Recently, news network RT.com asked for comments on the question of the 80 tonnes of the Reserve Bank of Australia’s (RBA) gold reserves and their supposed storage location at the Bank of England’s gold vaults in London. Based on some of those comments I made, RT has now published an article in its English language news website at www.rt.com about this Australian gold that the RBA claims is held in London.

The RT.com article, which was published on 18 February 2018, is titled “Hey UK! It’s not just Venezuela, what happened to Australia’s gold?“, and can be read in full here on the RT website.

For the commentary, RT actually asked me quite a few interesting questions on both the Australian gold and other related gold

Articles by Ronan Manly

Does the recent spate of Central Bank gold buying impact demand and price?

November 5, 2018There has been a lot of media coverage recently about the re-emergence of central bank gold buying and the overall larger quantity of gold than central banks as a group have been buying recently compared to previous years. For example, according to the World Gold Council’s Gold Demand Trends for Q3 2018, net purchases of gold by central banks in the third quarter of this year were 22% higher than Q3 2017, and the highest quarterly level since Q4 of 2015.

True, there have been a number of ‘new’ central banks announcing gold purchases recently, such as India, Poland and Hungary, central banks that had not been buying gold for a long time until now, but as the World Gold Council admits in its Q3 report, “Russia, Turkey

In surprise move, Central Bank of Hungary announces 10-fold jump in its gold reserves

October 18, 2018In one of the most profound developments in the central bank gold market for a long time, the Hungarian National Bank, Hungary’s central bank, has just announced a 10 fold jump in its monetary gold holdings. The central bank, known as Magyar Nemzeti Bank (MNB) in Hungarian, made the announcement in Budapest, Hungary’s capital.

The details of Hungary’s dramatic new gold purchase are as follows:

Before this month, Hungary’s central bank held 3.10 tonnes of gold.

During the first two weeks of October, the Hungarian National Bank purchased 28.4 tonnes of gold.

This gold purchase raised the central bank’s gold holdings from 3.1 tonnes to 31.5 tonnes, i.e. a 1000% or 10-fold increase.

The Hungarian central bank had not

LBMA Clearing and Vaulting data reveal the absurdity of the London ‘Gold’ Market

October 2, 2018The first day of each month sees the reporting of a number of statistics about the London Gold Market by the bullion bank led London Bullion Market Association (LBMA). These statistics focus on clearing data and vault holdings data and are reported in a 1 month lag basis for clearing activity and a 3 month lag basis for vault holdings data. Therefore the latest clearing data just published is for the month of August, while the latest vault holdings data is for the end of June.

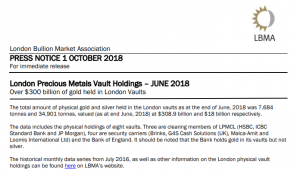

While LBMA clearing data has been published for many years now, publication of vault holdings data by the LBMA is a recent phenomenon and only began at the end of July 2017. As the LBMA press release at the time stated:

“The physical holdings

As Emerging Market Currencies Collapse, Gold is being Mobilized

September 3, 2018In recent weeks, global financial markets have been increasingly spooked by an intensifying crisis in emerging market currencies including those of Turkey and Argentina. Add to this the ongoing currency crisis in Venezuela and the currency problems of Iran. While all of these countries have economy specific reasons that explain at least some of their currency weakness, there are some common themes such as a stronger US dollar, high domestic inflation rates, economic mismanagement, reliance on foreign borrowing, and in some cases economic sanctions imposed by the US.

As one currency plummets, this intensifies emerging market risk across the entire asset class, and it’s not unreasonable at this time to at least

Annual Mine Supply of Gold: Does it Matter?

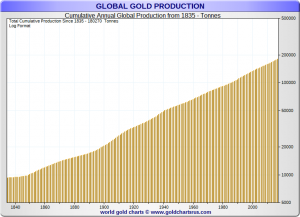

August 21, 2018The topic of how much extractable gold is left in the world has become increasingly discussed within the last few years. This is because of increased focus on ‘peak gold’ and also a concern about remaining levels of unextracted gold reserves. Peak gold is a term referring to the phenomenon of annual gold mining supply peaking (i.e. the rate of gold extraction increases until it peaks at maximum gold output and subsequently diminishes).

