On 9 February 2017, the Deutsche Bundesbank issued an update on its extremely long-drawn-out gold repatriation program, an update in which it claimed to have transferred 111 tonnes of gold from the Federal Reserve Bank of New York to Germany during 2016, while also transferring an additional 105 tonnes of gold from the Banque de France in Paris to Germany during the same time-period. Following these assumed gold bar movements, the Bundesbank now claims to have achieved its early 2013 goal of repatriating 300 tonnes of gold from New York to Frankfurt, but after 4 years it is still 91 tonnes short of its planned transfer of 374 tonnes of gold from Paris to Frankfurt. In essence, over an entire 4-year period (i.e. 208 weeks), the Bundesbank has only been able to transfer 583 tonnes of gold back from New York and Paris to Germany. And the Bundesbank still claims to have 1236 tonnes of gold remaining in storage with the New York Fed.

Topics:

Ronan Manly considers the following as important: 400 oz bar, Bank of England, banque de France, bar list, Bundesbank, Deutsche Bundesbank, Featured, Frankfurt, frbny, German gold, German gold repatriation, gold bars, London, New York, newslettersent, NY Fed, Paris, Ronan Manly (Bullionstar), Uncategorized, weight list

This could be interesting, too:

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Ryan McMaken writes A Free-Market Guide to Trump’s Immigration Crackdown

Wanjiru Njoya writes Post-Election Prospects for Ending DEI

Swiss Customs writes Octobre 2024 : la chimie-pharma détermine le record à l’export

On 9 February 2017, the Deutsche Bundesbank issued an update on its extremely long-drawn-out gold repatriation program, an update in which it claimed to have transferred 111 tonnes of gold from the Federal Reserve Bank of New York to Germany during 2016, while also transferring an additional 105 tonnes of gold from the Banque de France in Paris to Germany during the same time-period.

Following these assumed gold bar movements, the Bundesbank now claims to have achieved its early 2013 goal of repatriating 300 tonnes of gold from New York to Frankfurt, but after 4 years it is still 91 tonnes short of its planned transfer of 374 tonnes of gold from Paris to Frankfurt. In essence, over an entire 4-year period (i.e. 208 weeks), the Bundesbank has only been able to transfer 583 tonnes of gold back from New York and Paris to Germany. And the Bundesbank still claims to have 1236 tonnes of gold remaining in storage with the New York Fed.

Predictably, instead of prompting the mainstream financial media into asking why these supposed gold bar movements have taken so long, the Bundesbank press release threw the mainstream media into a frenzy of immediately back-slapping the Bundesbank while regurgitating its press release with articles such as “Germany brings its gold stash home sooner than planned” from Reuters , “Germany Gets Its Gold Back Faster With Job Seen Done in 2017” from Bloomberg, and “Germans Sent Gold Away to Keep It From the Soviets. Now Much of It Is Back” from the New York Times.

Furthermore, if the mainstream financial media had bothered looking at Federal Reserve “Table 3.13 – Selected Foreign Official Assets Held at Federal Reserve Banks” under ‘Earmarked Gold’ (line item 4), they would have seen that the foreign custody gold figure that the Fed reports has not changed since September 2016, and that the Fed’s foreign custody gold figure had dropped by 113 tonnes between March 2016 and September 2016, meaning that the Bundesbank’s 111 tonne gold transfer from the US to Germany had been completed by September 2016, i.e. at least 4 months before the Bundesbank reported it.

100 tonnes of gold per day Air-Lifted

All gold withdrawals from the Fed’s “earmarked gold” reporting category in 2016 occurred between March and September 2016, with activity each month throughout that period except in May. As to why there were gold withdrawals from the Fed of 113.45 tonnes when the Bundesbank only reported transferring back 111 tonnes is not clear. Was an additional amount withdrawn from the Fed vault by another foreign central bank or did the Bundesbank conduct further melting down of its US Assay office gold bars and lose 2+ tonnes (1.7%) of fine ounce content that was overstated in its Federal Reserve holdings? Or perhaps this amount was lost when weighing old US Assay Office ‘melts’ (batches of 18-22 bars) which had never been properly weighed before.

