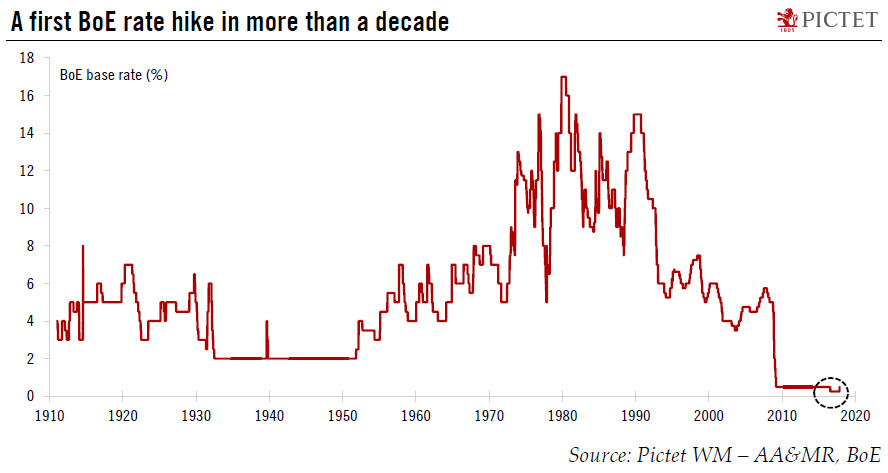

After a much-anticipated 25bp rate hike, further normalisation of policy will be conditional on progress in Brexit talks.The Bank of England (BoE) has raised rates for the first time in over a decade, while it hinted at a “limited and gradual” tightening cycle. Meanwhile, the assessment of the supply-side was downgraded once again amid “considerable risks” to the economic outlook. A 25bp rate hike alone is unlikely to have a material impact on the economy, beyond a small increase in the households’ mortgage interest burden. Ultimately, the outlook for the UK economy remains very much binary, depending on the outcome of Brexit negotiations.We remain of the view that a Brexit transitional deal will be a necessary condition for the BoE to hike rates again (in May 2018 according to our

Topics:

Frederik Ducrozet considers the following as important: Bank of England rate rise, Bank of England tightening, Brexit, Macroview, UK monetary policy

This could be interesting, too:

Claudio Grass writes “Inflation it is not an act of God”

Claudio Grass writes “Inflation it is not an act of God”

Dirk Niepelt writes The Economics of Brexit

Marc Chandler writes High Anxiety: China’s Covid and US Inflation

After a much-anticipated 25bp rate hike, further normalisation of policy will be conditional on progress in Brexit talks.

The Bank of England (BoE) has raised rates for the first time in over a decade, while it hinted at a “limited and gradual” tightening cycle. Meanwhile, the assessment of the supply-side was downgraded once again amid “considerable risks” to the economic outlook. A 25bp rate hike alone is unlikely to have a material impact on the economy, beyond a small increase in the households’ mortgage interest burden. Ultimately, the outlook for the UK economy remains very much binary, depending on the outcome of Brexit negotiations.

We remain of the view that a Brexit transitional deal will be a necessary condition for the BoE to hike rates again (in May 2018 according to our baseline scenario), although it may not be a sufficient one. In particular, wage growth needs to pick up to at least partially compensate for the loss in households’ disposable income.

Conditional on a Brexit transitional deal, we forecast the BoE will hike rates again in May 2018, but proceed very cautiously thereafter. Indeed, we remain sceptical that the BOE will be in a position to hike rates more than once in 2018. Only in the event of a soft Brexit maintaining the UK’s access to EU markets would the BoE be in a position to tighten further, up to a terminal rate which we estimate at around 1.5%.