The concern about remaining extractable gold is based on the fact that annual gold mining production is running at over 3200 tonnes per annum (e.g. 3247 tonnes in 2017 according to GFMS), while various metal and geological consultancy estimates put the amount of remaining extractable

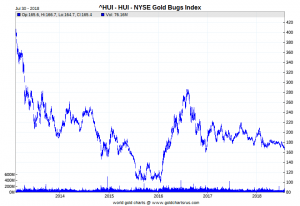

Read More »Spotlight on the HUI and XAU Gold Stock Indexes

August 2, 2018Probably the two best known gold mining stock indexes in the world’s financial markets are the HUI and the XAU. HUI is the ticker symbol for the NYSE Arca Gold BUGS Index. XAU is the ticker symbol for the Philadelphia Gold and Silver Index. Both of these monikers make an appearance on many gold related websites and many general financial market websites as well, so its worth knowing briefly what these indexes are and what they represent.

A quick note on terminology: The words indexes and indices are equally correct, it just depends on your preference. Likewise, when talking about gold stocks within indexes, we can interchangeably use the terms gold stocks, gold mining companies, gold miners, equities, securities,

Chinese Gold Market: Still in the Driving Seat

July 20, 2018With the first half of 2018 now behind us, it’s an opportune time to look at whats been happening in the Chinese Gold Market. As a reminder, China is the largest gold producer in the world, the largest gold importer in the world, and China’s Shanghai Gold Exchange is the largest physical gold exchange in the world.

For various reasons such as cross-border trade rules, VAT rules and deep liquidity, nearly all physical gold supply in China passes through the Shanghai Gold Exchange (SGE) vaulting network. These flows include imported gold, domestically mined gold, and recycled gold. Therefore, nearly all Chinese gold demand has to be met by physical gold withdrawals from the SGE, and SGE gold withdrawals are a suitable

Gold’s Price Performance: Beyond the US Dollar

July 4, 2018With the first half of 2018 now drawn to a close, much of the financial medias’ headlines and commentary relating to the gold market has been focusing on the fact that the US dollar gold price has moved lower year-to-date. Specifically, from a US dollar price of $1302.50 at close on 31 December 2017, the price of gold in US dollar terms has slipped by approximately 3.8% over the last six months to around $1252.50, a drop of US $50.

Since the world’s major gold price discovery hubs of London and New York trade gold in US dollars (or more correctly predominantly trade synthetic gold and derivatives), and since much of the mainstream financial media tends to be very US-centric, the media’s fixation with the US dollar

Sovereign Money Referendum: A Swiss Awakening to Fractional-Reserve Banking?

June 12, 2018On Sunday 10 June 2018, Switzerland’s electorate voted on a referendum calling for the country’s commercial banks to be banned from creating money. In a country world-famous for its banking industry, this was quite an interesting turn of events.

Known as the Sovereign Money Initiative or ‘Vollgeld’, the referendum was brought to the Swiss electorate in the form of a ‘Popular Initiative‘. The Sovereign Money referendum proposed that commercial banks in Switzerland should no longer be allowed to create money out of thin air as they currently do, and that in future only the Swiss central bank should have the power to create money. Sovereign money as a concept refers to money issued or created by a State or central

Turkey and Russia Highlight Gold’s Role as a Strategically Important Asset

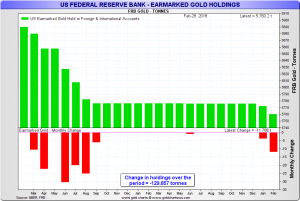

May 3, 2018On 17 April, Turkish news publication Ahval published a report stating that during 2017, Turkey withdrew 26.8 tonnes of gold that it had stored in the vaults of the New York Federal Reserve, and moved this gold under the custodianship of the Bank of England and the Bank for International Settlements (BIS).

The source of the Ahval report was a Turkish language article from the popular Hürriyet newspaper in Turkey. According to the Hürriyet report, also dated 17 April, which reported on the latest annual report of the Turkish Central Bank (Türkiye Cumhuriyet Merkez Bankası), Turkey’s central bank increased its gold holdings by 83.3 tonnes during 2017, 37.7 tonnes of which it purchased in the gold trading market of

Spoofing Futures and Banging Fixes: Same Banks, Same Trading Desks

April 22, 2018On 29 January 2018, the Commodity Futures Trading Commission (CFTC) Division of Enforcement together with the Criminal Division of the US Department of Justice and the FBI announced criminal and civil enforcement actions against 3 global investment banks and 5 traders for involvement in trade spoofing in precious metals futures contracts on the US-based Commodity Exchange (COMEX). COMEX is by far the largest and most active futures exchange in the world for trading precious metals futures including gold futures contracts and silver futures contracts.

