See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Waiting for Permanent Backwardation The price of gold dropped 9 bucks, while that of silver rose 3 cents. Readers often ask us if permanent backwardation (when gold withdraws its bid on the dollar) is still coming. We say it is certain (unless we can avert it by offering interest on gold at large scale). They ask is it imminent, and we think this is with a mixture of fear and longing for a higher gold price. We say well yeah that will bring a much higher gold price (perhaps it will hit some of the gold bug predictions, or perhaps it will go off the board before getting that high) but be careful what you wish for. And

Topics:

Keith Weiner considers the following as important: 6a) Gold & Bitcoin, Chart Update, dollar price, Featured, gold basis, Gold co-basis, newslettersent, Precious Metals, silver basis, Silver co-basis

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

Waiting for Permanent BackwardationThe price of gold dropped 9 bucks, while that of silver rose 3 cents. Readers often ask us if permanent backwardation (when gold withdraws its bid on the dollar) is still coming. We say it is certain (unless we can avert it by offering interest on gold at large scale). They ask is it imminent, and we think this is with a mixture of fear and longing for a higher gold price. We say well yeah that will bring a much higher gold price (perhaps it will hit some of the gold bug predictions, or perhaps it will go off the board before getting that high) but be careful what you wish for. And it’s not imminent. We will have a graph below that gives it some perspective. In the meantime, we all watch the price of gold and maybe trade it when there’s a clear opportunity. Speaking of which, we will show the only true picture of the fundamentals of supply and demand in gold. |

|

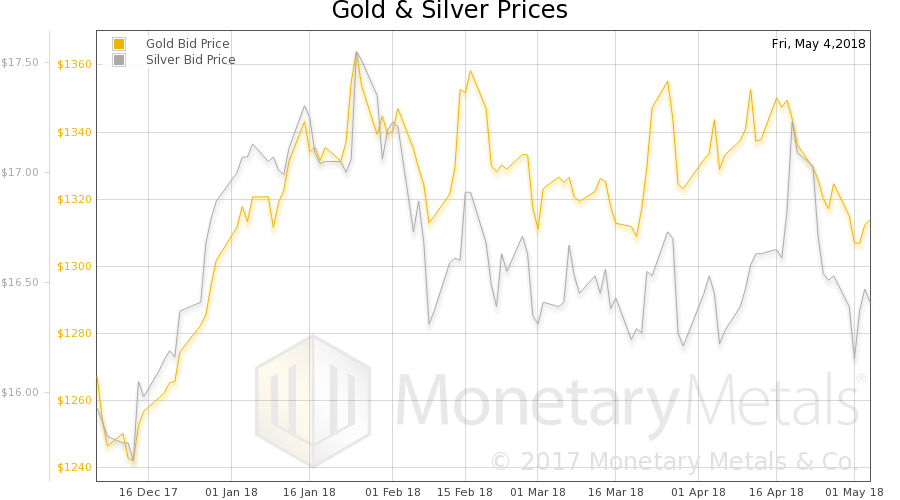

Fundamental DevelopmentsFirst, here is the chart of the prices of gold and silver. |

