No Country Can be Made Great by Devaluation John Connally, President Nixon’s Secretary of the Treasury, once remarked to the consternation of Europe’s financial elites over America’s inflationary monetary policy, that the dollar “is our currency, but your problem.” Times have certainly changed and it now appears that the dollar has become an American problem. In a recent interview with the Wall Street Journal, the...

Read More »UBS Chief Investment Office WM publishes real estate market study UBS Real Estate Focus 2017: Vacancy rates rising at the end of the real estate cycle

Zurich, 19 January 2017 – Switzerland’s major cities saw net prime yields for multi-family homes drop to 2.6% in 2016 from an average of 2.8%. This is equivalent to a 6% increase in net present value. These low yields are creating additional incentives for investors to seek out higher returns in less central locations. Yet the number of vacant rental apartments – which has already doubled since 2009 – is likely to...

Read More »Swiss Producer and Import Price Index, December 2016: +0.2 percent MoM, -1.8 percent YoY

The Producer Price Index (PPI) or officially named "Producer and Import Price Index" describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More »Pension Funds Need Gold before It’s Too Late

Tens of millions of Americans and their employers pour money into pension plans each month, counting on those funds to grow and to be there when needed at retirement. But a time bomb awaits. The bulk of U.S. pension funds are dangerously underfunded, and the assets are often invested in securities that have bleak prospects for providing income that keeps up with a general decline in purchasing power. A pension plan...

Read More »Pension Funds Need Gold before It’s Too Late

Tens of millions of Americans and their employers pour money into pension plans each month, counting on those funds to grow and to be there when needed at retirement. But a time bomb awaits. The bulk of U.S. pension funds are dangerously underfunded, and the assets are often invested in securities that have bleak prospects for providing income that keeps up with a general decline in purchasing power. A pension plan...

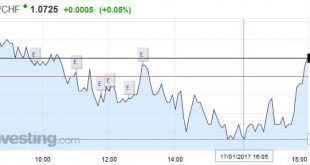

Read More »FX Daily, January 17: Trump’s Comments Send the Dollar Reeling

Swiss Franc EUR/CHF - Euro Swiss Franc, January 17(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF - British Pound Swiss Franc, January 17(see more posts on GBP/CHF, ) - Click to enlarge FX Rates The US dollar is broadly lower against major and emerging market currencies. It has given up yesterday’s gains and more. The proximate cause appears to be comments by President-elect Trump in a Wall...

Read More »Weekly Sight Deposits and Speculative Positions: Stronger SNB interventions at more expensive EUR

Headlines Week January 13, 2017 Who has read Milton Friedman knows that the Trump reflation trade is now showing its positive side. US wages are rising by 2.5%, while inflation is still relatively low. According to Friedman, inflation will increase only later. This implies that speculators are long the dollar and short the Swiss franc and the euro during the weak inflation period. The last ECB meeting showed that the...

Read More »Weekly Speculative Positions: CHF and GBP net shorts are slowly rising again

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »Weekly Speculative Position: CHF Net Shorts rising, but JPY net shorts falling

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »FX Weekly Preview: Five Events that Will Drive the Capital Markets in the Week Ahead

Summary: Bank of Canada may be more upbeat following strong jobs and trade figures. China’s President Xi will speak at Davos and likely defend globalization and free trade, which some think the US is abandoning. UK PM May’s speech on Brexit may be blunted by few surprises, collapse of the government in Northern Ireland, and the pending Supreme Court ruling. ECB will leave rates on hold and look for Draghi to push...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org