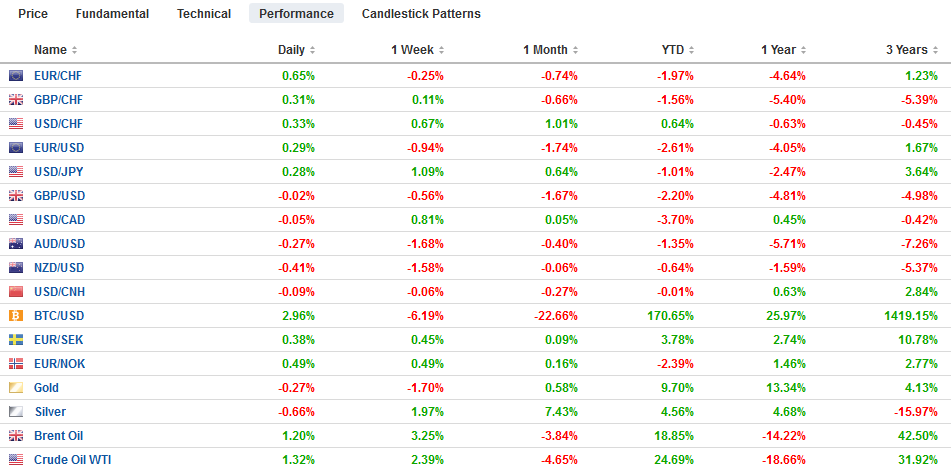

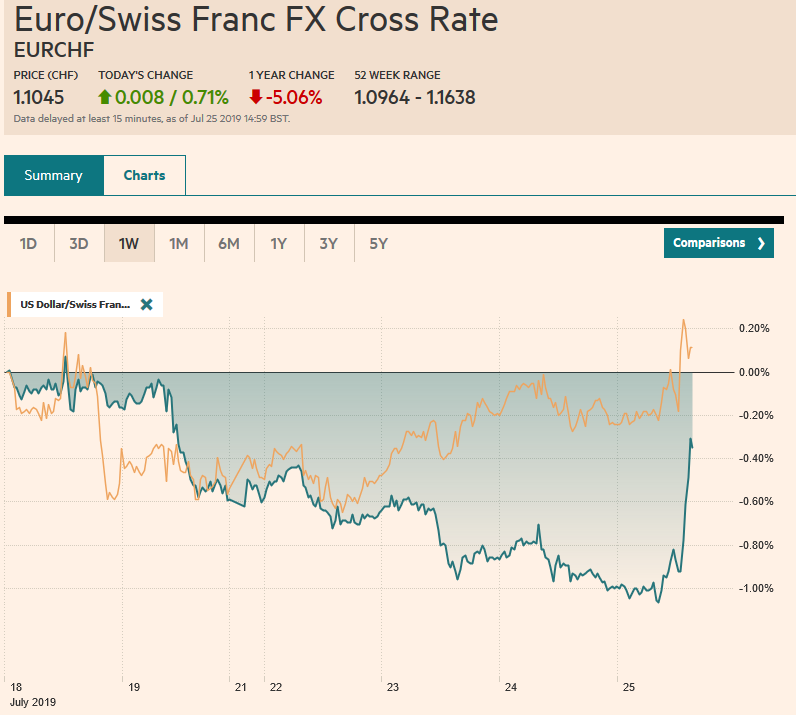

Swiss Franc The Euro has risen by 0.71% at 1.1045 EUR/CHF and USD/CHF, July 25(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The euro remains stuck in its trough below .1150 ahead of the ECB meeting. The US dollar is firmer against most of the major currencies. The yen continues to resist the draw of the greenback. Most emerging market currencies are lower. The Turkish lira is weaker ahead of its central bank meeting, which is expected to deliver a large cut (~250 bp). The South Korean won eased after North Korea fired two “projectiles” and the Kospi Index bucked the regional trend of higher equities after record closing highs in the US. European

Topics:

Marc Chandler considers the following as important: 4) FX Trends, ECB, Featured, newsletter, South Korea, Turkey, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.71% at 1.1045 |