The CFTC is bringing the charges under what it calls “commodities fraud and spoofing schemes“. Spoofing of orders is illegal under the US Commodity Exchange Act. The 3

Central Banks Care about the Gold Price – Enough to Manipulate it!

March 30, 2018In early March, RT.com, the Russian based media network, asked me for comments and opinion on the subject of central bank manipulation of gold prices.

The comments and opinion that I supplied to RT became the article that RT then exclusively published on its website on 18 March under the title “Central banks manipulating & suppressing gold prices – industry expert to RT“.

This article is now transcribed below, here on the BullionStar website.

Central bank gold price suppression is a well-documented fact. Central banks have a long and colorful history of manipulating the gold price. This manipulation has taken many shapes and forms over the years. It also shouldn’t be surprising that central banks intervene in the

Why the World’s Central Banks hold Gold – In their Own Words

March 22, 2018Collectively, the central bank sector claims to hold the world’s largest above ground gold bar stockpile, some 33,800 tonnes of gold bars. Individually within this group, some central banks claim to be the top holders of gold bullion in the world, with individual holdings in the thousands of tonnes range.

This worldwide central bank group, also known as the official sector, spans central banks (such as the Deutsche Bundesbank), international monetary institutions (such as the Bank for international Settlements) and national monetary authorities (such as the Saudi Arabian Monetary Authority – SAMA).

These institutions hold gold as one of their reserve assets. Any gold held by a central bank as a reserve asset is

US Gold Reserves, Of Immense Interest to Russia and China

January 22, 2018Recently, Russian television network RT extensively quoted me in a series of articles about the US Government’s gold reserves. The RT articles, published on the RT.com website, were based on a series of questions RT put to me about various aspects of the official US gold reserves. These gold reserves are held by the US Treasury, mostly in the custody of the US Mint. The US Mint is a branch of the US Treasury.

The first of these articles, published by RT on 30 December 2017, is titled “US gold of low purity & that’s why audit of reserves will never be allowed – expert tells RT”.

The second article was published by RT on 8 January 2018 and is titled “Russia-China combined gold reserves could shake US dominance in

Russia, China and BRICS: A New Gold Trading Network

December 12, 2017One of the most notable events in Russia’s precious metals market calendar is the annual “Russian Bullion Market” conference. Formerly known as the Russian Bullion Awards, this conference, now in its 10th year, took place this year on Friday 24 November in Moscow. Among the speakers lined up, the most notable inclusion was probably Sergey Shvetsov, First Deputy Chairman of Russia’s central bank, the Bank of Russia.

In his speech, Shvetsov provided an update on an important development involving the Russian central bank in the worldwide gold market, and gave further insight into the continued importance of physical gold to the long term economic and strategic interests of the Russian Federation.

Firstly, in his speech

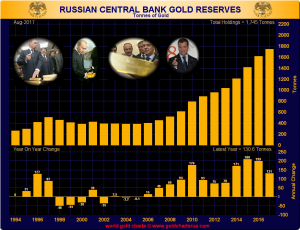

Neck and Neck: Russian and Chinese Official Gold Reserves

October 17, 2017Official gold reserve updates from the Russian and Chinese central banks are probably one of the more closely watched metrics in the gold world. After the US, Germany, Italy and France, the sovereign gold holdings of China and Russia are the world’s 5th and 6th largest. And with the gold reserves ‘official figures’ of the US, Germany, Italy and France being essentially static, the only numbers worth watching are those of China and Russia.

The Russian Federation’s central bank, the Bank of Russia, releases data on its official gold holdings in the Bank’s monthly “International Reserves and Foreign Currency Liquidity” report which is published towards the end of the third week of each month, and which confirms gold

The West lost at least another 1000 tonnes of large gold bars in 2015

August 14, 2017Over the last number of years, one of the most interesting trends in the physical gold world is the ongoing conversion of large 400 ounce gold bars into smaller high purity 1 kilogram gold bars to meet the insatiable demand of Asian gold markets such as China and India.

