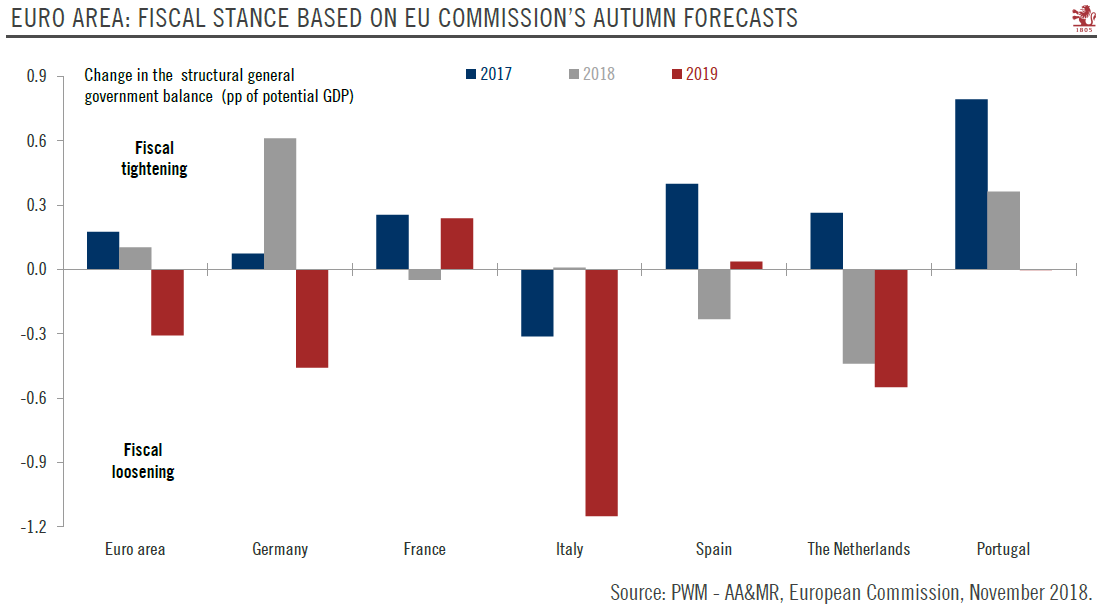

Modest fiscal easing could help counter mounting external risks and slowing growth indicators.Euro area member states have all submitted their 2019 Draft Budgetary Plans (DBP) to the European Commission (EC) by now. These show that, collectively and based on EU Commission’s autumn forecasts, the euro area’s fiscal stance1 will turn supportive in 2019, although it varies significantly from one country to the next.Germany, Italy and the Netherlands are planning fiscal expansions, but Spain, France and Portugal have pledged to work towards further fiscal consolidation next year. Admittedly, there remain significant uncertainties as to whether these plans will be implemented and whether they will have the expected impact on growth. First, the fiscal loosening may turn out to be smaller than

Topics:

Nadia Gharbi considers the following as important: euro area, Euro area GDP growth, Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes Gold climbing from record high to record high: why buy now?

Claudio Grass writes Gold climbing from record high to record high: why buy now?

Claudio Grass writes Gold climbing from record high to record high: why buy now?

Claudio Grass writes The permacrisis strategy: the mortal dangers of our “new normal”

Modest fiscal easing could help counter mounting external risks and slowing growth indicators.

Euro area member states have all submitted their 2019 Draft Budgetary Plans (DBP) to the European Commission (EC) by now. These show that, collectively and based on EU Commission’s autumn forecasts, the euro area’s fiscal stance1 will turn supportive in 2019, although it varies significantly from one country to the next.

Germany, Italy and the Netherlands are planning fiscal expansions, but Spain, France and Portugal have pledged to work towards further fiscal consolidation next year. Admittedly, there remain significant uncertainties as to whether these plans will be implemented and whether they will have the expected impact on growth. First, the fiscal loosening may turn out to be smaller than indicated in Germany’s DBP, as that country has had a tendency to under-deliver on fiscal easing pledges in recent years. In Italy, the budget plan represents a significant deviation from the EU’s fiscal rules. The outcome of arm wrestling between Rome and Brussels is still uncertain. Beyond the confrontation between the EC and the Italian government, fiscal loosening may turn out to be self-defeating when it comes to growth, as it could well be more than counterbalanced by the increase in interest rates. The minority government in Spain may be unable to push its fiscal plans though parliament, so major changes to the composition of the budget and fiscal targets cannot be ruled out. On balance, however, 2019 has a good chance of being the year when euro area fiscal policy finally becomes a tailwind for growth, albeit a modest one.

Euro area stimulus still pales compared with that seen in the US. Nevertheless, coming at a time of weaker-than expected GDP growth so far in H2 2018, ebbing monetary support and mounting external downsides risks, fiscal easing may provide a (modest) boost to euro area growth in 2019.