Precious metals advisor Claudio Grass believes Switzerland can serve as an example to rest of world Switzerland popular for gold storage due to understanding of the risks inherent in fiat money and gold’s value as a store of wealth. International investors opt to store gold in Swiss allocated accounts due to tradition of respecting private property. Country respects the importance of gold ownerships and 70% of world’s gold is refined there Across Europe many voters and politicians are expressing their dislike at the bureaucratic and overarching approach of the European Union. There are also regions and countries pushing to break ties with others that they have long been associated with. Catalonia is just the most

Topics:

Jan Skoyles considers the following as important: Claudio Grass, Daily Market Update, Featured, gold demand, GoldCore, newsletter

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

- Precious metals advisor Claudio Grass believes Switzerland can serve as an example to rest of world

- Switzerland popular for gold storage due to understanding of the risks inherent in fiat money and gold’s value as a store of wealth.

- International investors opt to store gold in Swiss allocated accounts due to tradition of respecting private property.

- Country respects the importance of gold ownerships and 70% of world’s gold is refined there

Across Europe many voters and politicians are expressing their dislike at the bureaucratic and overarching approach of the European Union. There are also regions and countries pushing to break ties with others that they have long been associated with. Catalonia is just the most recent example, many in Scotland are also calling for independence.

It is not an understatement to say that the role and influence of government is currently at the forefront of many citizens’ minds. This is understandable given political upheaval but also thanks to decisions by authorities that are arguably not in the best interests of the electorate. Bail-ins are just one very important example.

This is a situation investors must consider when deciding where they would like to store their gold bullion. It is because of concerns regarding political stability, motive and financial decisions that there is a belief amongst many bullion owners that owning bullion in Switzerland is safer than owning it in many EU countries, the UK and the U.S.

Claudio Grass, an Swiss independent precious metals advisor, recently spoke to the Mises Institute about Switzerland. In the interview he explains why the country is so attractive for investors.

The introduction by the Mises Institute notes that Switzerland is attractive as its political approach differentiates it from other countries. By taking a subsidiary function, the result is major limitations being placed on central political power structures at the federal level.

Switzerland is no libertarian paradise. It has bureaucrats and a wayward central bank. But it remains an astonishing modern example of the principles of federalism and subsidiarity in action. In fact, it exemplifies Lew Rockwell’s daydream: nobody much knows or cares who is president. Its federal administrative state demonstrates humility instead of hubris. And virtually all political decisions, from taxes to welfare to immigration, are decided locally. Claudio Grass joins Jeff Deist to discuss what libertarians can learn from Switzerland, and how neutrality in two disastrous European wars shapes Swiss DNA today.

| Readers can watch the full interview with Claudio Grass. | |

| Investors interested in protecting their wealth and looking for ways to diversify their assets should consider holding allocated gold bullion in Switzerland

In our Essential Guide to Gold Storage in Switzerland we clearly explain why the country remains the preferred destination for many Western and international retail and institutional investors. It takes just three simple steps to create a GoldCore secure storage account in Switzerland. The Swiss people understand the importance of gold in wealth management and preservation and the importance of storing bullion in a secure, independent and stable jurisdiction that specialises in discretion and confidentiality. |

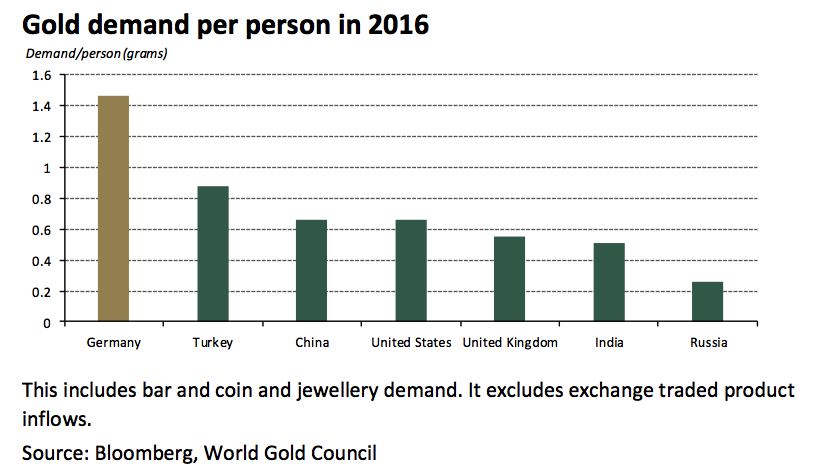

Gold Demand per Person 2016(see more posts on gold demand, ) |

Tags: Claudio Grass,Daily Market Update,Featured,gold demand,newsletter