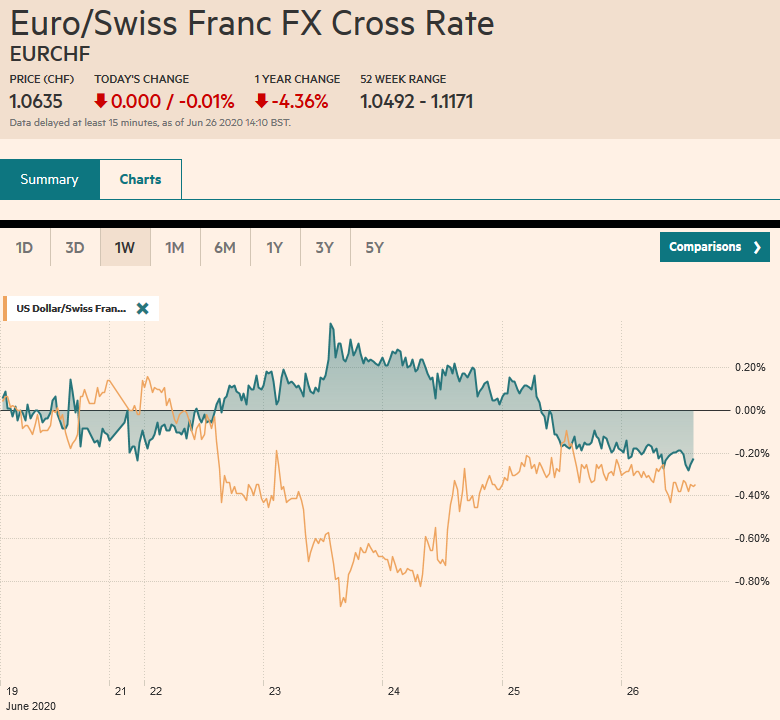

EUR/CHF and USD/CHF, June 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: It may be that a new surge in virus cases will elicit more policy support from officials, but the immediate focus may be on the economic disruption. The number of US cases is reaching records, and at least a couple of states are stopping their re-opening efforts. Several other countries, including parts of Australia, Japan, and Germany, are wrestling with the same thing, And some emerging markets, like Brazil and Mexico, have not experienced a lull. Asia Pacific markets followed the US lead and traded higher. Indices in Japan, South Korea, and Australia gained more than 1%. China and Taiwan markets remained close for a national holiday. Europe’s Dow Jones Stoxx 600 is up about 1.0% near midday, to pare the week’s loss to about 0.5%. US shares are trading little changed, and banks retreated after the Fed’s ordered large banks to freeze dividends at Q2 levels and banned share buybacks in Q3. The S&P 500 is off about 0.5% for the week coming into today. Benchmark 10-year yields are mostly a little lower today, with the US yield near 67 bp. On the week, the US and Germany have seen yields slip 2-3 bp. The US dollar is trading with a heavier bias against most of the majors, led by the yen and the New Zealand dollar. Sterling and the Norwegian krone are underperforming and nursing small losses. For the week, the Canadian dollar and krone are the only two with minor losses against the greenback, though the yen is struggling as well. Emerging markets currencies are mixed, with the South Korean won leading the advancers, and is among the strongest in the EM space this week with a 0.75% gain. Gold is consolidating its gain to new multiyear highs this week and is finding support above the top of the old range (~$1750). It is the third consecutive weekly gain. Oil is firm following news that Russia is limiting Ural crude exports. Even with today’s gain, the August WTI contract is off about 1.6% this week (around $39.2 a barrel). |

