Printing Until the Cows Come Home… It started out with Jay Powell planting a happy little money tree in 2019 to keep the repo market from suffering a terminal seizure. This essentially led to a restoration of the status quo ante “QT” (the mythical beast known as “quantitative tightening” that was briefly glimpsed in 2018/19). Thus the roach motel theory of QE was confirmed: once a central bank resorts to QE, a return to “standard monetary policy” becomes...

Read More »Gold Stocks – A Show of Strength

Gold Sector Outperforms Broad Market The gold sector is in an uptrend since September 2018. The initially rather labored move accelerated after a secondary low was established in May 2019 and the 50-day and 200-day moving averages were breached for the second time. Last week the two moving averages were once again overcome in the course of the post-crash rebound. Here is a chart showing the entire move since 2018: HUI mid-2018-2020After a rather harrowing decline...

Read More »Wealth Consumption vs. Growth – Precious Metals Supply and Demand

GDP – A Poor Measure of “Growth” Last week the prices of the metals rose $35 and $0.82. But, then, the price of a basket of the 500 biggest stocks rose 62. The price of a barrel of oil rose $1.63. Even the euro went up a smidgen. One thing that did not go up was bitcoin. Another was the much-hated asset in the longest bull market. We refer to the US Treasury. The spread between Treasury bonds and junk bonds narrowed this week. It is now close to its post-crisis low....

Read More »The Strongest Seasonal Advance in Precious Metals Begins Now

Plans and Consequences You are probably already getting into the holiday spirit, perhaps you are even under a little stress. But the turn of the year will soon be here – an occasion to review the past year and make plans for the new one. Many people are doing just that – and their behavior is creating the strongest seasonal rally in the precious metals markets. Anonymous industrial stackers showing off their freshly purchased silver hoard. PT Silver is seasonally...

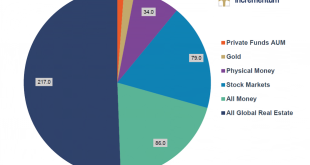

Read More »Incrementum 2019 Gold Chart Book

The Most Comprehensive Collection of Gold Charts Our friends at Incrementum have just published their newest Gold Chart Book, a complement to the annual “In Gold We Trust” report. A download link to the chart book is provided below. The Incrementum Gold Chart Book is easily the most comprehensive collection of charts related to or relevant to gold available anywhere. It contains everything from a wealth of economic to monetary data, to charts detailing sources of...

Read More »A Surprise Move in Gold

Traders and Analysts Caught Wrong-Footed Over the past week gold and gold stocks have been on a tear. It is probably fair to say that most market participants were surprised by this development. Although sentiment on gold was not extremely bearish and several observers expected a bounce, to our knowledge no-one expected this: Back in April the so-called “managed money” category in the disaggregated commitments of...

Read More »In Gold We Trust 2019

The New Annual Gold Report from Incrementum is Here We are happy to report that the new In Gold We Trust Report for 2019 has been released today (the download link can be found at the end of this post). Ronnie Stoeferle and Mark Valek of Incrementum and numerous guest authors once again bring you what has become the reference work for anyone interested in the gold market. Gold in the Age of Eroding Trust This year’s...

Read More »In Gold We Trust 2019 – The Preview Chart Book

The new IGWT report for 2019 will be published at the end of May… …and for the first time a Mandarin version will be released as well. In the meantime, our friends at Incrementum have decided to release a comprehensive chart book in advance of the report. The chart book contains updates of the most important charts from the 2018 IGWT report, as well as a preview of charts that will appear in the 2019 report. A brief...

Read More »Monetary U-Turn: When Will the Fed Start Easing Again? Incrementum Advisory Board Meeting Q1 2019

Special Guest Trey Reik and Board Member Jim Rickards Discuss Fed Policy On occasion of its Q1 meeting in late January, the Incrementum Advisory Board was joined by special guest Trey Reik, the lead portfolio manager of the Sprott Institutional Gold & Precious Metal Strategy at Sprott USA since 2015 [ed note: as always, a PDF of the complete transcript can be downloaded further below]. Trey Reik of Sprott USA. -...

Read More »The Gold Debate – Where Do Things Stand in the Gold Market?

A Recurring Pattern When the gold price recently spiked up to approach the resistance area even Aunt Hilda, Freddy the town drunk, and his blind dog know about by now, a recurring pattern played out. The move toward resistance fanned excitement among gold bugs (which was conspicuously lacking previously). This proved immediately self-defeating – prices pulled back right away, as they have done almost every time when...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org