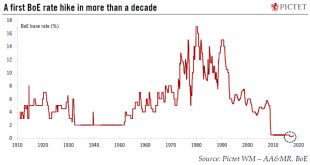

After a much-anticipated 25bp rate hike, further normalisation of policy will be conditional on progress in Brexit talks.The Bank of England (BoE) has raised rates for the first time in over a decade, while it hinted at a “limited and gradual” tightening cycle. Meanwhile, the assessment of the supply-side was downgraded once again amid “considerable risks” to the economic outlook. A 25bp rate hike alone is unlikely to have a material impact on the economy, beyond a small increase in the...

Read More »Hard times for sterling

With the UK set to start talks on leaving the EU, and with the country’s ability to attract funding to cover its current-account deficit uncertain, downward pressure on sterling is likely to continue. Sterling declined by roughly 6% against the US dollar within a few minutes on currency markets on 7 October. Whatever the reasons for the sudden plunge, and although there was a rapid (but partial) recovery in sterling’s value, it is quite worrying to see a major currency moving so much...

Read More »Bank of England on hold, sterling stable for now

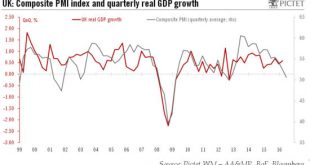

While recent data has been encouraging, we still expect the UK economy to weaken in 2017. Short-term support for sterling may be undermined by Brexit talks and twin deficits. At its 15 September meeting, the Bank of England (BoE) left its main policy rate unchanged at 0.25% and maintained its Asset Purchase Facility (APF) target at GBP435 bn. The BoE’s assessment of economic conditions was broadly similar to its August projections despite some “slight upside” in the data. Nevertheless, the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org