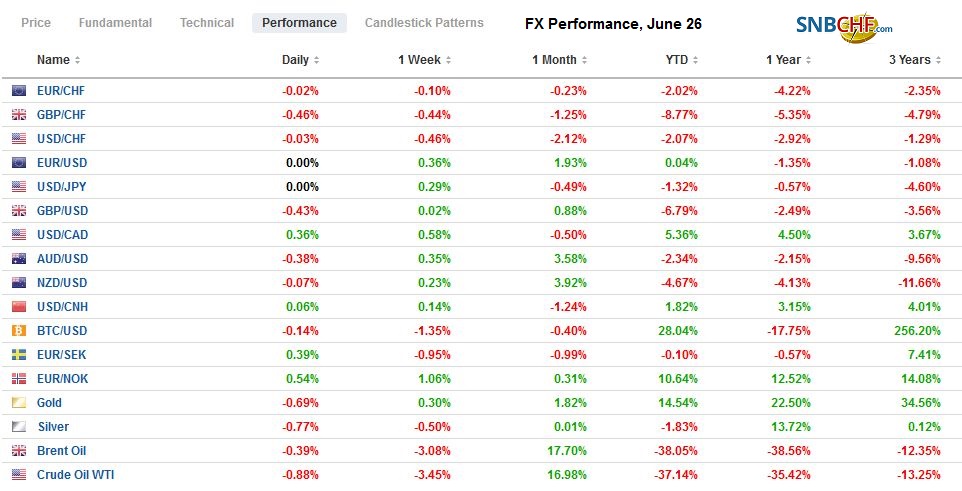

FX Performance, June 26 |

Asia Pacific

Tokyo’s June CPI, which leads the nation, saw little change. Energy prices remained low, and consumers remained restrained even though the national emergency was lifted. Core prices, which exclude fresh food, was unchanged at 0.2%. The headline rate slipped to 0.3% from 0.4%. Hotel prices were fell (6.6% year-over-year). The Bank of Japan meets in the middle of July. It appears to accept that there is little it can do to now to lift prices.

Australian industry reported house prices fell 0.4% in May and anecdotally appears to be falling faster this month. The central bank meets on July 7. The Australian dollar has rallied by nearly 12.3% this quarter. RBA Governor Lowe had an opportunity to talk it down this week but instead said the gains reflect the improving economy and that it did not yet pose a risk to the recovery.

The dollar reached JPY107.45 yesterday but has not been able to sustain the momentum and has been pushed back below JPY107.00 today. There is an option for nearly $465 mln struck at JPY107 that expires today. On an intraday basis, the dollar will likely find support ahead of JPY106.80. The dollar is virtually flat against the yen on the week. The Australian dollar is in about a third of a cent range below $0.6900. It has not been above there since the middle of the week. Last week, it settled near $0.6835. While the mainland markets have been closed for the past two sessions, the offshore Chinese yuan has slipped a little against the dollar. The dollar settled around CNH7.0790 on Wednesday and is currently trading near CNH7.0855.

Europe

There are three potential near-term flashpoints in the US-European trade ties. The first was evident yesterday as the US gets ready to impose tariffs on mostly some consumer products from Europe in retaliation for improper subsidies for Airbus. Second is the digital tax, and here France, the UK, Italy, and Spain have offered a compromise of a phased-approach that first targets automated digital services. Third, Germany, which takes over the rotating EU Presidency in H2, wants to take retaliatory steps if the US continues to sanction the Nord Stream II gas pipeline from Russia.

Eurozone money supply (M3) surged in May, rising 8.9% year-over-year, after an 8.2% pace in April. The median in the Reuters poll was for an 8.6% increase. Bank lending to non-financial businesses surged 7.3% in May from 6.6% in April. This was the strongest rise since 2009. Lending to households was steady at 3%. The new three-year loans from the ECB (TLTRO) at minus 100 bp, is linked to maintaining lending.

The euro is up a little less than 0.5% this week and is snapping a two-week decline that saw it slip by nearly 1%. Last week, and again this week, the euro found on dips below $1.12. There are three sets of expiring options to note today. The first is for about 630 mln euro at $1.1180. That may reinforce the limited downside. The second is for 2.2 bln euro at $1.1200, and the third may help cap the upside with about 765 mln euros in an option at $1.1250. It has been capped so far in late Asia and early European turnover near $1.1240. Since Tuesday, sterling has been struggling. It has been unable to recover from the outside down session recorded on Wednesday after reaching the week’s high near $1.2545. It is struggling to hold above $1.24 as the week winds down. The recent low was near $1.2335. The next immediate target below there is seen around $1.2280.

