Editor’s Note: We keep hearing from the Fed’s defenders that the current spate of new stimulus and bailouts from the central bank are really not a big deal and are all very prudent and moderate. I asked Senior Fellow Bob Murphy to provide some much needed perspective. Ryan McMaken: We’re in a very odd situation right now in terms of evaluating the state of the economy. We can see that there is rising unemployment, and there is likely to be a wave of missed mortgage...

Read More »The Importance of Economic Theory in Understanding Historical Data

It is a common belief that sound economics must be based on facts and not on theoretical reasoning as such. Some commentators are dismissive of economic analysis that is not derived from the true data, since it is not describing the facts of reality as depicted by historical data. The use of the free market economy framework, without the central bank and government intervention and with businesses as a foundation to derive valid conclusions, is dismissed as...

Read More »FX Daily, June 8: Monday Blues: Consolidation Threatened

Swiss Franc The Euro has fallen by 0.28% to 1.0831 EUR/CHF and USD/CHF, June 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The MSCI Asia Pacific Index rose for a sixth consecutive session. Japan, Taiwan, Singapore, and Indonesian markets advanced more than 1%. European bourses are mixed, with the peripheral shares doing better than the core, leaving the Dow Jones Stoxx 600 about 0.5% lower near midday after...

Read More »Lockdown led to big jump in worker productivity

Home office: more or less efficient? (© Keystone / Christian Beutler) Thanks to more focus and flexibility, productivity per worker increased by up to 16% during the Covid-19 lockdown in Switzerland, a study has calculated. The study by the Swiss Trade Association (SGV), reported in the NZZ am Sonntag newspaper, found that while hours worked dropped by 10% in the first quarter of 2020, GDP sank by just 2.6%. This translates to a productivity jump of up to 16%. And if...

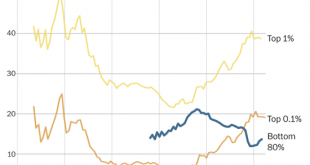

Read More »What Lies Ahead: Destabilizing Social Stratification

The bill for extreme wealth/income inequality is now overdue, and the penalties for ignoring the bill will be as extreme as the inequality. Our socio-economic-political system–let’s call it the status quo–has been hollowed out by extremes of wealth/power inequality driven by financialization and globalization, which have enriched the top 5% and left everyone else behind. As a result, the status quo has become increasingly fragile and brittle even as cheerleaders...

Read More »Why GDP Metrics Won’t Tell Us Much about the Post-COVID Recovery

In seeking to measure everything, econometricians gave us the dubious gift of gross national product and gross domestic product, the latter being in fashion today and the former in times past. Although there are different ways of measuring it, GDP is commonly taken as a measure of spending, comprised of household spending, government spending, investment spending, and net exports. The Bank of England’s guide says that it is a measure of the size and health of the...

Read More »10 Tips to Protect Your Online Personal Finances in 2020

(Disclosure: Some of the links below may be affiliate links) These days, most of your personal finances are probably online. You probably have access to your bank through an online banking platform. Also, you are likely to access your broker through your browser or through your phone. If someone is getting access to your online personal finances, he can do a lot of harm! You need to protect yourself! It is very important to protect your Online Personal Finances!...

Read More »WEF unveils dual physical and virtual Davos summit in 2021

The WEF Davos meeting will be rebuilt differently next year. (Keystone / Alessandro Della Valle) The World Economic Forum (WEF) annual conference in Davos will take place in January with fewer physical participants – but with a new “virtual” connection to more than 400 cities around the world. The introduction of a “powerful virtual hub network” at the 51st edition of WEF’s flagship event will allow a younger generation of “global shapers” to dial into the conference...

Read More »Is the lack of inflight social distancing on SWISS airlines a risk?

© Colicaranica _ Dreamstime.com Over two days last week, Thailand reported a score of new coronavirus cases. All were Thai nationals returning by air from the Middle East. Otherwise, there have been almost no new community or ‘inside country’ cases since mid-May. Thai Airways (as with a growing number of other airlines) requires a “fit-to-fly” medical certificate for all passengers; it also obliges passengers to wear face masks throughout the entire flight. Such...

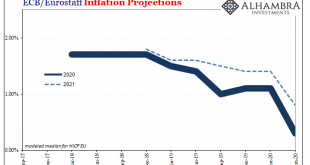

Read More »ECB Doubles Its QE; Or, The More Central Banks Do The Worse You Know It Will Be

A perpetual motion machine is impossible, but what about a perpetual inflation machine? This is supposed to be the printing press and central banks are, they like to say, putting it to good and heavy use. But never the inflation by which to confirm it. So round and round we go. The printing press necessary to bring about consumer price acceleration, only the lack of consumer price acceleration dictates the need for more of the printing press. It never ends. If you...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org