This transformation of 400 ounce bars into 1 kilogram bars is an established fact and is irrefutable given the large amount of evidence which proves it is happening, as has been documented on the BullionStar website and elsewhere.

It is also something which causes plenty of excitement in the gold world as it underscores the huge movement of physical gold from West to East, and the continual depletion of gold inventories from locations such as the

New Gold Pool at the BIS Switzerland: A Who’s Who of Central Bankers

June 13, 2017This is an extract and summary from “New Gold Pool at the BIS Basle, Switzerland: Part 1” which was first published on the BullionStar.com website in mid-May.

Part 2 of the series titled “New Gold Pool at the BIS Basle: Part 2 – Pool vs Gold for Oil” is also posted now on the BullionStar.com website.

“In the Governor’s absence I attended the meeting in Zijlstra’s room in the BIS on the afternoon of Monday, 10th December to continue discussions about a possible gold pool. Emminger, de la Geniere, de Strycker, Leutwiler, Larre and Pohl were present.” 13 December 1979 – Kit McMahon to Gordon Richardson, Bank of England

A central bank Gold Pool which many people will be familiar with operated in the gold market

New Gold Pool at the BIS Basle: Part 2 – Pool vs Gold for Oil

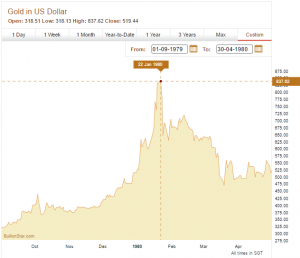

May 26, 2017This is Part 2 of a two-part series. The series focuses on collusive discussions and meetings that took place between the world’s most powerful central bankers in late 1979 and 1980 in an attempt to launch a central bank Gold Pool cartel to manipulate and control the free market price of gold. The meetings centered around the Bank for International Settlements (BIS) in Basle, Switzerland.

Part 2 takes up where Part 1 left off, and begins by looking at developments in the BIS Gold Pool discussions during January 1980, a month in which the US dollar gold price rocketed more than 60% during a three-week period to reach a then record of $850 per ounce. Part 2 then looks at how the discussions involving these central

New Gold Pool at the BIS Basle, Switzerland: Part 1

May 21, 2017“In the Governor’s absence I attended the meeting in Zijlstra’s room in the BIS on the afternoon of Monday, 10th December to continue discussions about a possible gold pool. Emminger, de la Geniere, de Strycker, Leutwiler, Larre and Pohl were present.”

13 December 1979 – Kit McMahon to Gordon Richardson, Bank of England

Introduction

A central bank Gold Pool which many people will be familiar with operated in the gold market between November 1961 and March 1968. That Gold Pool was known as the London Gold Pool.

This article is not about the 1961-1968 London Gold Pool. This article is about collusive central bank discussions relating to an entirely different and more recent central bank Gold Pool arrangement. These discussions about a second Gold Pool began in late 1979, i.e. more than 11 years after the London Gold Pool had been abandoned. This article is Part 1 of a 2 part series. Part 2 will be published shortly.

These discussions about a new Gold Pool arrangement took place in an era of soaring free market gold prices and in the midst of the run-up in the gold price to US$850 in January 1980.

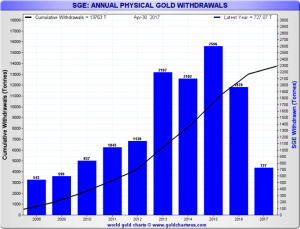

An update on SGE Vault Withdrawals and SGE Price Premiums

May 20, 2017In 2016, withdrawals of gold from the Shanghai Gold Exchange totalled 1970 tonnes, the 4th highest annual total on record. This was 24% less than SGE gold withdrawals recorded in 2015, which reached a cumulative 2596 tonnes (See Koos Jansen’s 6 January 2017 blog at BullionStar “How The West Has Been Selling Gold Into A Black Hole” for more details of the 2016 withdrawals).