America

The Federal Reserve made two announcements yesterday. First, the broad results of the stress test were announced. While the largest 34 banks are sufficiently positioned to weather a crisis, the Fed expressed concern that a protracted crisis could lead to hundreds of billions of dollars of bad loans. Under its worst-case scenario, the unemployment rate stays high, and there is no recovery in the economy for several quarters, as much as $700 bln in loans could sour. Given the results, the Fed has capped dividend payouts at Q2 levels and banned share buybacks in Q3. Governor Brainard dissented in favor of a ban on dividends on Q2. Large banks had voluntarily refrained from share buybacks in Q2. Second, the Fed softened the Volcker Rule to allow more venture capital activity and reduces the reserves required for inter-affiliate swaps. Some estimate that the reserve adjustment could be worth as much as $40 bln.

| The Federal Reserve’s balance sheet shrank by almost $12.4 bln. It was the second consecutive week it has declined. Repo use and foreign central bank swaps appear to be the main drivers, offsetting the Fed’s asset purchases. Some observers continue to complain about foreign central banks intervening in the foreign exchange market. However, what seems like intervention maybe, at least for some, replenishing of reserves run down in March and April. In a six week span, foreign central banks liquidated around $155 bln of Treasuries held at the Federal Reserve’s custody account. Over the past 11 weeks, foreign central banks have been rebuilding their holdings here and acquired about $123 bln of Treasuries. Incidentally, foreign central bank holdings of Agency bonds in their custody account with the Fed have declined by about $13 bln in the past 11 weeks as the Treasuries were accumulated. |

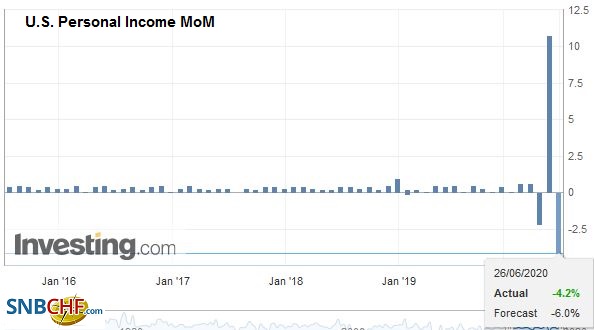

U.S. Personal Income MoM, May 2020(see more posts on U.S. Personal Income, ) Source: investing.com - Click to enlarge |

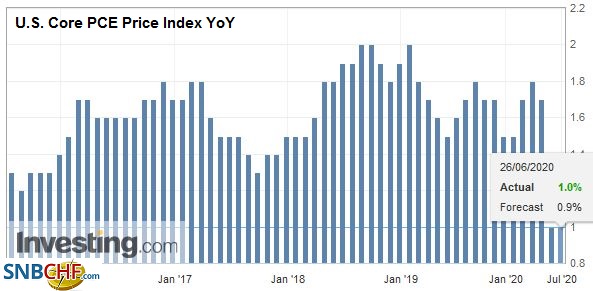

| The US reports May’s household income and consumption expenditure today. Government transfer payments have distorted the income figures, which soared by 10.5% in April. A strong correction is likely, but the 6% decline seen by the median forecast in the Bloomberg survey may be a bit much. On the other hand, the gradual re-opening likely saw consumption recover from the 13.2% slide. The headline deflator, which the Fed targets at 2% are likely to be little changed from the 0.5% year-over-year increase reported in April. The core rate, which Fed officials talk about, may have slipped from April’s 1%. The final University of Michigan consumer sentiment reading may have edged higher from the preliminary report. Canada’s economic diary is light, while Mexico reports May’s trade balance. It is expected to swing back into surplus after a $3 bln deficit in April. |

U.S. Core PCE Price Index YoY, May 2020(see more posts on U.S. Core PCE Price Index, ) Source: investing.com - Click to enlarge |

The US dollar saw good demand earlier this week after dipping below CAD1.3500. It is firm near CAD1.3650, just below the week’s high around CAD1.3670. The high since June 1 is a little higher near CAD1.3685. Watch the downtrend line off the March and May highs intersects around CAD1.3735. Banxico delivered the 50 bp rate cut that was widely expected and indicated scope for lower rates. At least another cut is likely after 225 bp of cuts have already been delivered this year. The peso ticked higher against the cut, but and so did the Philippine peso after its surprise cut and as did the Turkish lira, where the central bank unexpectedly kept rates steady yesterday. However, the peso is offered today, and the dollar may retest the month’s high seen earlier yesterday near MXN23.00.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Currency Movement,EUR/CHF,Europe,Featured,federal-reserve,FX Daily,Mexico,newsletter,U.S. Core PCE Price Index,U.S. Personal Income,USD/CHF