Janet Yellen’s likely successor is cut from the same cloth as Janet Yellen. The Fed will remain prudent when it comes to rate hikes, but its stance on banking deregulation will merit watching.On 2 November, President Trump nominated Jerome (‘Jay’) Powell to succeed Janet Yellen at the helm of the Federal Reserve System, confirming recent press speculation. The next step before the new Fed chairman can enter office next February is Senate confirmation. This looks unlikely to be problematic for Powell.From a monetary policy perspective, Powell is likely to stay true to Yellen’s approach. Powell is centrist-to-dovish, and the Fed is likely to remain prudent in its rate-hiking cycle as a result. In other words, rate hikes will most probably remain on the slow track. Powell’s landing the role

Topics:

Thomas Costerg considers the following as important: Fed appointments, Macroview, New Fed chairman, US bank deregulation, US monetary policy, Yellen replacement

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Janet Yellen’s likely successor is cut from the same cloth as Janet Yellen. The Fed will remain prudent when it comes to rate hikes, but its stance on banking deregulation will merit watching.

On 2 November, President Trump nominated Jerome (‘Jay’) Powell to succeed Janet Yellen at the helm of the Federal Reserve System, confirming recent press speculation. The next step before the new Fed chairman can enter office next February is Senate confirmation. This looks unlikely to be problematic for Powell.

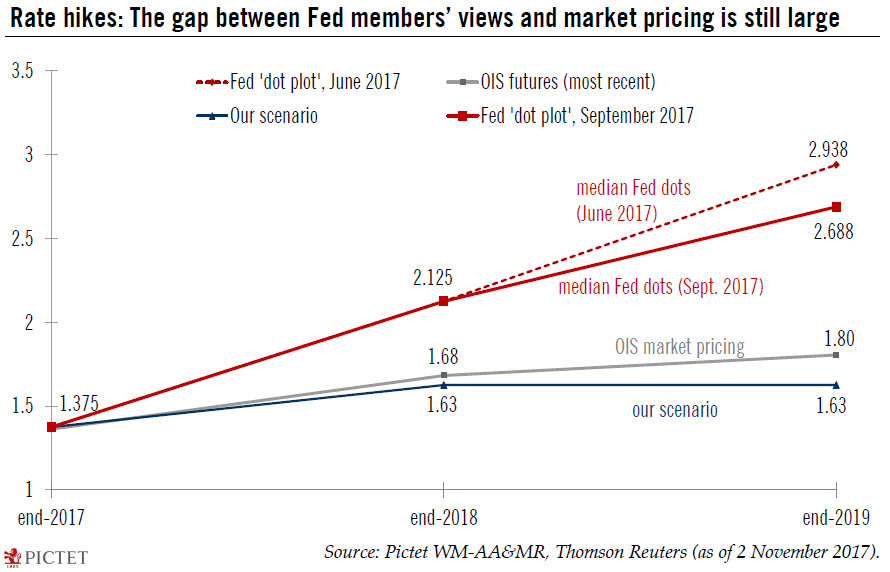

From a monetary policy perspective, Powell is likely to stay true to Yellen’s approach. Powell is centrist-to-dovish, and the Fed is likely to remain prudent in its rate-hiking cycle as a result. In other words, rate hikes will most probably remain on the slow track. Powell’s landing the role therefore leaves unchanged our monetary policy scenario, which foresees two 25bps hikes ahead (one in December, the other in March 2018). We also believe the risk of a June rate hike is rising given stronger-than-expected economic momentum.

Powell has broadly followed the Yellen line since being appointed Fed governor in 2012. The key pillars of the Yellen-Bernanke policy ‘dogma’ are likely to remain in place. Like them, Powell believes in the Philips curve link between a tighter labour market and higher inflation. He also believes that the theoretical neutral rate has shifted down significantly in recent years, which should limit the magnitude of rate hikes in the current cycle.

Many politicians, including probably Trump himself, are less interested in the Fed’s role in setting monetary policy than in its role as banking regulator. In that respect, the spotlight will be on Randal Quarles, the Fed’s newly appointed Vice Chair for Supervision. While Powell has been advocating a more relaxed approach to regulation, but no deregulatory big bang, we think that Quarles, an avid de-regulator, will probably take the lead in the deregulation efforts. It will be interesting to watch how the relationship between the two men evolves.