Der Finanzstabilitätsbericht 2025 der Deutschen Bundesbank zeigt eine Zunahme systemischer Risiken. Geopolitische Spannungen, Handelskonflikte und steigende Staatsverschuldung belasten das makrofinanzielle Umfeld – mit Folgen für Banken, Märkte und die Stabilität der Eurozone.

Read More »“Nicht-Wissen kann schützen (Knowing Less Protects),” FuW, 2018

Finanz und Wirtschaft, November 24, 2018. PDF. Ökonomenstimme, November 26, 2018. HTML. European firms dealing with Iran face U.S. “secondary sanctions.” European counter measures (including a blocking statute) prove toothless. Even central banks in the European Union surrender to U.S. pressure, as does SWIFT. Ignorance is bliss: For a sovereign, the best protection against foreign states pressuring to monitor domestic citizens and businesses may be to know as little as possible.

Read More »“Nicht-Wissen kann schützen (Knowing Less Protects),” FuW, 2018

Finanz und Wirtschaft, November 24, 2018. PDF. Ökonomenstimme, November 26, 2018. HTML. European firms dealing with Iran face U.S. “secondary sanctions.” European counter measures (including a blocking statute) prove toothless. Even central banks in the European Union surrender to U.S. pressure, as does SWIFT. Ignorance is bliss: For a sovereign, the best protection against foreign states pressuring to monitor domestic citizens and businesses may be to know as little as possible.

Read More »New Gold Pool at the BIS Switzerland: A Who’s Who of Central Bankers

This is an extract and summary from “New Gold Pool at the BIS Basle, Switzerland: Part 1” which was first published on the BullionStar.com website in mid-May. Part 2 of the series titled “New Gold Pool at the BIS Basle: Part 2 – Pool vs Gold for Oil” is also posted now on the BullionStar.com website. “In the Governor’s absence I attended the meeting in Zijlstra’s room in the BIS on the afternoon of Monday,...

Read More »New Gold Pool at the BIS Basle, Switzerland: Part 1

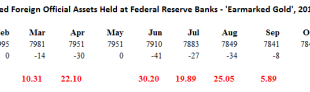

“In the Governor’s absence I attended the meeting in Zijlstra’s room in the BIS on the afternoon of Monday, 10th December to continue discussions about a possible gold pool. Emminger, de la Geniere, de Strycker, Leutwiler, Larre and Pohl were present.” 13 December 1979 – Kit McMahon to Gordon Richardson, Bank of England Introduction A central bank Gold Pool which many people will be familiar with operated in the...

Read More »Sweden’s Gold Reserves: 10,000 gold bars (pet rocks) shrouded in Official Secrecy

In February 2017 while preparing for a presentation in Gothenburg about central bank gold, I emailed Sweden’s central bank, the Riksbank, enquiring whether the Riksbank physically audits Sweden’s gold and whether it would provide me with a gold bar weight list of Sweden’s gold reserves (gold bar holdings). The Swedish official gold reserves are significant and amount to 125.7 tonnes, making the Swedish nation the...

Read More »Germany’s Gold remains a Mystery as Mainstream Media cheer leads

On 9 February 2017, the Deutsche Bundesbank issued an update on its extremely long-drawn-out gold repatriation program, an update in which it claimed to have transferred 111 tonnes of gold from the Federal Reserve Bank of New York to Germany during 2016, while also transferring an additional 105 tonnes of gold from the Banque de France in Paris to Germany during the same time-period. Following these assumed gold bar...

Read More »Who Owns the Public Gold: States or Central Banks?

It’s a common misconception that the world’s major central banks and monetary authorities own large quantities of gold bars. Most of them do not. Instead, this gold is owned by the sovereign states that have entrusted it to the respective nation’s central bank, and the central banks are merely acting as guardians of the gold. Tracing the ownership question a step further, what are sovereign states? A sovereign state is...

Read More »European Central Bank gold reserves held across 5 locations. ECB will not disclose Gold Bar List.

Submitted by Ronan Manly, BullionStar.com The European Central Bank (ECB), creator of the Euro, currently claims to hold 504.8 tonnes of gold reserves. These gold holdings are reflected on the ECB balance sheet and arose from transfers made to the ECB by Euro member national central banks, mainly in January 1999 at the birth of the Euro. As of the end of December 2015, these ECB gold reserves were valued on the ECB...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org