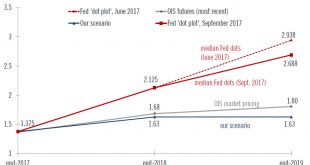

The Federal Reserve is probably looking back at 2017 with satisfaction. After on the rate rise expected on 13 December, it will have pushed through the three rate hikes it signalled earlier in the year. For once, it has not under-delivered. Meanwhile, the gradual, ‘passive’ decline in the Fed’s balance sheet has been mostly ignored by markets. In fact, broader financial conditions have eased this year despite the...

Read More »Fed rate unlikely to move much above 2% next year

The Fed is expected to raise rates again this week. But it continues to wrestle with low core inflation, while the impact of tax cuts will need to be monitored. After the quarter-point rate rise expected on 13 December, the Federal Reserve will have pushed through the three rate hikes it signalled earlier in the year. For once, it has not under-delivered. Meanwhile, the gradual, ‘passive’ decline in the Fed’s balance sheet has been mostly ignored by...

Read More »Federal Reserve – New sheriff in town

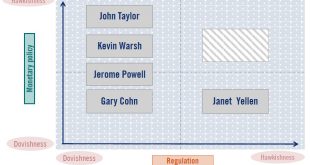

Janet Yellen’s likely successor is cut from the same cloth as Janet Yellen. The Fed will remain prudent when it comes to rate hikes, but its stance on banking deregulation will merit watching.On 2 November, President Trump nominated Jerome (‘Jay’) Powell to succeed Janet Yellen at the helm of the Federal Reserve System, confirming recent press speculation. The next step before the new Fed chairman can enter office next February is Senate confirmation. This looks unlikely to be problematic...

Read More »New Fed Chair—Change or Continuity?

Markets are speculating about the potential hawkishness of the Fed’s next chairperson, but we doubt there will be any ‘regime change’ in monetary policy.The Trump White House has reportedly narrowed the list of candidates for the role of Fed Chair to five people, and a decision could be announced in the coming days.The initial market reaction could be guided by the perceived hawkishness of any nominee compared with Janet Yellen. John Taylor and Kevin Warsh are perhaps the most hawkish of the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org