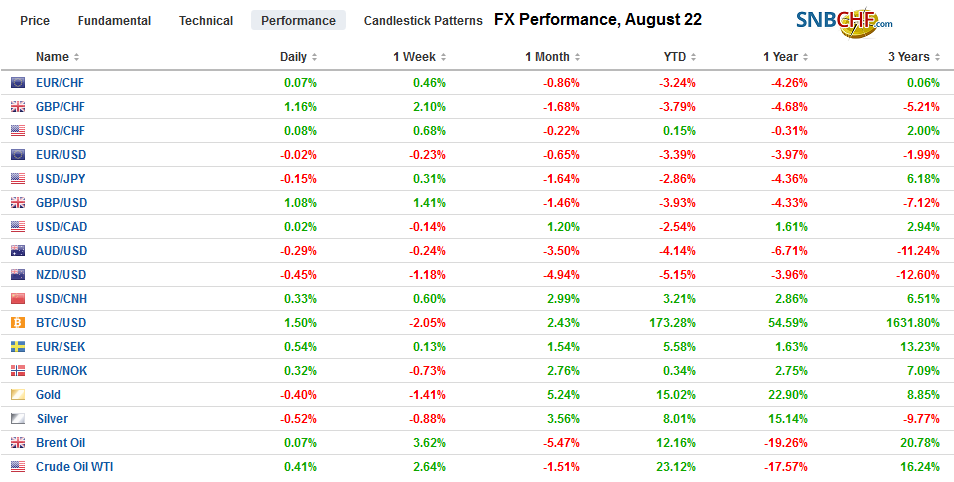

Swiss Franc The Euro has risen by 0.17% to 1.0905 EUR/CHF and USD/CHF, August 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Soft data in Asia and the continued decline in the yuan (six days and counting) prevented Asian equities from following the US lead from yesterday when the S&P 500 advanced by 0.8%. European shares are paring yesterday’s 1.2% advance despite an unexpected gain in the EMU flash PMI. US shares are little changed in the European morning. Benchmark 10-year bond yields in Europe are 1-2 bp higher, and though the political crisis in Italy has not been resolved, Italian bonds continue to outperform, ostensibly on hopes that a near-term election can be avoided. The dollar narrowly mixed and

Topics:

Marc Chandler considers the following as important: $CNY, 4.) Marc to Market, 4) FX Trends, Currency Movements, EUR, EUR/CHF, Eurozone Manufacturing PMI, Featured, FX Daily, Germany Manufacturing PMI, Germany Services PMI, IDR, Japan Manufacturing PMI, newsletter, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.17% to 1.0905 |

EUR/CHF and USD/CHF, August 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Soft data in Asia and the continued decline in the yuan (six days and counting) prevented Asian equities from following the US lead from yesterday when the S&P 500 advanced by 0.8%. European shares are paring yesterday’s 1.2% advance despite an unexpected gain in the EMU flash PMI. US shares are little changed in the European morning. Benchmark 10-year bond yields in Europe are 1-2 bp higher, and though the political crisis in Italy has not been resolved, Italian bonds continue to outperform, ostensibly on hopes that a near-term election can be avoided. The dollar narrowly mixed and seemingly stuck in recent ranges. The Swedish krona has been dragged lower by a weak employment report.and its 0.5% loss is the largest among the majors, though the New Zealand dollar is giving it a run for its money. Among emerging markets currencies, Russia and central/eastern European currencies are faring best. The Turkish lira is bucking the regional trend and is leading the declines with about a 0.8% fall. The US dollar neared TRY5.80 for the first time since early July. |