SGE gold withdrawals are an important metric in the physical gold market because SGE gold withdrawals are a suitable proxy for approximating Chinese wholesale gold demand. This proxy functions well because China’s domestic gold mining production, Chinese gold imports, and most Chinese gold scrap are all sold on the Shanghai Gold Exchange. As a reminder, gold withdrawals from the SGE means actual physical gold bars withdrawn from the SGE’s network of 62 approved precious metals vaults in 35 cities across China. (See “The Mechanics Of The Chinese Domestic Gold Market” for a discussion of why this proxy works).

Bank of England releases new data on its gold vault holdings

May 4, 2017An article in February on BullionStar’s website titled “A Chink of Light into London’s Gold Vaults?” discussed an upcoming development in the London Gold Market, namely that both the Bank of England (BoE) and the commercial gold vault providers in London planned to begin publishing regular data on the quantity of physical gold actually stored in their gold vaults.

Critically, this physical gold stored at both the Bank of England vaults and the commercial London vaults underpins the gargantuan trading volumes of the London Gold Market and the same market’s ‘liquidity’. Therefore, a new vault holdings dataset would be a very useful reference point for relating to London’s ‘gold’ trading volumes as well as relating to data such as the level and direction of the gold price, the volume of gold held in gold-backed Exchange Traded Funds (ETFs), UK gold import and export statistics, and Swiss and Hong Kong gold imports and exports.

The impending publication of this new gold vault data was initially signalled by two sources.

Sweden’s Gold Reserves: 10,000 gold bars (pet rocks) shrouded in Official Secrecy

April 28, 2017In February 2017 while preparing for a presentation in Gothenburg about central bank gold, I emailed Sweden’s central bank, the Riksbank, enquiring whether the Riksbank physically audits Sweden’s gold and whether it would provide me with a gold bar weight list of Sweden’s gold reserves (gold bar holdings). The Swedish official gold reserves are significant and amount to 125.7 tonnes, making the Swedish nation the world’s 28th largest official gold holder.

Before looking at the questions put to the Riksbank and the Riksbank’s responses, some background information is useful. Sweden’s central bank, Sveriges Riksbank aka Riksbanken or Riksbank, has the distinction of being the world’s oldest central bank (founded in 1668). The bank is responsible for the administration of Swedish monetary policy and the issuance of the Swedish currency, the Krona.

Since Sweden is a member of the EU, the Riksbank is a member of the European System of Central Banks (ESCB), but since Sweden does not use the Euro, the Riksbank is not a central bank member of the European Central Bank (ECB). Therefore the Riksbank has a degree of independence that ECB member central banks lack, but still finds itself under the umbrella of the ESCB.

Death Spiral for the LBMA Gold and Silver auctions?

April 17, 2017In a bizarre series of events that have had limited coverage but which are sure to have far-reaching consequences for benchmark pricing in the precious metals markets, the LBMA Gold Price and LBMA Silver Price auctions both experienced embarrassing trading glitches over consecutive trading days on Monday 10 April and Tuesday 11 April. At the outset, its worth remembering that both of these London-based benchmarks are Regulated Benchmarks, regulated by the UK’s Financial Conduct Authority (FCA).

In both cases, the trading glitches had real impact on the benchmark prices being derived in the respective auctions, with the auction prices deviating noticeably from the respective spot prices during the auctions. It’s also worth remembering that the LBMA Gold Price and LBMA Silver Price reference prices that are ‘discovered’ each day in the daily auctions are used to value everything from gold-backed and silver-backed Exchange Traded Funds (ETFs) to precious metals interest rate swaps, and are also used widely as reference prices by thousands of precious metals market participants, such as wholesalers, refineries, and bullion retailers, to value their own bi-lateral transactions.

German and Swiss Precious Metals Refiners join forces as Heraeus acquires Argor-Heraeus

April 4, 2017German precious metals group Heraeus Precious Metals (HPM), part of the Heraeus industrial group, has just announced the full acquisition of Swiss precious metals refining group Argor-Heraeus. Heraeus is headquartered in Hanau, just outside Frankfurt. Argor-Heraeus is headquartered in Mendrisio in the Swiss Canton of Ticino, beside the Italian border.

The Heraeus takeover announcement, on 3 April 2017, continues a noticeable acquisition trend in the Swiss precious metals refining sector and follows the July 2016 acquisition of Neuchâtel based Metalor Technologies by Japanese Tanaka Precious Metals, and the takeover of Ticino-based Swiss gold and silver refiner Valcambi by Indian group Rajesh Exports in July 2015. The Heraeus press release from Monday 3 April can be read here in English.