Whatever the case, we will never know because the Fed does not divulge the identities of its central bank gold custody customers, nor does the Bundesbank divulge simple details such as gold bar serial numbers on its so-called gold bar list (more of which below).

Simple common sense would have alerted the mainstream media robots to the fact that it is not normal for international gold movements to take 4 years to complete, and that there is something absolutely not right with Germany’s foreign held gold taking so long to transport from New York and Paris. Paris is just a 1 hour flight from Frankfurt and 6 hours by road, and New York is less than 9 hours flying time to Frankfurt.

Other simple questions which the mainstream financial media have failed to ask or have failed to think of include why does the Bundesbank need to keep any gold at all stored at the Federal Reserve in New York, let alone 1236 tonnes, when the New York Fed vault is not even an international gold trading center. And is this gold left in New York is under any liens, claims, encumbrances, loans or swaps?

In contrast to the Bundesbank’s laughable repatriation program duration, take for example, the Banco Central do Venezuela, which was able to transfer 160 tonnes of gold from Europe to Venezuela’s capital, Caracas, over a 2 month period from 25 November 2011 to 30 January 2012. See “Venezuela’s Gold Reserves – Part 2: From Repatriation to Reactivation” for details.

That’s 80 tonnes per month, which would equate to a 4 month transfer window for 300 tonnes of the Bundesbank’s gold stored in New York, not 4 years. Furthermore, why is the mainstream media not asking the Bundesbank why it takes more than 4 years to transfer 374 tonnes of gold from Paris to Frankfurt?

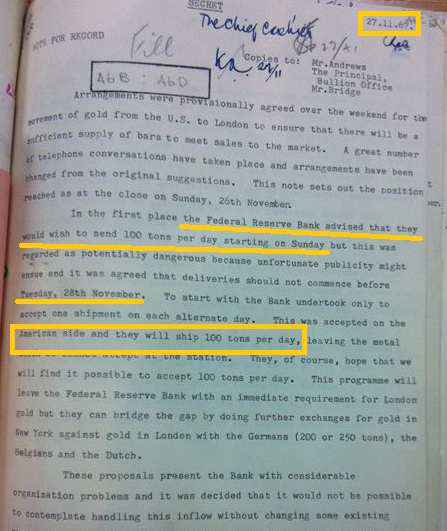

More damning to the contemporary Bundesbank, the same Americans (Federal Reserve) were able to fly over 800 tonnes of gold from the US to England exactly 50 year ago, in November and December 1967, to prop up their share of the London Gold Pool gold holdings at the Bank of England. This gold was flown into RAF Mildenhall in Suffolk over 9 days in batches of around 100 tonnes each day using US air force cargo carriers, and then this gold was ferried by police escorted convoys down to the City of London.

The first 4 of these US air force flights were on Tuesday 28 November 1967, Wednesday 29 November, Friday 1 December, and Sunday 3 December, with the Americans flying in 100 tonnes of gold each day to RAF Mildenhall over those 4 days. That’s 400 tonnes of gold flown from the US to Europe in just 6 days. See screenshot below.

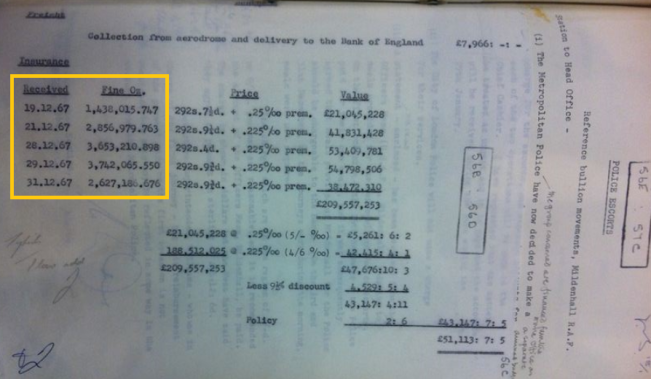

These 4 flights in late November and early December 1967 were followed by 5 more flights on Tuesday 19 December, Thursday 21 December, Thursday 28 December , Friday 29 December, and Sunday 31 December 1967. These 5 flights transported another 445 tonnes of gold bars (14,317,458 fine ounces) from the US to the Bank of England vaults (see screenshot below). That’s another 445 tonnes of gold moved from the US to London in just 13 days.

