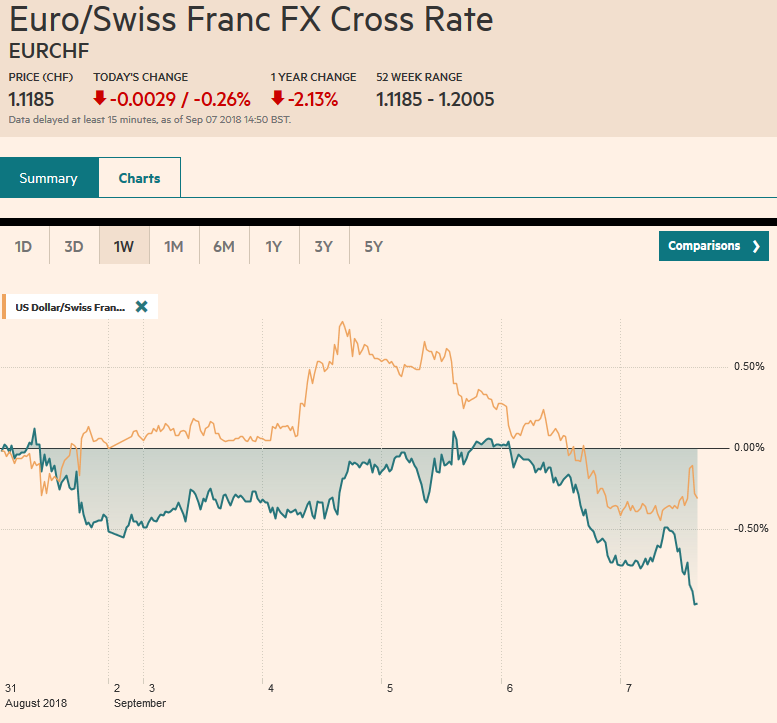

Swiss Franc The Euro has fallen by 0.26% at 1.1185 EUR/CHF and USD/CHF, September 7(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro’s resilience strikes us as a potentially important reflection of market psychology. Last week’s high was set near .1735, and the high for August was a little higher at nearly .1745. The euro has not been above .1750 since the middle of July. The euro’s downside appears to be protected by options, with almost 790 mln euro struck at .16 set to expire today. Today and the first two sessions of next week see large options struck at .15 expiring (2.7 bln euros today, 1.9 bln euros Monday, and 1.7 bln euros Tuesday). There are a

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, AUD, EUR, Featured, FX Daily, JPY, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

Swiss FrancThe Euro has fallen by 0.26% at 1.1185 |

EUR/CHF and USD/CHF, September 7(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe euro’s resilience strikes us as a potentially important reflection of market psychology. Last week’s high was set near $1.1735, and the high for August was a little higher at nearly $1.1745. The euro has not been above $1.1750 since the middle of July. The euro’s downside appears to be protected by options, with almost 790 mln euro struck at $1.16 set to expire today. Today and the first two sessions of next week see large options struck at $1.15 expiring (2.7 bln euros today, 1.9 bln euros Monday, and 1.7 bln euros Tuesday). There are a couple of other expiring options that could influence today’s activity. There is a GBP273 mln option struck at $1.2950 and A$894 mln in a $0.7150 option that will roll-off today. |

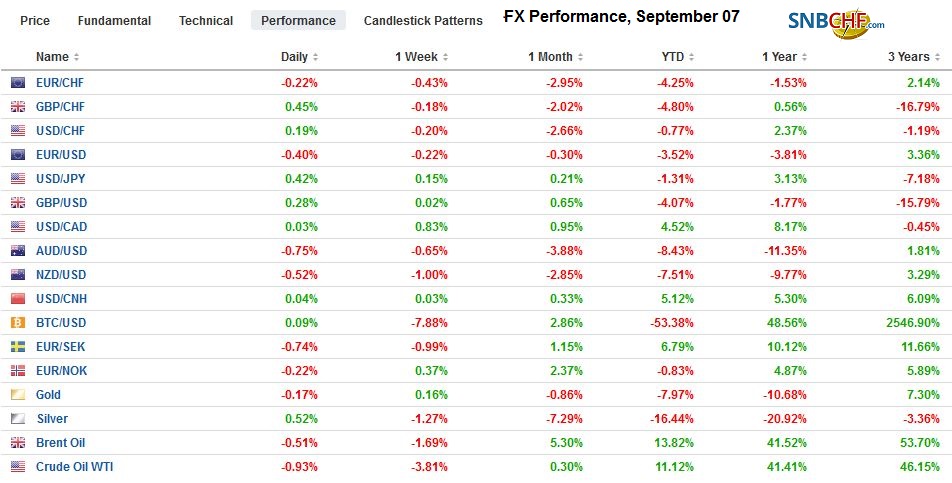

FX Performance, September 07 |

The global capital markets are finishing the week on a more stable note than it began. Indeed, since the middle of the week, many of the besieged emerging market currencies, like the South African rand, Turkish lira, and Argentine peso have posted some corrective upticks. Today, the MSCI Emerging Market Index is snapping a seven-day slide register a modest gain, ahead of the Latam session.

The euro is trading firmly within yesterday’s range when it made recorded the high for the week near $1.1660. Like yesterday, in the face of an unexpected drop in German factory orders, the euro is showing resilience despite more disappointing German data. The real sector data is not nearly as strong as the survey data suggested. German July industrial output was expected to post a small gain and instead fell 1.1%. To put it in perspective, consider that the average monthly change this year is -0.2%. In the same period last year, German industrial output averaged a 0.5% increase per month. Germany also reported a surprising 0.9% drop in exports. Economists expected a 0.3% increase. German exports edged 0.1% lower a month on average this year compared with a 0.8% average in the first seven months of 2017.