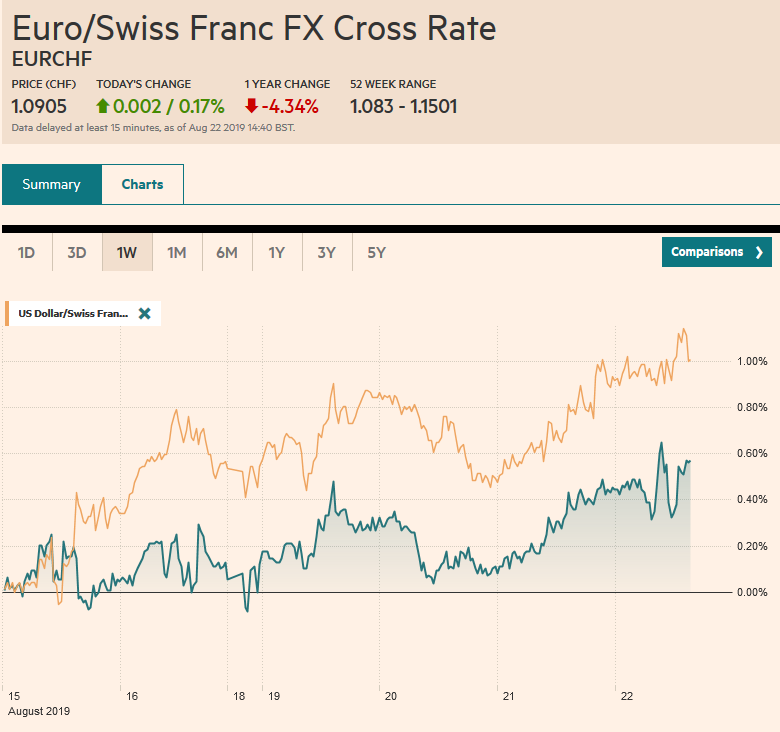

FX Performance, August 22 |

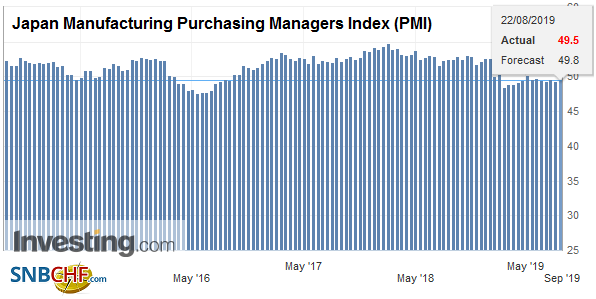

Asia PacificIndonesia joined the rate-cutting party with a 25 bp cut to bring the seven-day repo rate to 5.5%. Most economists did not expect the cut today, but the rupiah is little changed. The central bank had cut rates in July as well. Equities initially gained on the surprise move but quickly reversed to finish about 0.2% lower. Japan’s June all-industries activity index fell 0.8% in June. This was in line with expectations and follows a revised 0.5% (from 0.3%) gain in May. With stronger than expected Q2 GDP already reported, the interest was in the more timely release of the preliminary August PMI. A common theme was evident: manufacturing weakness is still apparent, but strength in the service sector compensated. The manufacturing PMI edged to 49.5 from 49.4, while the service PMI rose to 53.4 from 51.8. This saw the composite rise to 51.7, a new high for 2019, from 51.2. |

Japan Manufacturing Purchasing Managers Index (PMI), August 2019(see more posts on Japan Manufacturing PMI, ) Source: investing.com - Click to enlarge |

Australia disappointed and ran counter to the general pattern. Manufacturing and services PMI readings softened, and the composite fell below the 50 boom/bust level for the first time since March (49.5 vs. 52.1). The manufacturing reading eased to 51.3 from 51.6, while services fell to 49.2 from 52.3. Still, the market is not convinced of a rate cut at the September 3 RBA meeting. Around 10%, the odds are less than half of what was attributed a week ago. The meeting on October 1 is seen as a more likely venue.

The dollar remains confined to the narrow ranges seen this week (~JPY106.15-JPY106.70). It is showing little enthusiasm in either direction. Expiring options struck at JPY106 and JPY107 today do not seem particularly relevant. The Australian dollar also remains in its well-worn range seen for the better part of the past two weeks (~$0.6755-$0.6800). It is heavy and additional support is seen near $0.6735. The Chinese yuan is trading lower for the sixth consecutive session. The PBOC continues to lean against the pressure and set the dollar’s reference rate weaker than the models projected. The dollar is at new highs against the onshore yuan (CNY), but against the offshore yuan (CNH) it is below August 6 high (CNH7.14).