Overall, the November and December 1967 gold airlifts transported nearly 850 tonnes of gold from the US to Europe in just 1 month.

There were also further massive gold airlifts from the US to the Bank of England in the summer of 1968 which ironically the Federal Reserve needed to do so as to pay back physical gold swaps which the Bundesbank had made available to the Americans at the Bank of England during the last days of the London Gold Pool in March 1968.

These rapid and massive physical gold movements over international borders in 1967 and 1968 show how laughable the Bundesbank’s current gold repatriation program actually is, and how servile the mainstream financial media are in not even questioning the timeframe of the Bundesbank’s repatriation operations.

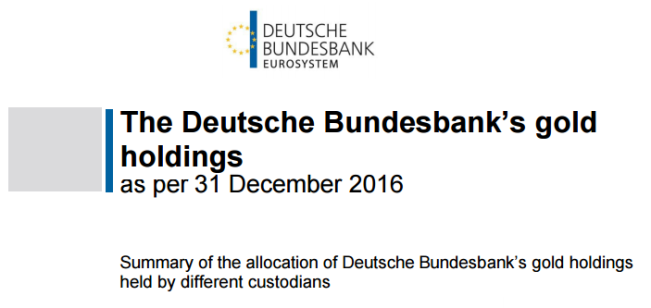

Updated “So-Called” Bar List

Following its press release on 9 February, the Bundesbank then published an updated version of its so-called gold bar list on 23 February, specifying its gold holdings as of 31 December 2016. A so-called gold bar list, because the format of the Bundesbank’s gold bar list does not follow any accepted industry standard format and does not contain basic details such as bar serial number and bar refiner name that are crucial to any normal gold bar weight list. The updated Bundesbank bar list was also released in a very low-key way, and its publication does not seem to have been picked up by any of the mainstream financial media. The updated Bundesbank ‘list’ can be viewed here in a file that the Bundesbank had actually created on 14 February 2017.

To reiterate, a proper gold bar weight list, as per the definition of the London Bullion Market Association (LBMA) in its Good Delivery Rules for Gold and Silver Bars, contains the following details:

- Serial Number of bar

- Bar Refiner Brand

- Gross weight (troy ounces)

- Assay (Fineness)

- Fine Weight (troy ounces)

For example, here is a recent gold bar weight list from the iShares Gold Trust (IAU). For each bar held in the iShares Gold Trust, the weight list lists:

- bar brand (refiner name)

- bar serial number

- shape (400 oz)

- Assay (fineness)

- Gross ounces

- Fine ounces

- Vault (example JP Morgan London)

The Bundesbank claims that all of its gold bars are good delivery bars, so it and its gold custodians (Bank of England, Banque de France and Federal Reserve Bank of New York) have all of this information stored on their respective gold bar accounting systems, including real bar serial numbers and refiner names. They have to store this information since any bars entering or leaving LBMA network gold vaults need to be accompanied by proper weight lists, including serial number and bar refiner brand.

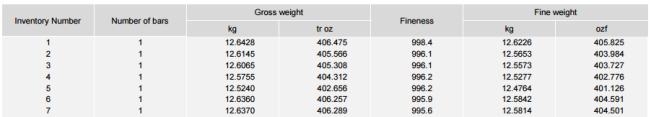

Compare a proper weight list with the sparse and incomplete what the Bundesbank includes in its gold bar list:

- Inventory Number (internal sequence numbers or incomplete bar numbers)

- Gross Weight

- Fineness

- Fine Weight

For Germany’s bars listed as held by the Bundesbank, Bank of England and Banque de France, these inventory numbers are merely “internally assigned inventory numbers”, and ludicrously in the case of the Bank of England and Banque de France gold vaults, they only allow other central banks to publish partial internal inventory numbers (the last three digits).

The secrecy with which the Bank of England, Banque de France and other central banks treat real gold bar serial numbers and other identifiers is most likely due to their paranoia that publication of such serial numbers would undermine their ability to operate with secrecy in the gold lending and gold swap market where bar identities might pop up in the gold holdings of commercial operators such as gold-backed Exchange Traded Funds (ETFs).

Numbers listed against Bundesbank bars held at the Federal Reserve Bank of New York do supposedly show a refiner number, or a melt number, but without the refiner name and year of manufacture of these bars being divulged by the Bundesbank, there is no way to verify and cross-check these bar numbers.