Gold and Silver Prices(see more posts on Gold prices, silver prices, ) |

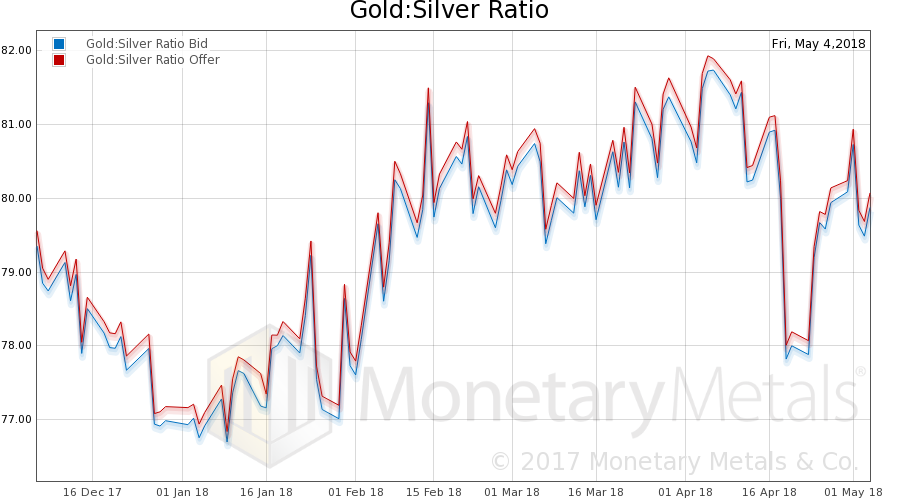

| Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It fell this week. |

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

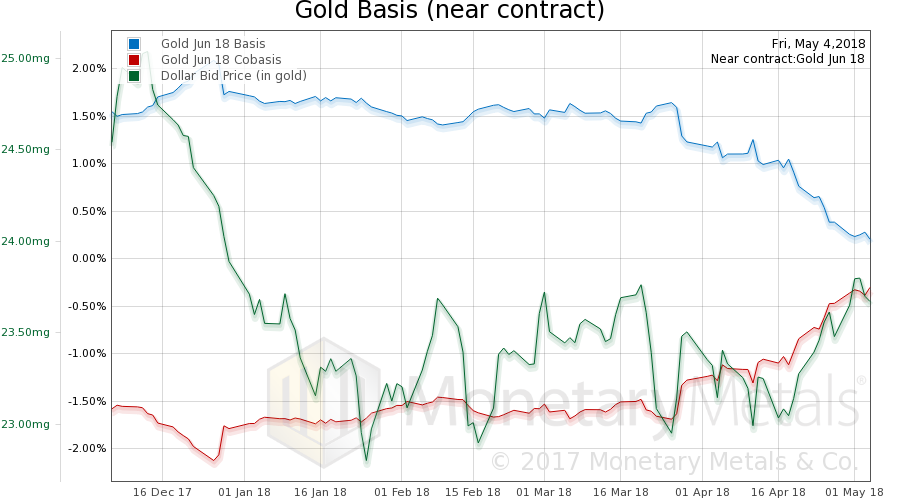

| Here is the gold graph showing gold basis, co-basis and the price of the dollar in terms of gold price.

The price of gold fell slightly (which means the dollar rose, as measured in gold). And with the price drop comes an increase in scarcity (i.e. the co-basis, the red line). Alas, this is just the near contract which is already under selling pressure as it expires in a few weeks. Farther contracts do not show an increase in scarcity, but a slight decrease (not a sign of imminent backwardation). |

Gold Basis and Co-basis and the Dollar price(see more posts on dollar price, gold basis, Gold co-basis, ) |

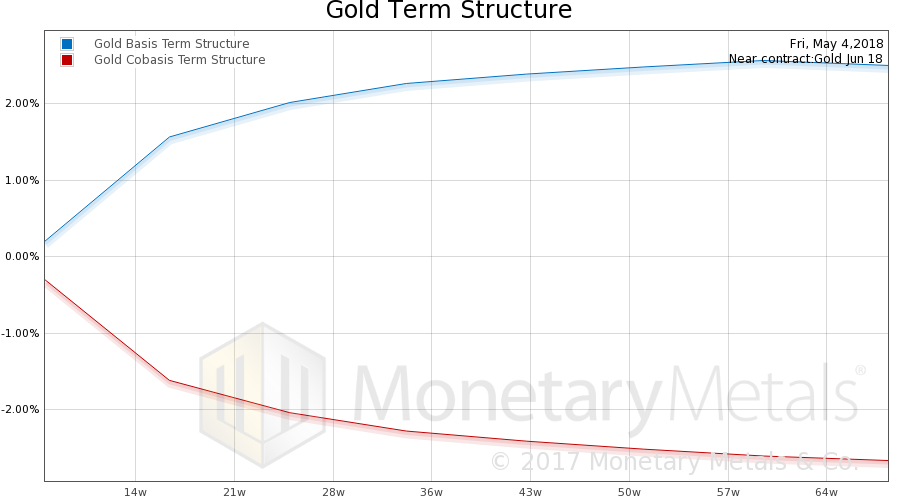

| Here is a graph of the gold term structure. Note no backwardation, and each farther contract has a higher basis (which is normal). |

Gold Basis and Co-basis(see more posts on gold basis, Gold co-basis, ) |

| The Monetary Metals Gold Fundamental Price fell $41 this week to $1,497. Now let’s look at silver.

