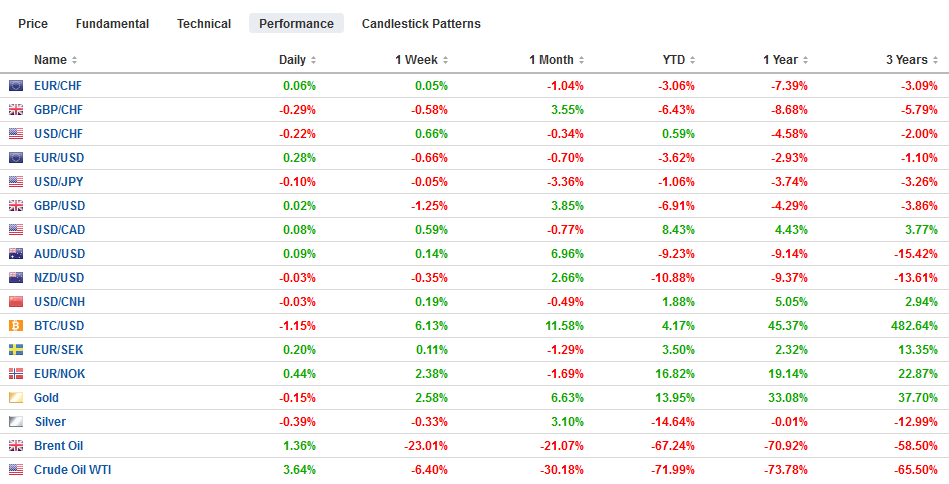

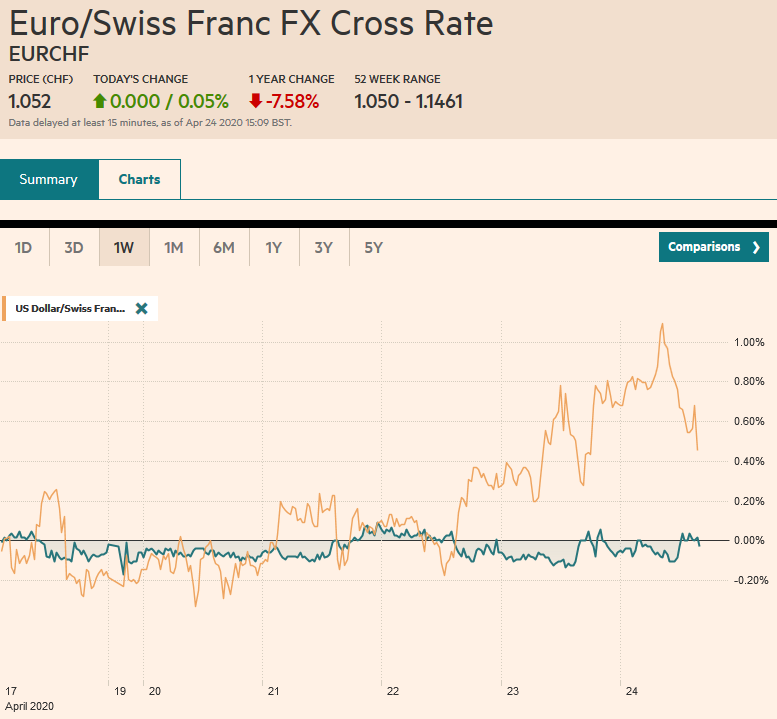

Swiss Franc The Euro has risen by 0.05% to 1.052 EUR/CHF and USD/CHF, April 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The reversal in US equities yesterday set the stage for today’s losses. All the Asia Pacific bourses fell today but Australia. For the week, the regional index is off more than 2%. Europe’s Dow Jones Stoxx 600 was flat for the week coming into today’s sessions. It is off around 0.5% in late morning activity. US shares are firmer, while the S&P 500 is 2.7% through yesterday. It fell by about 3% last week. Core bond yields are a little lower, and after a rocky start, peripheral European yields have softened. It is not simply a result of disappointment that the EU did not reach an

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Currency Movement, EUR/CHF, Europe, Featured, Federal Reserve, newsletter, PBOC, U.K. Retail Sales, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.05% to 1.052 |