Note that this new Bundesbank gold bar list is the third such list that it has published, and it is in the same format as the previous two versions, both of which are also not real gold bar weight lists since they lack refiner serial numbers and refiner names.

For the purposes of this article, let’s refer to a “Bundesbank bar list” as an “incomplete partial weight list”. The Bundesbank had actually signalled the publication of its updated list at the bottom of its 9 February press release, where it stated:

“On 23 February, the Bundesbank will publish an updated list of its gold bars on its website. This list contains the bar, melt or inventory numbers, the gross and fine weight as well as the fineness of the gold.”

3 Bundesbank gold bar lists

To recap, the Bundesbank had already published 2 incomplete partial weight lists. The first of these was published on 7 October 2015 and showed holdings as of 31 December 2014. The file can be accessed here, or at the bottom of the page here. The Bundesbank actually created this file on 5 October 2015 and saved it with a file name of 2015_10_07_gold.pdf.

The publication of this first bar list was elegantly and deftly dissected and critiqued by Peter Boehringer, of the German campaign “Repatriate our Gold”, in his October 2015 article “Guest Post: 47 years after 1968, Bundesbank STILL fails to deliver a gold bar number list”.

The Bundesbank’s second incomplete partial weight list was created on 4 February 2016 and listed holdings as of 31 December 2015, and was published sometime after 4 February 2016. Confusingly, the incomplete partial weight list as of 31 December 2015 file was uploaded to the same web page and with the same file name as the 31 December 2014 file (i.e. it was uploaded with the filename 2015_10_07_gold.pdf and it over-wrote the first list). This second incomplete partial weight list can be accessed here.

Why no lists prior to December 2014?

Given that the Bundesbank has now demonstrated its ability to generate files itemising its gold holdings, even with limited bar details, the fact that the Bundesbank only began publishing its gold holdings’ lists in October 2015 should immediately raise suspicion as to why it did not publish such bars lists as of the end of 31 December 2012 (prior to the repatriation beginning), and as of 31 December 2013.

A casual observer would deduct that the Bundesbank does not want anyone to see an itemised list of its gold holdings on these dates in 2012 and 2013, and the casual observer would probably be correct in deducing such a conclusion. For its was during 2013 and 2014 that the Bundesbank melted down and recast 55 tonnes of the gold bars that it had held in New York. Five tonnes of its gold was melted down and recast in 2013 and a whopping 50 tonnes was melted down and recast in 2014. Recall that in January 2014, the Bundesbank stated that during 2013:

”We had bars of gold which did not meet the ‘London Good Delivery’ general market standard melted down and recast. We are cooperating with gold smelters in Europe,” Thiele continued. The smelting process is being observed by independent experts. It is set up in such a manner that the Bundesbank’s gold cannot be commingled with foreign gold at any time.’

“Some of the bars in our stocks in New York were produced before the Second World War.” “Our internal audit team was present last year during the on-site removal of gold bars and closely monitored everything. The smelting process is also being monitored by independent experts.”

“The very same gold arrived at the European gold smelters that we had commissioned.” “The gold was removed from the vault in the presence of the internal audit team and transported to Europe. Only once the gold had arrived in Europe was it melted down and brought to the current bar standard.”

And again in January 2015, the Bundesbank revealed that: during 2014 it:

“took advantage of the transfer from New York to have roughly 50 tonnes of gold melted down and recast according to the London Good Delivery standard, today’s internationally recognised standard.”

For more details of these statements, and follow-up questions to the Bundesbank, please see “The Keys to the Gold Vaults at the New York Fed – Part 3: ‘Coin Bars’, ‘Melts’ and the Bundesbank“.

If the Bundesbank had published weight lists as of the end of years 2012 and 2013, then details such as bar gross weight, fineness (gold purity), and bar fine weight would have to have been divulged. By not publishing earlier bars lists, no one outside the Bundesbank – Federal Reserve nexus will ever be aware of the weights and purities of these 55 tonnes of gold bars that were melted down and recast. The Bundesbank obviously has or had the details of these smelted bars, since it commissioned and monitored the smelting process. But as Peter Boeringher stated in his October 2015 article “it appears the bar lists for these transferred bars were lost or destroyed.”

