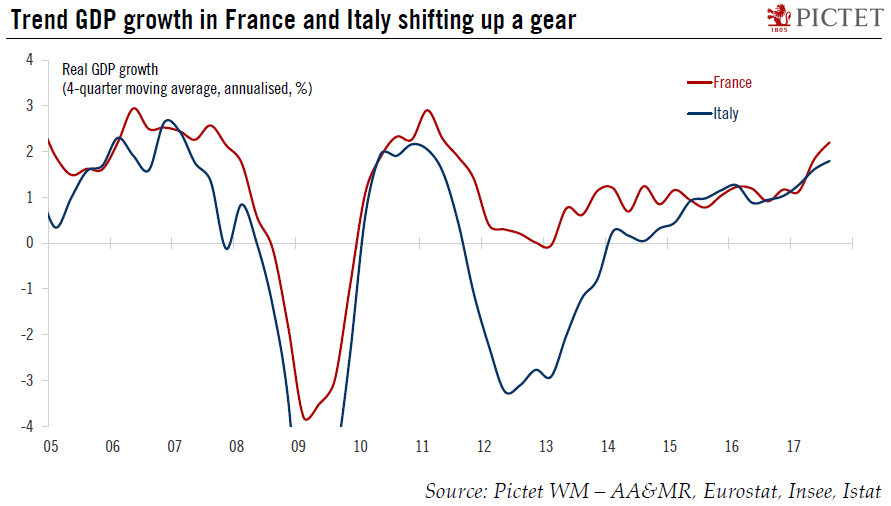

Accelerating growth in France and Italy should make the ECB more confident about its plans for policy normalisation.The current leg of the euro area recovery is about both quantitative and qualitative improvement in the economic outlook.Trend GDP growth in France and Italy has risen to 2.2% and 1.8%, respectively, on an annualised basis. Those countries are catching up with the strongest member states, more than compensating for the moderate growth slowdown we forecast in Germany and Spain.Companies have used this increased visibility about the economic outlook to boost employment and investment spending. We see large positive effects on public finances too. Last but not least, a faster closing of the output gap should eventually translate into stronger wage growth and inflation. No

Topics:

Frederik Ducrozet considers the following as important: euro area growth prospects, euro area recovery, French Italian economic growth, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Accelerating growth in France and Italy should make the ECB more confident about its plans for policy normalisation.

The current leg of the euro area recovery is about both quantitative and qualitative improvement in the economic outlook.

Trend GDP growth in France and Italy has risen to 2.2% and 1.8%, respectively, on an annualised basis. Those countries are catching up with the strongest member states, more than compensating for the moderate growth slowdown we forecast in Germany and Spain.

Companies have used this increased visibility about the economic outlook to boost employment and investment spending. We see large positive effects on public finances too. Last but not least, a faster closing of the output gap should eventually translate into stronger wage growth and inflation. No wonder the ECB is feeling more confident.