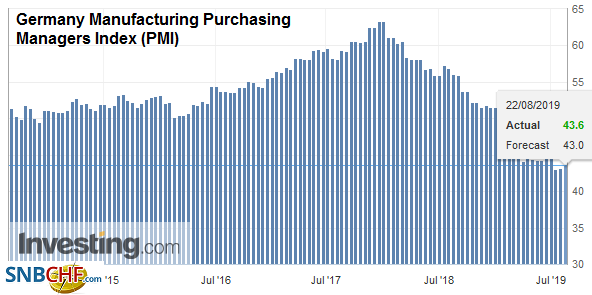

EuropeThe flash PMI in Europe is better than expected but not sufficiently so to change the outlook for the ECB’s policy response in a few weeks (September 12). German manufacturing, for example, rose to 43.6 from 43.2, but it is the eighth-month of contraction. |

Germany Manufacturing Purchasing Managers Index (PMI), August 2019(see more posts on Germany Manufacturing PMI, ) Source: investing.com - Click to enlarge |

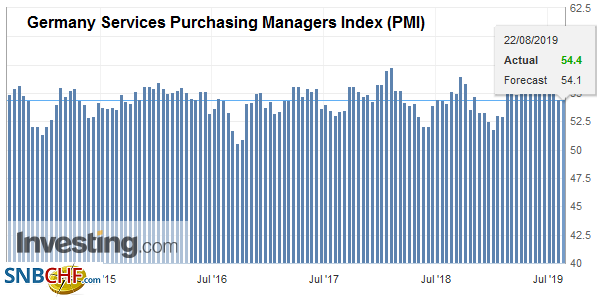

| The service sector continues to hold up better, though it slipped to 54.4 from 54.5 (a seven-month low). The composite rose to 51.4 from 50.5. Orders and hiring continued to contract.

France, less dependent on the auto sector and exports more broadly continues to fare better than Germany. The manufacturing sector rose to 51.0 from 49.7 to return to growth. Services rebounded as well, to 53.3 from 52.6, which is a new high since last November. The combination lifted the composite to 52.7 from 51.9, which matches the year’s high. |

Germany Services Purchasing Managers Index (PMI), August 2019(see more posts on Germany Services PMI, ) Source: investing.com - Click to enlarge |

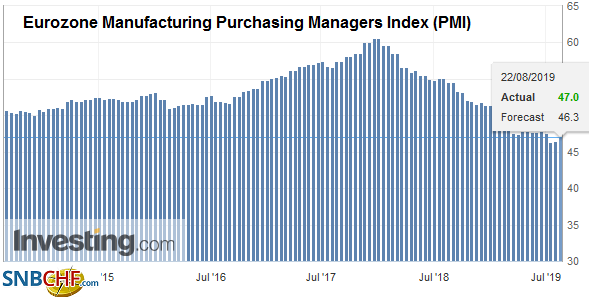

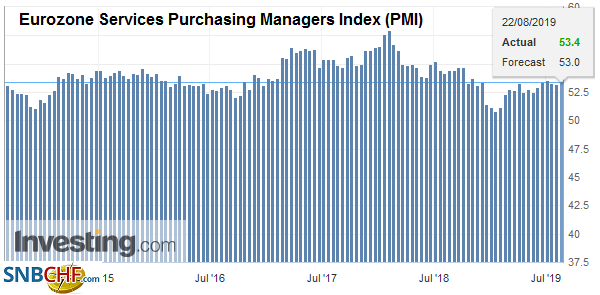

| The EMU aggregate reading improved but is no game-changer. The manufacturing PMI rose to 47.0 form 46.5 |

Eurozone Manufacturing Purchasing Managers Index (PMI), August 2019(see more posts on Eurozone Manufacturing PMI, ) Source: investing.com - Click to enlarge |

| while the service PMI nudged up to 53.4 from 53.2. The composite rose to 51.8 from 51.1. The other EMU members were projected to be little changed.