EUR/CHF and USD/CHF, July 25(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The euro remains stuck in its trough below $1.1150 ahead of the ECB meeting. The US dollar is firmer against most of the major currencies. The yen continues to resist the draw of the greenback. Most emerging market currencies are lower. The Turkish lira is weaker ahead of its central bank meeting, which is expected to deliver a large cut (~250 bp). The South Korean won eased after North Korea fired two “projectiles” and the Kospi Index bucked the regional trend of higher equities after record closing highs in the US. European shares are extending their advance, with the Dow Jones Stoxx 600 up for a fifth consecutive session. Benchmark bond yields are lower across the board. Dovish comments by the RBA’s Lowe saw new record lows in Australia. The prospects of new asset purchases scheme are helping to push European yields lower, with Italy and Greece’s 10-year benchmarks at new all-time lows (~1.46% and ~ 1.95% respectively). Gold and oil are a little firmer. |

FX Performance, July 25 |

Asia Pacific

North Korea fired what reports are calling two “projectiles” as it seeks to draw the US attention in a similar way that Iranian actions in the Persian Gulf appear aimed at re-engaging the US. The market impact is mild and typically not long-lasting. Separately, South Korea, which eased rates last week, reported a slightly firmer than expected Q2 GDP of 1.1% quarter-over-quarter (most economists forecast a little less than 1%) after a 0.4% contraction in Q1. The year-over-year rate rose to 2.1% from 1.7%. That said, with trade an important headwind and inflation (CPI) below 1%, there is scope for another rate cut later this year if needed, despite today’s GDP report. Separately, yesterday the period of public comments ended in Japan regarding removing South Korea from a list in Tokyo of preferred export partners. This could result in widening the impact of Japanese action from the semiconductor and screen sector to include auto parts, for example.

The Reserve Bank of Australia cut its cash rate in June and July and is unlikely to cut rates when it meets again on August 6. However, Governor Lowe confirmed market suspicions that the rate-cutting cycle may not be over. The combination of lower rates (cash rate is at a record low 1%), tax cuts, and higher commodity prices may not prove sufficient to bolster the economy. The Australian dollar fell to new two-week lows on the back of Lowe’s comments. The two-year yield is trading nearly 15 bp through the cash rate. A rate cut could come as early as September, though many economists see October 1 as more a more likely timeframe now.

The dollar is trading inside yesterday’s range against the Japanese yen, which was inside Tuesday’s range. Specifically, the greenback is in about a 10 tick range on either side of JPY108.15. There is a roughly $535 mln option at JPY108 that will be cut today and another one at JPY108.25 for about $575 mln that also expires today. Technically, a move above JPY108.30 is needed to potentially spur a further advance toward JPY109, which offers important resistance. On the downside, options for more than $2.5 bln, expiring today, in the JPY107.75-JPY107.90 may provide the greenback some support. The Australian dollar is pushing lower for the fifth consecutive session and is trading near two-week lows, just above $0.6960. The intraday technicals are trying to turn higher, but it needs to resurface above $0.7000 to be anything noteworthy. Meanwhile, the Chinese yuan remains in unusually narrow ranges that have confined for the past couple of weeks.

Europe

The ECB is center stage today. Despite yesterday’s disappointing flash eurozone PMI, weaker money supply growth, and today’s news that the German IFO fell to new six-year lows, market sentiment has shifted away from expecting a rate cut today. Interpolating from the Overnight Index Swaps, the odds have fallen from a little more than 50% at the end of last week to a little below 40% now. That said, when the market has misjudged Draghi, it is because it has not fully appreciated his decisive resolve to aggressively pursue what he sees as the central bank’s legal mandate. The expectations shift away from a cut today is not though because investors are less dovish but rather more so in the sense of accepting that ECB will respond using several of its tools at the same time.

1. Today, the market expected the ECB to alter its forward guidance and signal action in September. As part of its forward guidance, it could commit to keep rates at present levels or lower through the end of next year. The current commitment is not to raise rates until at least through the middle of next year.

2. In September, the staff updates its forecasts, and it is underneath the cover it provides that the ECB appears to feel most comfortable taking significant steps.

