Overview: The dollar is bid to start the new week. It has taken out last week's high against the Swiss franc, and the euro has been sold through last week's lows. The divided opposition allowed Ishiba to continue as Japan's prime minister, heading up a minority government. The German government collapsed last week. Chancellor Scholz wanted to hold off holding (and losing) a vote of confidence until January, setting the stage for elections, but it seems increasingly...

Read More »Dollar Stabilizes After Extending Gains

Overview: The dollar's gains were initially extended before a consolidative tone emerged. The euro has been sold to $1.0460 and has returned to almost $1.05. Sterling fell to nearly $1.2060 and has recovered though has stopped short of $1.2100. The dollar edged closed to JPY150 but stalled near JPY149.95 and has held above JPY149.65. The Australian dollar near $0.6300 and the greenback rose to CAD1.3725. Benchmark 10-year yields are firm, though a well-received...

Read More »Is it Too Easy to Think the Market Repeats its Reaction to a Soft US CPI?

Overview: The market expects a soft US CPI print today, which has recently been associated with risk-on moves. The US 10-year yield is holding slightly above 3.50%, the lowest end of the range since the middle of last month. The two-year yield is a little above 4.20%, also the lower end of its recent range. Most observers see the Federal Reserve slowing the pace of its hikes to a quarter point on February 1. The dollar has spent the last few days consolidating after...

Read More »The State of the German Blockchain Ecosystem

Despite a global venture capital (VC) pullback, shrinking valuations and public market turmoil, Germany’s blockchain VC funding market remained stable this year, with companies in the space securing a total of US$218 million across 20 deals year-to-date (YTD), just US$37 million short of 2021’s US$255 million, a new report by CV VC, a Swiss VC and private equity firm specialized in cryptocurrency and blockchain solutions, shows. The German Blockchain Report, released...

Read More »Weekly Market Pulse: Currency Illusion

When we think about the challenges facing an investor today, the big problems, the things we worry about that could cause a lot more harm than some interest rate hikes, are mostly outside the United States. China is prominent this weekend because of demonstrations against their zero COVID policies. The Chinese people appear to be pretty well fed up with the endless lockdowns and have finally decided to try and do something about it. Unfortunately, I’m not sure...

Read More »Nasty Number Five, Not Hawk Hiking CBs

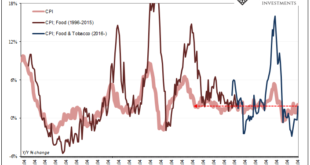

It’s not recession fears, those are in the past. For much if not most (vast majority) of mainstream pundits and newsmedia alike, unlike regular folks this is all news to them (the irony, huh?) Economists and central bankers everywhere had said last year was a boom, a true inflationary inferno raging worldwide. For once, CPIs (or European HICPs) seemed to have confirmed the narrative. Unlike 2018 when inflation indices kept policymakers and their forecasts out in the...

Read More »No Pandemic. Not Rate Hikes. Doesn’t Matter Interest Rates. Just Globally Synchronized.

The fact that German retail sales crashed so much in April 2022 is significant for a couple reasons. First, it more than suggests something is wrong with Germany, and not just some run-of-the-mill hiccup. Second, because it was this April rather than last April or last summer, you can’t blame COVID this time. Something else is going on. . In America, the Fed Cult is out to take credit for this brewing downturn (Jay Powell seeking his place alongside Volcker, which...

Read More »Synchronizing Chinese Prices (and consequences)

It isn’t just the vast difference between Chinese consumer prices and those in the US or Europe, China’s CPI has been categorically distinct from China’s PPI, too. That distance hints at the real problem which the whole is just now beginning to confront, having been lulled into an inflationary illusion made up from all these things. To start with, yesterday China’s NBS reported the index for its consumer prices rose 2.1% year-over-year in April 2022. That’s up from...

Read More »China Then Europe Then…

This is the difference, though in the end it only amounts to a matter of timing. When pressed (very modestly) on the slow pace of the ECB’s “inflation” “fighting” (theater) campaign, its President, Christine Lagarde, once again demonstrated her willingness to be patient if not cautious. Why? For one thing, she noted how Europe produces a lot of stuff that, at the margins of its economy, make the whole system go. Or don’t go, as each periodic case may be: Europe in...

Read More »Goldilocks And The Three Central Banks

This isn’t going to be like the tale of Goldilocks, at least not how it’s usually told. There are three central banks, sure, call them bears if you wish, each pursuing a different set of fuzzy policies. One is clearly hot, the other quite cold, the final almost certainly won’t be “just right.” Rather, this one in the middle simply finds itself…in the middle of the other two. Running red-hot to the point of near-horror, that’s “our” Federal Reserve. The FOMC minutes...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org