In an NBER working paper, Laurence Ball and Sandeep Mazumder question the puzzles of first, missing disinflation and subsequently, missing inflation in the Euro area. From the abstract: … we measure core inflation with the weighted median of industry inflation rates, which is less volatile than the common measure of inflation excluding food and energy prices. We find that fluctuations in core inflation since the creation of the euro are well explained by three factors: expected inflation...

Read More »A truce between Rome and Brussels

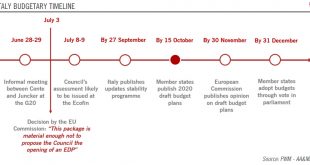

For now, Italy has avoided Brussels' Excessive Deficit Procedure. But tensions are set to rise again in the autumn when Italy presents its 2020 budget package.In its mid-year budget revision, the Italian government lowered its 2019 deficit target. The government pointed to better-than-expected revenues for this revision, including tax revenues that were EUR3.5bn higher than expected and an additional EUR2.7bn in other revenues (including dividends from state-owned companies). Furthermore,...

Read More »A truce between Rome and Brussels

For now, Italy has avoided Brussels’ Excessive Deficit Procedure. But tensions are set to rise again in the autumn when Italy presents its 2020 budget package. In its mid-year budget revision, the Italian government lowered its 2019 deficit target. The government pointed to better-than-expected revenues for this revision, including tax revenues that were EUR3.5bn higher than expected and an additional EUR2.7bn in other...

Read More »Rising downside risks to euro area growth

While our forecasts remain unchanged for now, external drags on growth prospects for the euro area look set to persist for longer than we had previously expected. A potential improvement in euro area growth in H2 2019 on the back of a revival in the global economy is in jeopardy due to the intensifying trade dispute between the US and China. The euro area is not directly affected, but its indirect exposure to this...

Read More »Rising downside risks to euro area growth

While our forecasts remain unchanged for now, external drags on growth prospects for the euro area look set to persist for longer than we had previously expected.A potential improvement in euro area growth in H2 2019 on the back of a revival in the global economy is in jeopardy due to the intensifying trade dispute between the US and China. The euro area is not directly affected, but its indirect exposure to this dispute is not insignificant. Potentially weaker domestic demand in the US,...

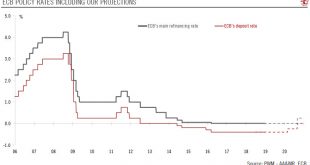

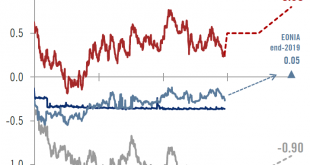

Read More »ECB Forward Guidance: the Devil is in the Detail

Following the changes to its forward guidance, we have revised our forecast for ECB policy rates. Last week, the European Central Bank (ECB) announced a new long-term refinancing package for banks (called TLTRO-III) and made clear that interest rates would not be raised this year. While these measures were expected, they have come earlier than we thought. We were also taken aback by the extent of the downside revisions...

Read More »ECB rates and TLTRO-III: the devil in the details

Following the changes to its forward guidance, we have revised our forecast for ECB policy rates.Last week, the European Central Bank (ECB) announced a new long-term refinancing package for banks (called TLTRO-III) and made clear that interest rates would not be raised this year. While these measures were expected, they have come earlier than we thought. We were also taken aback by the extent of the downside revisions to the ECB’s inflation and growth projections and ECB President Draghi‘s...

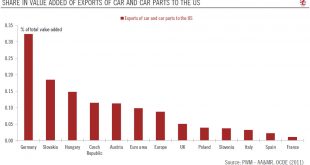

Read More »Euro area : What if car tariffs lie ahead ?

New US auto tariffs may impact the economy significantly more than the previous tariffs on steel and aluminium. Among the key risks for our euro area outlook, the threat of US auto tariffs is of major importance. The US Commerce Department’s investigation on national security threats posed by auto imports is due to be concluded on 17 February. Given the complexity of the global auto supply chain, it is very complicated...

Read More »Euro area : What if car tariffs lie ahead ?

New US auto tariffs may impact the economy significantly more than the previous tariffs on steel and aluminium.Among the key risks for our euro area outlook, the threat of US auto tariffs is of major importance.The US Commerce Department’s investigation on national security threats posed by auto imports is due to be concluded on 17 February.Given the complexity of the global auto supply chain, it is very complicated to isolate the effect of a one-off increase in US tariffs on European...

Read More »Core Euro Sovereign Bonds 2019 Outlook

It’s all about the European Central Bank’s hiking cycle. In our central scenario, we expect the 10-year Bund yield to rise gradually to 0.8% by the end of next year from 0.26% on 17 December. Underpinning this upward movement is our expectation of a cumulative deposit rate hike of 40 basis points (bps) by the ECB, against current market expectations of only 10 bps. The euro area economic activity has been decelerating...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org