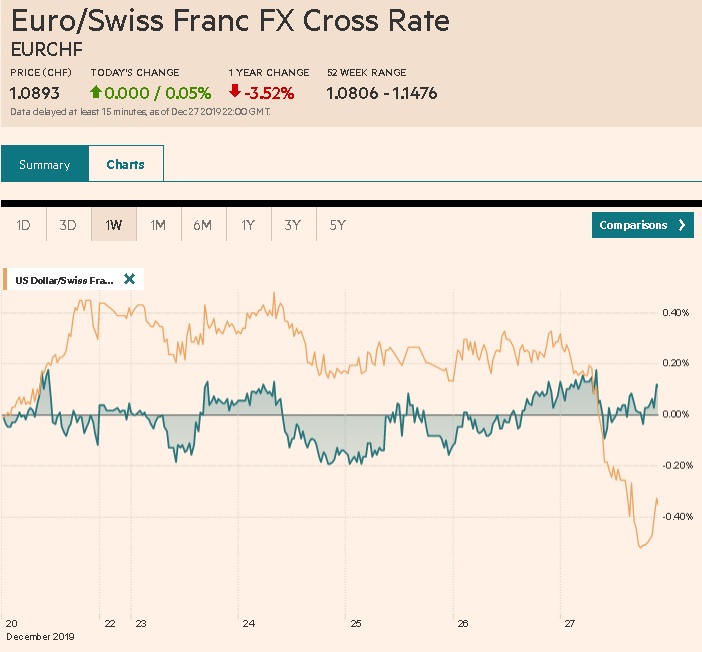

Swiss Franc The Euro has risen by 0.05% to 1.0893 EUR/CHF and USD/CHF, December 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge Overview: Equities are finishing the holiday-shortened week on a firm note, encouraged by strong holiday internet sales in the US. Most markets in the Asia Pacific region advanced except China and Thailand, while Japanese markets were mixed after weak industrial output and retail sales. The MSCI Asia Pacific Index rose for the fourth consecutive week. Europe’s Dow Jones Stoxx 600 is pushing to new record highs in its third straight weekly advance. It has only fallen in three weeks here in Q4. US shares are trading firmer, and the S&P 500 is set to extend its increase for the fourth week. It has only

Topics:

Marc Chandler considers the following as important: 4) FX Trends, 4.) Marc to Market, Brexit, China, Currency Movement, Featured, Japan, newsletter, USD

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

Swiss FrancThe Euro has risen by 0.05% to 1.0893 |

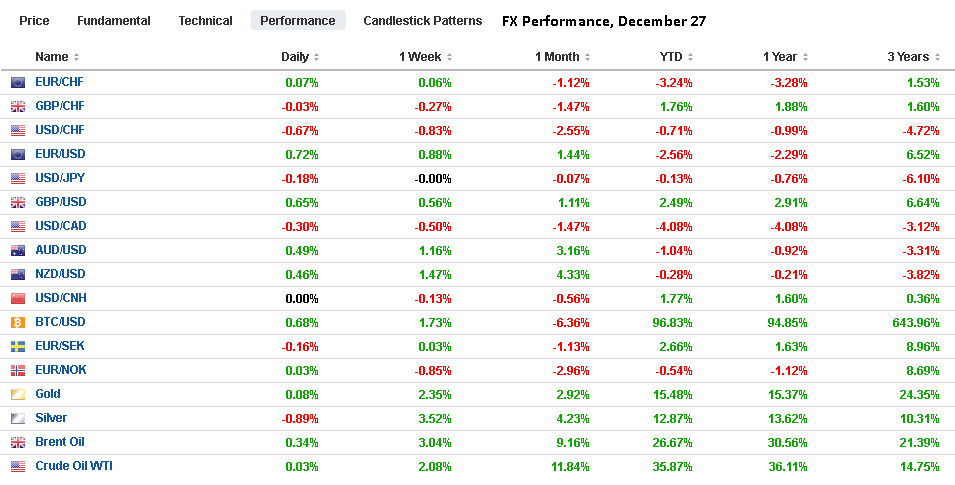

EUR/CHF and USD/CHF, December 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