Germany’s trade surplus fell to 16.5 bln euros in July, down from 21.8 bln euro in June. It was not simply a case of weakening exports, but imports jumped 2.8%. The broader measure, the current account surplus dropped to 15.3 bln euros from 26.6 bln. Germany’s external surplus is controversial in the EU as well as with the US. The deterioration reported today, however, will do little to assuage critics, who want to see a change in German macroeconomic policy in favor of greater investment and a less restrictive fiscal stance.

To be sure, Germany is not the only source of disappointment in the EMU today. The Dutch reported a 0.9% decline in manufacturing output. It is the second consecutive decline. Spain reported a 0.3% decline in July industrial output. It is also the second consecutive decline and the third fall in the past four months. France provided the unexpected good news. Industrial production and manufacturing output were stronger than forecast (0.7% and 0.5% respectively, when both were expected to rise 0.2%). And, the considerably smaller trade deficit (3.5 bln euros down from a 6.02 bln euro shortfall in June) allow France to record its first current account surplus since February.

When news broke yesterday that President Trump may next turn his attention on bilateral trade with Japan, the initial instinct was to buy the yen. The dollar, which had reached a high near JPY111.40 in Tokyo yesterday, finished the North American session near JPY110.75 and was pushed a little below JPY110.40 in Tokyo earlier today, a two and a half week low. The dollar has recovered to about JPY110.85 by midday in Europe. If the dollar can hold on to these gains through the North American session, it would strengthen the dollar’s technical tone going into next week.

Ironically, the yen weakened despite the unexpected rise in household spending. Economists had forecasts household spending in Japan to have fallen nearly 1% in July year-over-year. Instead, a 0.1% gain was reported, the first increase since January. There is a $988 mln option struck at JPY111.00 that rolls off today. There is another option struck at JPY110.50 for nearly $870 mln that also expires today. On the top side, there are almost $1.8 bln in JPY111.40-JPY111.50 options that will be cut.

China reported a small decline in its reserves for August. The reserves eased to $3.110 bln from $3.118 bln in June. The change is a minor, little more than a rounding error. It would lend credence to other time series that suggest that the PBOC did not intervene in last month. The decline in the dollar value of reserves likely reflected valuation adjustments. Separately, the market is bracing for an announcement as early as today that the next round of US tariffs (on $200 bln of Chinese goods) will be implemented. China has already announced its retaliatory plans with a range of tariffs o $60 bln of US goods.

US jobs growth disappointed in July, and most are looking for a rebound in August. In July the world’s biggest economy created 157k new jobs. The average in H1 was 224k new jobs a month. Through July, the average is 215k compared with 184k for the same period last year. Economists expect almost 200k jobs to have been created in August.

Hourly earnings need to rise 0.2% in August to keep the year-over-year rate steady at 2.7%. The unemployment rate could slip to 3.7% from 3.8%. Hourly earnings were growing closer to 4.0% the last time unemployment was this low. Many observers are worried about consumption because hourly earnings are not keeping up with inflation. While this is important for a host of economic, political, and social reasons, consumption is holding up fine. Consider that if the 1.5 mln new jobs this year paid a median salary $56k a year, that would generate $84 bln in household income annually and about $60 bln after taxes and social security or about 0.5% of US household consumption.

The employment data is important in its own right, generating insight into the US economy, but it is also significant for its policy implications. However, the policy implications of today’s data are practically nil. A surprisingly poor report would be shrugged off, even if not immediately, as some anomaly. There is nothing in other labor market data, such as weekly initial jobless claims (nearly 50-year lows), the ISM surveys (non-manufacturing employment index rose to its highest level since Feb), and the ADP estimate (solid even if below expectations) that points to weakness. Also, at this stage in the business cycle and the proximity of the Fed’s targets, officials are unlikely to be swayed by a single volatile data point.

The market is going into the jobs data with no doubt of a rate hike later this month. According to the CME’s calculations, 99% chance has been discounted. It estimates that the market sees about a 69% chance that there will be a follow-up hike in December. Given the emphasis we place on interest rate differentials and the policy mix, we expect the next significant move in the dollar to be driven by shifting expectations for that year-end meeting. Whatever it is that will shape those expectations, we feel confident they are not to be found in today’s data or more broadly Q3’s economic performance.

It seems that many observers confuse themselves (and others) being too caught up in hawk or dove labels. These are not ontological categories. They are always contextual and relative. Chicago Fed President Evans seems to have confused those who see him as some sort of perma-dove. However, as the Fed’s targets come into view, Evans appears considerably more willing to support additional rate hikes. Some thought Williams, the new New York Fed chief, sounded dovish when he admitted to still being puzzled by the relatively modest wage pressures. Yet, unlike some other Fed presidents, Williams did not seem to be particularly bothered by the risk of an inverted (2-10 yr) yield curve.

Canada also reports August jobs data today. The Bank of Canada has done nothing to dissuade the market that it will hike rates in next month. The employment report is unlikely to succeed in impacting expectations, which according to Bloomberg’s model is nearly 87% discounted. The optics of the July report were better than the details and August could be the opposite. The 54.1k jobs Canada created last month were all part-time positions. Full-time jobs fell by 28k. This time, a small headline increase may mask that loss of part-time positions and the increase in full-time jobs.

Hourly wage growth for full-time positions has slowed to 3% in July, the low for the year. The unemployment rate may tick-up, but if it reflects an increase in the participation rate, it will be easier for investors to shrug it off.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$AUD,$CNY,$EUR,$JPY,Featured,FX Daily,newsletter