What secrets did these bars hold? One distinct possibility was that they were low-grade coin bars, that had been produced from melted gold coin. In this case they would have been bars of 0.90 or .9167 gold purities or similar. Low grade coin bars began appearing at the NY Fed vault in Manhattan in 1968 and most likely came from the US Treasury’s gold holdings at Fort Knox, Kentucky which consist of about 80% low-grade coin bars. It would not look good for the NY Fed if such low grade bars appeared on a foreign central bank’s gold bar list, and would invariably raise questions as to which US vaults this gold was sourced from.

Perhaps the bars that the Bundesbank melted were Prussian Mint bars from the Nazi era which the Bundesbank would be averse to holding in Germany for political reasons? Or maybe they were problematic US Assay office bars which had a lower fine ounce content than was stated on the actual bar, an issue that dogged another portion of the Bundesbank’s gold stocks in London in 1968. Or perhaps they were gold bars with some other embarrassing provenance which the Bundesbank and Federal Reserve needed to mask the true origin of. Without the Bundesbank ever clarifying this issue, we will never know.

Comparing the 3 Lists

What can we glean from comparing the 3 lists to each other? The only variable on which to compare the lists are gross weight, fineness, and fine weight, and the bar and melt counts per location.

In theory, the lists from December 2014, December 2015 and December 2016 should be identical assuming that the total amount of gold bars has not changed between versions.

If the lists are not identical, then it could suggest a number of things including:

- gold bars that were previously held in Melts have now been individually weighed and itemized on the more recent list. This would most likely be for bars that were transferred to Frankfurt, but could also apply to bars which remained in the other storage locations

- further instances of gold bars remelted / recast while being transferred from New York or Paris to Frankfurt that the Bundesbank has kept quiet about

- gold bars still held in Paris or New York (or London) that have been being recast and upgraded before being moved. This would apply more to Paris going forward

- sales of gold bars to ‘fund’ the German official gold coin program.

- gold lending / swap / repo transactions

Since the lists do state melt number, if there are less any melt numbers listed in more recent lists compared to older lists, then it means that the Bundesbank or its agents have weighed and itemised the individual bars in various melts (groups of 18-24 bars). For example, if the entries for 20 melts had disappeared from a more recent version of a list, then there should be about 400 extra individual bars of the newer list.

Using some quick eyeballing, the file dated 31 December 2014 has 2307 pages including introduction. The file dated 31 December 2015 has 2401 pages including introduction, i.e. the latter file has 94 extra pages. There are approximately 44 pages of melts in the 2014 file listed from page 2263 to the last page 2307. There are approximately 40 pages of melts in the 2015 file listed from page 2361 to the last page 2401. From a rough count, there are about 85 rows per page. This would mean about 340 melts were weighed and converted into itemised rows of single bars during 2015. Not all melts have full sets of bars, but assuming they did, that would be about 20 bars per melt, which would be about 20*340 = 6800 bars which would appear in individual rows in the 2015 list if the melts were “broken out”, which is about 80 pages, and is fairly near explaining the reason for the extra 94 pages in the 2025 file.

If you look at the number of gold bars listed in the press releases (current version and archived version), you will see that there were in total 270,326 bars at the end of 2014 and 270,058 bars at the end of 2015, so there were 258 less bars at the end of 2015.

As of the end of 2015, there were 34,808 bars in London vs 35,066 bars at the end of 2014. i.e. There were 258 bars less in London (about 3 tonnes). So the London drop explains the total drop. This could be gold used for a gold coin program.

This is just some quick eyeballing. The next step is to do an automated comparison of the 3 lists side by side by comparing the variables gross weight, fineness and fine weight so see which bar details may have changed over the 2 year period, and to look at what might have changed. This matching and calculation exercise will probably be undertaken by a gold bar database expert in the near future, so watch this space for further details.

Ronan Manly

E-mail Ronan Manly on:

Tags: 400 oz bar,Bank of England,Banque de France,bar list,Bundesbank,Deutsche Bundesbank,Featured,Frankfurt,frbny,German gold,German gold repatriation,gold bars,London,New York,newslettersent,NY Fed,Paris,Uncategorized,weight list