In spite of internal divisions, the Fed may go for a third rate cut in October and step in to alleviate pressure in repo market. The Federal Reserve (Fed) cut rates by 0.25% on Wednesday, as widely anticipated. The new fed funds target range is 1.75%-2.00%. The interest rate on banks’ excess reserves was cut by 0.30% to 1.80%. Fed Chairman Jerome Powell again justified this second rate cut since July as “insurance” against risks to the US outlook – mostly the weak...

Read More »Powell plays the ‘insurance’ card again

In spite of internal divisions, the Fed may go for a third rate cut in October and step in to alleviate pressure in repo market.The Federal Reserve (Fed) cut rates by 0.25% on Wednesday, as widely anticipated. The new fed funds target range is 1.75%-2.00%. The interest rate on banks’ excess reserves was cut by 0.30% to 1.80%. Fed Chairman Jerome Powell again justified this second rate cut since July as “insurance” against risks to the US outlook – mostly the weak global growth picture and...

Read More »September Fed meeting preview

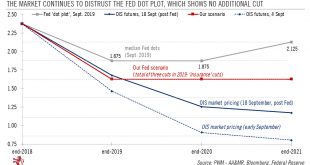

A rate cut is on the cards, but communication will be more difficultThe Federal Reserve (Fed) is very likely to cut rates again on 18 September, a follow-up to its 25-basis point (bp) rate cut at its last meeting in July. The explanation is likely to again be the need to take “insurance” against growing downside risks to the outlook, including from President Trump’s erratic trade policy as well as weaker foreign growth.Fed Chairman Powell is unlikely to pre-commit to a third rate cut at this...

Read More »July FED MEETING PREVIEW

We still see the Fed's expected July rate cut as fundamentally of a “recalibration” nature.We expect the Federal Reserve (Fed) to cut its fed funds target rate range by 0.25%, and leave the door open for another cut later, after its two-day policy meeting ending on 31 July.Chairman Jerome Powell has a lot of explaining to do as to why the Fed is making this rate cut, only six months after the last rate hike: this explaining could condition the path of future interest rate moves.The Fed will...

Read More »Fed update – Driving under the (political) influence

We now see a 25bp cut on 31 July (versus in December in the main scenario prior), followed by another 25bp cut on 18 September.The role of politics including President Trump’s pressure to cut rates (and his call to dismiss Powell) and the anxiety ahead of the G20 summit on 28-29 June – particularly the crucial Trump-Xi meeting – has been even more impactful than we expected (we were wrong!), leading Chairman Powell to signal more firmly an imminent rate cut.This political noise adds to the...

Read More »US employment: keeping an eye on the clock

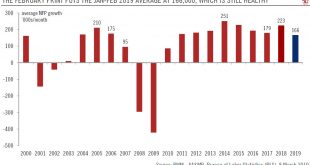

Despite a weaker than expected February employment report, the three-month average remains robust and we would tend to dismiss this weak print as a mere ‘blip’.With only 20,000 job additions, the US employment report for February was weak. However, with the three-month average remaining robust at 186,000, we would tend to dismiss this weak print as a mere ‘blip’. Furthermore, the weak reading is inconsistent with other labour market data and indicators, including recent consumer and business...

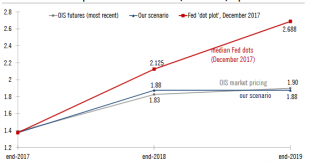

Read More »Fed rate decoupling

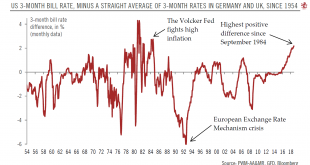

Monetary policy drift to continue.Fed likely to keep tightening while buoyed by a solid domestic backdrop Looking at the Federal Reserve (Fed) from the other side of the Atlantic, the question is really to what extent the Fed can continue to ‘decouple’ its monetary policy from other main global central banks, including those in Europe.The three-month Treasury bill rate in the US is at c.2.2%, while a straight average of the corresponding rate in Germany (c.-0.6%) and the UK (c.0.7%) is...

Read More »Fed not deviating from rate-hiking routine

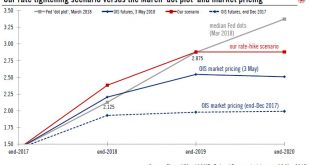

At its latest meeting, the Fed showed it remained cool-headed about inflation risks. It should not deviate from its gradualist approach of one rate hike per quarter.The Federal Reserve meeting of 1-2 May 2018 brought no surprises. As the Fed kept rates unchanged (i.e., the Fed’s interest rate on excess reserves still at 1.75%), as widely expected, the focus was on the post-meeting statement for possible signals on future rate hikes. There was no press conference.The question was how the Fed...

Read More »Academic debates aside, Fed officials’ optimism is rising

With Fed officials becoming more optimistic about the US outlook, there is a risk of additional rate hikes this year. Meanwhile, strategy brainstorming about tweaking inflation targeting continues.A number of Fed officials have given speeches since the beginning of the year, sending mixed messages to markets in the process. Complicating matters, the discussion about the short-term cyclical outlook has become mixed up with an open debate about whether the Fed’s current flexible inflation...

Read More »Fed’s enthusiasm on tax cut plans remains limited

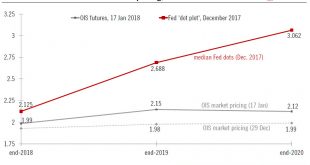

The 13 December Fed decision – and Chair Yellen’s last press conference – was much as expected. The Fed hiked rates 25bps, bringing the interest rate on excess reserves to 1.5%. Meanwhile, Fed officials maintained their rate-hiking forecasts for next year: three rate increases, according to the ‘dot plot’. A salient take -away from the meeting was the Fed’s relative caution about Congress’s tax-cutting plan. Even...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org