– Click to enlarge

A Deal Telegraphed in November

In early November 2016, BullionStar was among the first to report that Swiss Argor-Heraeus was indeed an acquisition target. At the time, market sources had indicated that the most likely acquirer was a private equity company Capinvest, with other suitors said to be Japanese group Asahi and Swiss based MKS-PAMP.

Germany’s Gold remains a Mystery as Mainstream Media cheer leads

March 6, 2017On 9 February 2017, the Deutsche Bundesbank issued an update on its extremely long-drawn-out gold repatriation program, an update in which it claimed to have transferred 111 tonnes of gold from the Federal Reserve Bank of New York to Germany during 2016, while also transferring an additional 105 tonnes of gold from the Banque de France in Paris to Germany during the same time-period.

Following these assumed gold bar movements, the Bundesbank now claims to have achieved its early 2013 goal of repatriating 300 tonnes of gold from New York to Frankfurt, but after 4 years it is still 91 tonnes short of its planned transfer of 374 tonnes of gold from Paris to Frankfurt. In essence, over an entire 4-year period (i.e. 208 weeks), the Bundesbank has only been able to transfer 583 tonnes of gold back from New York and Paris to Germany. And the Bundesbank still claims to have 1236 tonnes of gold remaining in storage with the New York Fed.

Who Owns the Public Gold: States or Central Banks?

February 4, 2017It’s a common misconception that the world’s major central banks and monetary authorities own large quantities of gold bars. Most of them do not. Instead, this gold is owned by the sovereign states that have entrusted it to the respective nation’s central bank, and the central banks are merely acting as guardians of the gold. Tracing the ownership question a step further, what are sovereign states? A sovereign state is an entity with legal personality that is represented by one government. And with each government representing the people of that sovereign state, in essence, the large gold hordes managed by the central banks are in fact pools of gold owned by the state for the benefit of its citizens.

Owned by the State

When ownership of gold reserves resides with the associated sovereign state, the central bank or monetary authority is officially appointed to act on behalf of the state in holding and managing that state’s gold reserves.

Gold Market Charts – A Month in Review

January 4, 2017BullionStar has recently started a new series of posts highlighting charts relating to some of the most important gold markets, gold exchanges and gold trends around the world. The posts include charts of the Chinese Gold Market, the flow of gold from West to East via the London and Swiss gold markets, and the holdings of gold-backed Exchange Traded Funds (ETFs). This is the second post in the series. Please see the November 2016 chart post article for background about the charts chosen for this series.

All of the charts featured below originate from the excellent GOLD CHARTS R US website run by Nick Laird. For BullionStar’s customizable gold and silver price charts, go to BullionStar Charts where, for example, you can measure a wide variety of financial assets in terms of gold and other precious metals.

Shanghai Gold Exchange (SGE) – Gold Withdrawals

Total physical gold withdrawals from the SGE in November 2016 reached a substantial 214.7 tonnes, over 40% higher than gold withdrawals from the Exchange during October. November was also the second highest monthly withdrawal total of the year, only surpassed by January’s withdrawal numbers. Year-to-date to November, gold withdrawals from the SGE have reached 1,774 tonnes.

Gold In London And Hong Kong Is Used To Settle COMEX Futures

December 8, 2016Physical gold located in Hong Kong and London is used to settle COMEX gold futures contracts through “Exchange For Physical” trading in the over-the-counter market.

This post is a sequel to Understanding GOFO And The Gold Wholesale Market and COMEX Gold Futures Can Be Settled Directly With Eligible Inventory – in which Exchange For Physical (EFP) trading is explained and how it can increase or decrease open interest at the COMEX. If you’re new to this subject it’s advised to first read my previous posts.

Most gold analysts surmise COMEX 100-ounce gold futures contracts (GC) can only be physically settled through taking and making delivery. This is technically true when excluding the possibility of EFP trading in GC through the over-the-counter (OTC) market. While on Exchange trading in GC is “executed openly and competitively”, trading GC in the OTC realm (and thus the price of the gold, its form and location) is a “privately negotiated transaction” between buyer and seller. The COMEX is a subsidiary of CME Group, which offers its clients OTC trading on a platform called ClearPort.