EUR/CHF and USD/CHF, April 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The reversal in US equities yesterday set the stage for today’s losses. All the Asia Pacific bourses fell today but Australia. For the week, the regional index is off more than 2%. Europe’s Dow Jones Stoxx 600 was flat for the week coming into today’s sessions. It is off around 0.5% in late morning activity. US shares are firmer, while the S&P 500 is 2.7% through yesterday. It fell by about 3% last week. Core bond yields are a little lower, and after a rocky start, peripheral European yields have softened. It is not simply a result of disappointment that the EU did not reach an agreement yesterday. The ECB has had a difficult time this week. Spanish and Portuguese 10-year yields have risen about 10-12 bp this week, Italy about 5 bp, and Greece over 15 bp. The comparable German and French yields were1-2 bp softer. The US 10-year benchmark is little changed on the week near 60 bp. The dollar is firm against all the major currencies, not just on the day but for the week as well. Most emerging market currencies are lower, but South Africa, Mexico, and Hungary are notable exceptions. The JP Morgan Emerging Market Currency Index has fallen every day this week for a cumulative decline of a little more than 1.5%, about last week’s loss as well. Gold is little changed and holding on to about a 3% advance this week. Oil is heavy, and the June WTI contract is near $16 as one the most dramatic weeks winds down. It is off by more than a third this week. |

FX Performance, April 24 |

Asia Pacific

The Bank of Japan was resisting deflationary forces, and the pandemic will make its task more difficult. The March CPI figures showed core inflation, which excludes fresh food prices, eased to 0.4% from 0.6% in February. Excluding fresh food and energy, the CPI was unchanged at 0.6%. However, the sales tax increase, imposed last October, and the free pre-school initiative distorts measured inflation. When these are stripped, core inflation, which the BOJ targets fell to 0.1%. Separately, Japan reported its all industry activity index (a proxy for GDP) fell 0.6% in February after rising as much in January (revised from 0.8%). Also, Japan reported that department store sales plunged by more than a third in March. Lastly, the Tokyo Governor is encouraging an extension of the Golden Week holidays starting as soon as tomorrow to keep social distancing that slows the spread of the virus.

The People’s Bank of China injected funds into the banking system via the targeted one-year medium-term lending facility at 2.95%. This reflects the 20 bp rate cuts seen in other facilities over the last few weeks. It does not signal a new round of easing, but that is likely to be forthcoming as well. A new Bloomberg survey found the median GDP forecast for this year has been halved to 1.8% from 3.7% last month.

The dollar has been confined to a narrow range against the yen all week; roughly JPY107.30-JPY108.05. It finished last week near JPY107.55, which corresponds to today’s low. The greenback has not been above JPY107.80 today, so far. The intraday technicals are giving little guidance suggesting continued consolidation is the most likely scenario. The Australian dollar is little changed on the day, pinned in about a quarter-cent range either side of $0.6360. It is virtually unchanged on the week after settling last week near $0.6365. The US dollar finished last week near CNY7.0735 and is now quoted around CNY7.08.

Europe

On the one hand, the EU leaders failed to secure an agreement. The naysayers are wagging their fingers and shaking their heads. On the other hand, all is not lost. First, it appears to have been decided that the EU’s budget is the vehicle of choice. Second, given that this is the case, it is clearly not for immediate needs. This route means that little can be counted on until next year. In turn, this means that there is plenty of time to work out the details. Third, that is what is ultimately involved, details. Of course, it doesn’t mean the details are unimportant. That is where the devil resides. However, Merkel’s explicitly recognized that considerably more resources were necessary, and she committed Germany. In the modus operandi, the details leave room for compromises and securing buy-ins. Some mix between loans and grants, for example.

That the German April IFO survey weakened is a dog-bites-man story. It is hardly surprising after the ZEW and preliminary PMI. However, what is different here is that, unlike the ZEW results, the IFO did not show any improvement in the expectations component. Instead, the IFO’s measure fell to 69.4 from 79.5. Separately, it is notable that Merkel expressed frustration that some states were relaxing the shutdown too early and that this could cause new flare-ups. German cases rose the most in a week.