Germany’s Merkel seemed frustrated with UK’s Johnson visit. If the UK does not want the backstop that it had previously negotiated, Merkel, said, then it is incumbent on the UK to propose an alternative and “no backstop” is not an alternative. In effect, she seemed to be calling Johnson’s bluff, giving him 30 days to find the alternative that has eluded others. France’s assessment that a no-deal Brexit has become the base case is likely shared by others. |

Eurozone Services Purchasing Managers Index (PMI), August 2019 Source: investing.com - Click to enlarge |

The euro is mired in a roughly $1.1065-$1.1115 range. There is a 1.6 bln euro option at $1.11 that expires today, Powell’s speech at Jackson Hole tomorrow is awaited. Sterling is also in a narrow range today (~$1.2110-$1.2155). The 20-day moving average is found near $1.2140 today and sterling has not closed above this average for nearly two months. The euro-sterling cross is little changed on the week (~GBP0.9130).

America

The firmer than expected Canadian July CPI arrested the rate cut fever that had sapped the Canadian dollar recently. The headline rate rose 0.5% for a 2.0% year-over-year pace, which was unchanged from June but defied expectations for slippage toward 1.7%. The underlying measures were also firm, suggesting that seasonal pressures on airfares may not be the only driver. The market trimmed expectations for a surprise cut next month. While the odds of a cut before the end of the year were also shaved, it remains elevated around 70%.

The BLS benchmark revisions to non-farm payrolls will be finalized earlier next year. On a preliminary basis, it estimates a downward revision of about 500k jobs or around 42k a month for the year ending this past March. The monthly average for that 12-month period was 193k. It is unfortunate but not material in the sense of altering views. The labor market is strong. The link between the labor market, wages, and inflation is blurred, assuming it was once clearer. Separately, the FOMC minutes confirmed the midcourse (“re-calibration”). Words do matter, and that midcourse correction framing is reminiscent of Greenspan’s use in the 1990s, and each signaled (in hindsight) three rate cuts. The first was last month. The market sees next month’s as done deal. It has fully discounted a third. It is the next one that investors continue to vacillate around. The odds shifted a bit against it after the FOMC minutes.

The US reports weekly jobless claims (may slip after rising to 220k previously, a six-week high), July Leading Economic Indicators (look for a 0.3% gain after a 0.3% decline in June), and the flash August Markit PMI (the composite was at 52.6 in July having bottomed in May at 50.9). The focus is on the tomorrow’s Jackson Hole confab, where Powell will speak around 10 am ET. Mexico reports its bi-weekly CPI estimate. It is expected to fall to 3.5% year-over-year from 3.72%. It would be the lowest in three years and may support ideas that the central bank will cut rates again in Q4. Mexico reports a second look at Q2 GDP tomorrow. It initially reported a 0.1% quarterly expansion, and it may be revised to flat. Canada reports wholesale trade figures today, but more importantly, June retail sales will be released tomorrow. A third consecutive monthly decline is anticipated.

The Canadian dollar is little changed, and the US dollar appears comfortable in a CAD1.3250-CAD1.3340 range. Today’s range may be inside that, and we see CAD1.3280-CAD1.3320 to likely hold today. The dollar tested MXN19.90 at the start of the week and pulled back to about MXN19.65 were bids were found. Yesterday’s high was near MXN19.77, and a move above it could spur a retest of the week’s highs, which are also the highs for the year. Only a break of MXN19.55 would take the pressure off the peso.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,$EUR,Currency Movements,EUR/CHF,Eurozone Manufacturing PMI,Featured,FX Daily,Germany Manufacturing PMI,Germany Services PMI,IDR,Japan Manufacturing PMI,newsletter,USD/CHF