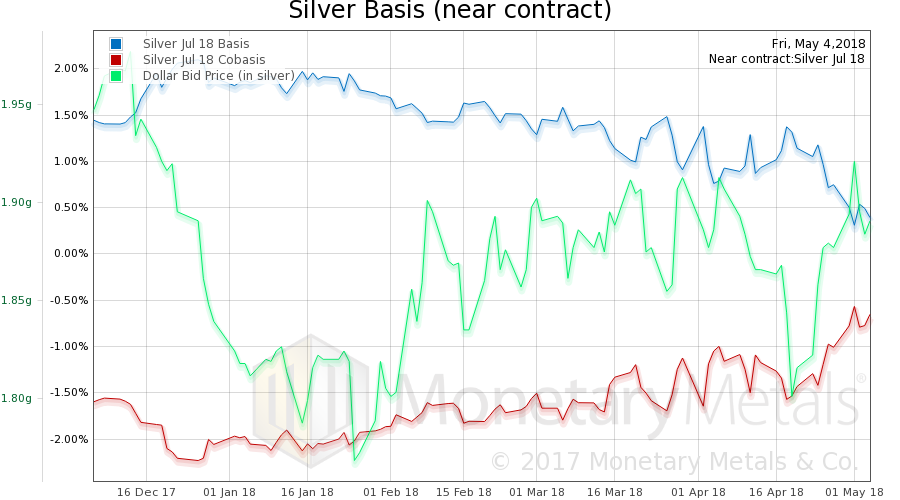

In silver, not only did the price rise (a few pennies) but scarcity increased in the near and farther contracts. So it should not be a surprise that the Monetary Metals Silver Fundamental Price rose 20 cents to $17.69. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

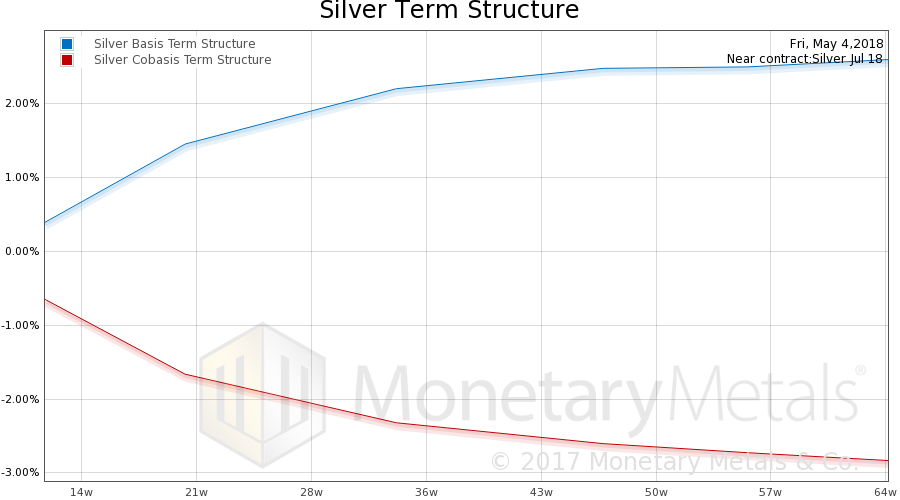

| Here is a graph of the silver term structure. |

Silver Basis and Co-basis(see more posts on silver basis, Silver co-basis, ) |

Charts by: Monetary Metals

Chart and image captions by PT

Tags: Chart Update,dollar price,Featured,gold basis,Gold co-basis,newslettersent,Precious Metals,silver basis,Silver co-basis