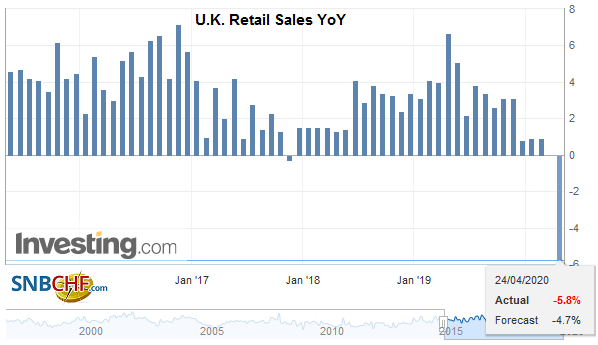

| UK March retail sales fell the most on record. Including petrol, retail sales fell 5.1% on the month. Excluding auto fuel, retail sales fell 3.7%. Only food stores, pharmacies, and other essential businesses were open by the end of the month. Clothing sales were hit among the hardest, down by over a third. Food sales jumped over 10%, and alcohol sales surged by more than 31% (note that this does not include supermarket sales, where the majority of alcohol is bought in the UK). Online sales rose by 8%. |

U.K. Retail Sales YoY, March 2020(see more posts on U.K. Retail Sales, ) Source: investing.com - Click to enlarge |

The euro has fallen every day this week and has approached the lowest level in a month near $1.0725 today. It finished last week around $1.0875. Previous support in the $1.0780-$1.0800 area is likely to offer resistance now. The low in March was close to $1.0635. Sterling is trading heavily as well. It traded in a 2.5-cent range in the first two sessions this week (~$1.2250-$1.2500) and has remained in that range since. It settled last week near the upper end of that range and is approaching the lower end of that range now, near $1.2320, before as the North American session begins.

America

The US House of Representative easily passed the new $484 bln stimulus bill that replenishes the Payroll Protection Progam that turns loans into grants for businesses that retain or rehire employees. There is widespread expectation that the funds will be quickly exhausted. Separately, Treasury Secretary Mnuchin acknowledged that he is considering efforts to support US oil producers. It is not clear if such a program would be run out of the Treasury Department or another facility that the Fed runs, with Treasury money as a backstop. Meanwhile, at least 13 meat processing plants have closed due to the virus, and this is impacting roughly 10% of the US beef production and 25% of pork production. This is affecting the supply chain and prices.

The Federal Reserve’s efforts to unlock the funding market are beginning to show clear effects. The benchmark three-month dollar LIBOR is below 1% for the first time in over a month. The swap lines with foreign central banks continue to be used. There is a bit more than $430 bln outstanding. One program that has not been used is the repo lines the Fed offered, so foreign central banks had an alternative to selling their Treasury holdings. We had been skeptical of the merits because the central banks the private sector already offered such a facility. No central bank has taken the Fed up on its offer. However, at the same time, central bank selling appears to have eased as the Fed’s custody holdings of Treasuries have risen for the past two weeks (~$6 bln) after falling for the previous six weeks (~$155 bln).

The US reports March durable goods orders, and large declines are anticipated. Next week, the US reports Q1 GDP. The median of a Reuters poll puts it at -4.8% while the median of the Bloomberg poll has it at -3.7%. Baker Hughes reports the rig count today, and given the turbulence in oil, it may attract more attention than usual. The oil rig count stood at 683 in mid-March and has fallen for the past five weeks to 438. It is expected to have fallen toward 420 this week. In the last crash in oil prices (2016), the number of oil rigs bottomed near 315.

The US dollar set a new three-week high against the Canadian dollar earlier this week near CAD1.4265 while holding for the most part above CAD1.40. Over the past nine weeks, the Canadian dollar has risen in only two, and both coincided with double-digit gains in the S&P 500. Initial resistance is seen in the CAD1.4125-CAD1.4150 area. A close below CAD1.40 would weaken the greenback’s technical tone. The US dollar edged to a new high for the week against the Mexican peso earlier today near MXN24.8520. It was threatening to extend its advancing streak to a fifth consecutive session but has come back a bit offered in late morning turnover in Europe to test the MXN24.65 area. Still, the intraday technicals warn that the US dollar is likely to test the highs again ahead of the weekend. Last week, the dollar settled near MXN23.70.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Currency Movement,EUR/CHF,Europe,Featured,federal-reserve,newsletter,PBOC,U.K. Retail Sales,USD/CHF