Published: Thursday November 02 2017Olivier Capt says that technology will transform the wealth management industry, leading to higher client engagement, better advice and superior service.Winston Churchill once said: ‘Out of intense complexities, intense simplicities emerge.’ This is exactly what technology is driving today. Intense simplification is at work in all industries and customers now purchase, book, compare and select without relying on intermediaries.Humans are known to be lazy by nature, so why would they prefer executing an action themselves rather than merely asking someone for help, even when cost is not an issue? Because, technology simplifies the undertaking of a complex task, removing the desire to ask someone else to carry it out. Adios complexity, hello

Topics:

Perspectives Pictet considers the following as important: Digital transformation, Financial Time supplement, In Conversation With, Operational Governance, Pictet FT supplement

This could be interesting, too:

Perspectives Pictet writes House View, October 2020

Perspectives Pictet writes Weekly View – Reality check

Perspectives Pictet writes Exceptional Swiss hospitality and haute cuisine

Jessica Martin writes On the ground in over 80 countries – neutral, impartial and independent

Olivier Capt says that technology will transform the wealth management industry, leading to higher client engagement, better advice and superior service.

Winston Churchill once said: ‘Out of intense complexities, intense simplicities emerge.’ This is exactly what technology is driving today. Intense simplification is at work in all industries and customers now purchase, book, compare and select without relying on intermediaries.

Humans are known to be lazy by nature, so why would they prefer executing an action themselves rather than merely asking someone for help, even when cost is not an issue? Because, technology simplifies the undertaking of a complex task, removing the desire to ask someone else to carry it out. Adios complexity, hello simplicity.