| Overview: Equities are finishing the holiday-shortened week on a firm note, encouraged by strong holiday internet sales in the US. Most markets in the Asia Pacific region advanced except China and Thailand, while Japanese markets were mixed after weak industrial output and retail sales. The MSCI Asia Pacific Index rose for the fourth consecutive week. Europe’s Dow Jones Stoxx 600 is pushing to new record highs in its third straight weekly advance. It has only fallen in three weeks here in Q4. US shares are trading firmer, and the S&P 500 is set to extend its increase for the fourth week. It has only fallen in two weeks over the past three months. Benchmark 10-year yields are mostly softer 1-2 basis points on day and week, with the US 10-year yield off the most of the major economies with a 4.5 bp decline to 1.88%. The dollar is trading lower against all the major currencies and most of the emerging markets. On the week, only the yen among the G10 currencies is struggling to gain against the dollar. The Dollar Index is off about 0.4% this week, pending the North American session. It would be the third weekly decline in the past four. Meanwhile, although gold is a little softer today, but is holding above $1500. It has gained 2.2% this week, which is its best performance since August. WTI for February delivery is edging closer to $62 a barrel and its fourth weekly advance. It finished last month near $55.15. |

FX Performance, December 27 |

Asia Pacific

Chinese industrial profits snapped a three-month contraction and rose 5.4% in November. It followed a 9.9% decline in October. It dovetails nicely with the emerging narrative that the stimulative efforts are beginning to pay-off, and the world’s second-largest economy is finding traction into the end of the year. That said, the December official PMI and Caixin’s manufacturing measures that will be reported early next week are expected to ease slightly after the November rebound.

Japanese economic data failed to inspire investors. The best news was the unemployment rate unexpectedly fell 2.2% from 2.4%, but the other reports were less favorable. Retail sales bounced back in November less than expected. The 4.5% gain on the month was supposed to be 5% after the revised 14.2% plummet in October as the sales tax increase had brought purchases forward. The year-over-year decline stands at 2.1%. Industrial output fell 0.9% in November after falling 4.5% in October. It is the first back-to-back decline in a year. That said, the world’s third-largest economy is expected to bottom this quarter with the sales tax increase and aftermath of the typhoon.

The dollar has been confined to about a fifth of a yen (~JPY109.45-JPY109.65) as it remains mired within its recent range. There is an option for about $665 mln at JPY109.65 that expires today. Note that the dollar finished November at about JPY109.50. The Australian dollar is putting the final touches on its fourth consecutive weekly advance. It ended last month near $0.6765 and is now at seven-month highs near $0.6960. After being turned back by its 200-day moving average several times this year, it powered above it ($0.6900) this week. The dollar is straddling the CNY7.0 level. It has been alternating between gains and losses over the past five weeks. The greenback is poised to close slightly lower on the week.

Europe

The UK election did not end the Brexit debate and discussion. It has simply entered a new phase. Comments by European Commission President von der Leyen underscore this fact. She suggested that UK Prime Minister Johnson’s desire for a long-term trade agreement to be completed by the end of next year may be optimistic. Meanwhile, the EC wants the UK to maintain its alignment with EU rules to facilitate close ties for trade, finance, and data.

The euro has moved higher every day this week. Today’s advance has carried it to a seven-day high near $1.1145. At its highs, it is flirting with its 200-day moving average, which it has not closed above since the end of June. The intraday technicals are stretched, warning that fresh gains may be difficult to sustain ahead of the weekend. Sterling found a base near $1.29 earlier this week, and that pullback from $1.35 on the election may have been sufficient to bring in new buyers. Initial resistance is pegged near $1.3090 and then $1.3140.

America

There is little data of consequence today in North America. The only release of note is Mexico’s November trade balance. It is expected to be in deficit (~$537 mln) for the third consecutive month. The Fed’s term repo (14-day) yesterday was the third consecutive provision for the turn that was undersubscribed. The next term repo is scheduled for Monday.

The US dollar held support near CAD1.3100 yesterday but has punched below it today for the first time in two-months. The broad weakness of the greenback is the main culprit, though we do note that Canada has offered a premium over the US to borrow two-year money all month. Higher oil prices and risk-on sentiment also favor the Canadian dollar. We also note that the CRB Index gapped higher yesterday and is trading at eight-month highs. The US dollar is also heavy against the Mexican peso but is holding above the bottom of a shelf that it has forged over the past two weeks in the MXN18.88-MXN18.90 area. The technical indicators suggest the greenback is trying to bottom.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,China,Currency Movement,Featured,Japan,newsletter