There is sometimes a tendency to confuse ends and means. For example, in traveling through an airport there is extensive inspection of passengers. Before you are allowed to board an airplane, you must go through a process that is intrusive and increasingly invasive. This is deemed to be security. How do we know it makes us secure? Because it is annoying. See the switcheroo? The degree of disruption of your schedule and possessions bears only a faint relationship to...

Read More »Gold and Silver Markets Start to Normalize, Report 4 May

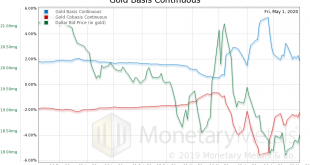

The price of gold dropped $29 and the price of silver dropped $0.27. We’ll get back to where we think the prices are likely to go in a bit. In recent Reports, we’ve looked at the elevated bid-ask spread in gold (though not nearly as elevated as some goldbugs would have you believe) and the elevated gold basis. As an aside, we continue to see articles that get the high gold basis exactly backwards, the way John Maynard Keynes got commodity markets backwards. A high...

Read More »Widening Bid-Ask Spreads, Gold and Silver Market Report 17 February

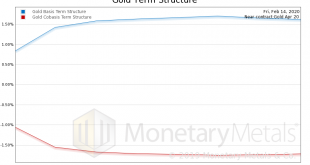

The price of gold rose $14 and the price of silver fell $0.07. The gold-silver ratio rose further with this price action. Welcome to our new Gold and Silver Market Report, or “Market Report” for short. We are separating this from the economics essay, which was attached for many years. As they used to say in many toy commercials of yore, “batteries sold separately”—or in this case essays. The new Market Report is going to depart from the familiar old format of four...

Read More »The End of an Epoch, Report 8 Dec

“There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.” What the heck did John Maynard Keynes mean by saying this? Overturning the existing basis of society?! Let’s begin by stating something that is both obvious and unpopular. We are living in days...

Read More »What’s the Price of Gold in the Gold Standard, Report 10 Nov

Let’s revisit a point that came up in passing, in the Silver Doctors’ interview of Keith. At around 35:45, he begins a question about weights and measures, and references the Coinage Act of 1792. This raises an interesting set of issues, and we have encountered much confusion (including from one PhD economist whose dissertation committee was headed by Milton Friedman himself). Gold, Paper, and Redeemability Back in the 18th century, three facts were obvious and not...

Read More »Targeting nGDP Targeting, Report 3 Nov

Not too long ago, we wrote about the so called Modern Monetary so called Theory (MMT). It is not modern, and it is not a theory. We called it a cargo cult. You’d think that everyone would know that donning fake headphones made of coconut shells, and waving tiki torches will not summon airplanes loaded with cargo. At least the people who believe in this have the excuse of being illiterate. You’d think that everyone would know that printing fake money and waving bogus...

Read More »Wealth Accumulation Is Becoming Impossible, Report 20 Oct

We talk a lot about the falling interest rate, the too-low interest rate, the near-zero interest rate, the zero interest rate, and the negative interest rate. Hat Tip to Switzerland, where Credit Suisse is now going to pay depositors -0.85%. That is, if you lend your francs to this bank, they take some of them every year. Almost 1% of them. A bank deposit comes with a risk. But instead of compensating you for the risk, the bank pays you nothing. So it’s a return-free...

Read More »Motte and Bailey Fallacy, Report 13 Oct

This week, we will delve into something really abstract. Not like monetary economics, which is so simple even a caveman can do it. A Clever Ruse We refer to a clever rhetorical trick. It’s when someone makes a broad and important assertion, in very general terms. But when challenged, the assertion is switched for one that is entirely uncontroversial but also narrow and unimportant. The trick is intended to foreclose debate of the broad assertion, not really to...

Read More »A Wealth Tax Consumes Capital, Report 6 Oct

It seems one cannot make a name for one’s self on the Left, unless one has a proposal to tax wealth. Academics like Tomas Piketty have proposed it. And now the Democratic candidates for president in the US propose it too, while Jeremy Corbyn proposes it in the UK. Venezuela finally added a wealth tax in July. A Wealth Tax So how does a wealth tax work? The politicians quibble among themselves, as if the little implementation details that differ between them are...

Read More »The Purchasing Power of Capital, Report 29 Sep

We discuss capital consumption all the time, because it is the megatrend of our era. However, capital consumption is an abstract idea. So let’s consider some concrete examples, to help make it clearer. Flipping Homes, Consuming Capital First, let’s look at the case of Timothy Housetrader. Tim has a small two-bedroom house. Next door, his neighbor Ian Idjit, owns a four-bedroom house which is twice the size. For some reason, Ian offers to trade houses with Tim. Both...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org