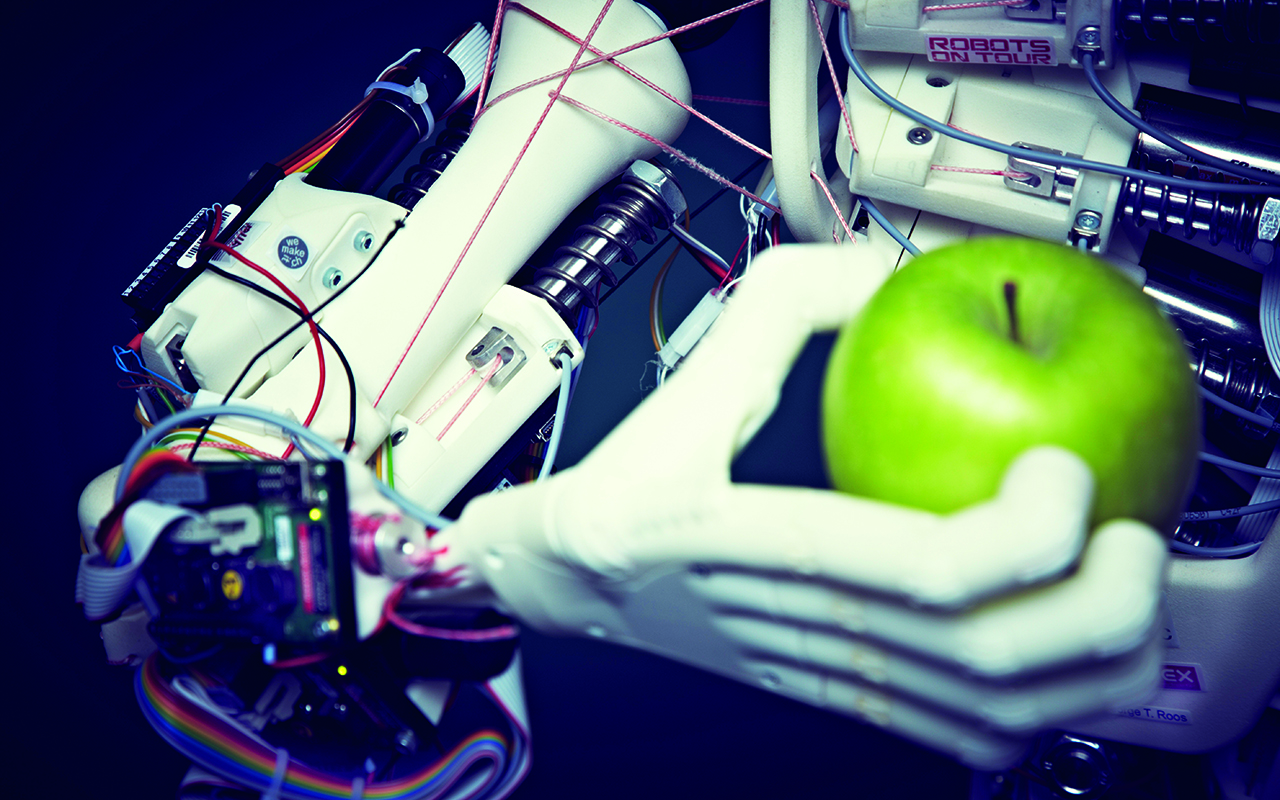

This force is also at work in the wealth management industry. To no surprise, the role of the private banker has thrived on complexity. Translating financial objectives into efficient investment strategies while providing portfolio understanding to clients, amongst other things, required very broad skillsets and efficient market access. Today, portfolio simulation tools, investment knowledge, reporting and market access are widely available online, sometimes at low or zero cost. Does this mean we have reached simplicity? Will private bankers disappear? Adios bankers, hello robots?

For a fringe of the population, robo-investing is most likely to suffice. But for wealthy individuals and families it is an entirely different story. Technology will in fact reinforce the client-banker relationship, empowering wealth managers to deliver a better service and achieve higher returns for their clients. And yes, for those who ask, the search for higher returns is definitely on the agenda as expected returns for all asset classes have decreased dramatically in historical comparisons.

The 2008 subprime crisis triggered a decade of regulatory transformation never seen before in the financial industry, increasing complexity and costs dramatically. The decade ahead of us will be marked by digital transformation, reducing complexity and costs, and we should look forward to it. This transformation will take place along three dimensions.

Private banks will redesign key processes to implement lean processes crafted around customer journeys. These journeys will seamlessly integrate products, operations, risk and compliance to create efficiency and robustness, thereby reducing operational risks. This will also eliminate low value-added tasks that clients will be able to handle themselves, as a result of sleek digital user interfaces.

As a collateral effect, lean processes will enable bankers to spend more time on high value-added services. For advisory clients, for example, this will take the form of better and more informed discussions around the many asset classes and investment products the bank has to offer.

To achieve better and more informed discussions, we will see the emergence of redefined client relationships.

Bank statements belong to the past. Clients can now access their portfolios, positions, transactions and documents in real time and can have timely portfolio-centred investment expertise delivered to their smartphones, tablets and desktops; a smart combination of push and pull technologies.

It may seem obvious to state that clients should receive up-to-the-minute precise information relating to their holdings or investment interests, but done right it will have a big impact. It is one thing to receive an analysis on a specific stock or sector, but it is something else to extract the knowledge from that piece of research and put it in the context of an investment strategy.

Full research access and compliance with market abuse rules will ensure that bankers and advisory clients have access to the same level of information for the entire investment universe – equities, bonds, funds, foreign exchange and alternative asset classes. In this context, technology will enable empowered bankers to make each piece of advice more relevant for their clients.

Every single piece of information will be looked at in the context of the client’s investment objectives. Every proposal, opportunity or client request will be weighed against the backdrop of the global investment house views. Any required additional analysis will be channelled to asset-class experts. Finally, technology will handle the complexity behind the delivery mechanisms, making sure that the information is compliant with local regulations and in line with client suitability.

Although most of the examples in this article relate to advisory clients, discretionary clients will benefit from the same advances. Tomorrow’s clients will benefit from higher transparency, greater autonomy and unbiased access to world-class investment knowledge. Their sophistication will increase as a result, giving way to rich discussions with their bankers.

Ultimately, clients will be able to place more emphasis on their wealth as a whole, better aligning their global ambitions and future aspirations.

Tomorrow’s bankers will spend less time on administration work and more time on client-facing activities, leading to higher client engagement, better advice and superior service. Private bankers will be able to focus more on the moments that matter most for clients, providing the right service at the right time – which will result in higher client satisfaction.

At the industry level, the gap in the quality of service between banks implementing new technologies wisely and those focusing on maintaining their IT infrastructure will widen and ultimately determine their future. Will private bankers disappear in the process? Not at all, it seems, after all.

Olivier Capt is Head of Innovation & Digital Client Solutions of Pictet Wealth Management. Pictet’s 10-year views on expected returns for each individual asset class can be checked at group.pictet/horizon.