3. The market expects a 10 bp cut in the deposit rate, which currently stands at minus 40 bp. There is some suggestion that it may introduce a tiered system, whose purpose would be to mitigate some of the undesirable consequences of negative interest rates. Although the rate cut expected in September, the risk is not insignificant that the move happens today. The market is pricing in the likelihood of another 10 bp rate cut in Q4.

4. The ECB is expected to wait until next month to announce the details of a resumption of its asset purchases. To do so, some of its self-imposed position limits will likely be revisited. We do not expect significant innovations, like the purchase of equities, which some observers have advocated. Estimates of the size of the operation seem to gravitate around 40-50 bln euros a month.

5. A new targeted long-term refinance operation was announced in June to begin in September. The terms may be tweaked in the direction of easier terms. Banks in the periphery, especially Italian banks, use the facility.

Turkey’s central bank holds its first meeting since the previous governor was dismissed. The question is how large of a cut will be delivered today. Expectations have crept up in recent days, and the median forecast in the Bloomberg survey now sees a 250 bp cut in the one-week repo rate that sits at 24% now. Inflation is falling faster than expected. In June, the CPI was up 15.72% year-over-year. It finished last year up 20.30% after peaking at almost 20.25% in October 2018. Turkey has the highest real rates (adjusted for inflation) in the world. Turkey’s 10-year bond has fallen 34 bp over the past month and nearly 250 bp over the past three months. The two–year yield has fallen from almost 23.6% at the end of May to trade below 17% earlier this week.

The UK’s new Prime Minister Johnson appointed his cabinet. The key appointments include Raab as Foreign Secretary, which is effectively the deputy PM. Javid became Chancellor of the Exchequer, and Patel is the Home Secretary. Johnson replaced 18 of 29 ministers, which is not that uncommon. Brown did more when he replaced Blair, for example. Johnson will begin with a two-seat operating majority in the House of Commons that could be whittled down to one after a byelection scheduled next week. In terms of the policy thrust, to prepare for a no-deal exit, that Johnson threatens, fiscal stimulus is expected.

The euro slipped to almost $1.1120 in the European morning. A push below $1.11 would likely trigger stop-loss selling, and the next support is expected near $1.1075, where there may be some option-related demand. There is a nearly 535 mln option at $1.1125 that will be cut today and roughly 785 mln euros at $1.1170. Sterling is hugging yesterday’s settlement level (~$1.2485). The 20-day moving average is near $1.2525, and it has not traded above it since July 1. There is a GBP330 mln option at $1.25 that rolls off today. The euro is consolidating yesterday’s pullback that saw it approached GBP0.8900 for the first time since June 21.

America

Ironically, despite the penchant for unilateral action, the US has proposed a multilateral effort to monitor and protect oil ships in the Gulf in what has called Operation Sentinel. Europe appears to be rebuffing it. Europe wants to run an independent mission.

The US reports a series of economic reports today, including durable goods orders, inventories, and trade. The data will be overshadowed by the reaction to the ECB meeting and Draghi’s press conference as well as the fact that the first estimate of Q2 GDP will be made tomorrow. While growth is expected to have slowed from the 3.1% in Q1, the price measures are likely to have markedly firmed. Meanwhile, the US earnings season is in full gear and among the highlights today will be Amazon and Alphabet.

After rallying on Monday and Tuesday, the US dollar has consolidated against the Canadian dollar. Rising equities and firmer oil prices are supportive for the Canadian dollar, but US two-year premium has nearly doubled to 40 bp over Canada in the past few weeks. Disappointing retail and wholesale trade appears to have spurred the bout of profit-taking. The greenback stalled near CAD1.3165. Initial support is now pegged near CAD1.31. The five-day moving average crossed above the 20-day average for the first time since June 5 yesterday. The US dollar was turned back from MXN19.20 yesterday. It is finding support ahead of MXN19.00. Mexico reports May retail sales today, and the median forecast from the Bloomberg survey calls for a flat reading after a 0.7% rise in April. Next week, Mexico reports Q2 GDP and a modest gain of around 0.5% is likely after a 0.2% contraction in Q1 19 and a flat Q4 18. Still, pressure on the central bank to cut the high real and nominal rates continues to build but may not be gratified until Q4.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,ECB,Featured,newsletter,South Korea,Turkey