Central banks are currently creating the mother of all bubbles. To my view it was caused by masses of cheap labor in China that entered the global economy in the early 1990s.This reduced inflation and interest rates, while Chinese productivity continously improved, in particular when rural workers came into the cities.The mother of all bubbles will pop at the latest, when Chinese wages approach Western levels....

Read More »Deutsche Bank CEO Returns Home Empty-Handed After Failing To Reach ‘Deal’ With DOJ: Bild

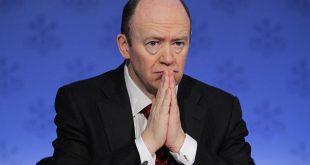

Following the seemingly endless procession of short-squeeze-fueling trial balloons last week – from settlement rumors to German blue-chip bailouts to Qatari investors – Germany’s Bild newspaper confirms the rumors that sparked weakness on Friday: Deutsche bank CEO John Cryan has failed to reach an agreement with the US Justice Department. John Cryan - Click to enlarge Having soared over 25% off the briefly...

Read More »FX Daily, October 07: Sterling Stabilizes After Harrowing Drop, Now Jobs

Swiss Franc EUR/CHF - Euro Swiss Franc, October 07 2016. - Click to enlarge FX Rates Sterling again steals the limelight. In early Asia, sterling inexplicably dropped nearly eight cents in minutes (to ~$1840), and on some platforms, may have traded below $1.1380. It almost immediately rebounded but has not resurfaced above $1.2480. Over the last couple of years,there have been a number of sudden dramatic moves...

Read More »Weekly Swiss Markets: Stocks fluctuated on central bank statements

SMI The Swiss Market Index is set to finish the week mainly unchanged, outperforming global stocks modestly while markets fluctuated on speculation that the US Fed will increase interest-rate later this year. SMI Index, October 7 - Click to enlarge Economic Data Global equity markets oscillated this week while the dollar strengthened, reflecting renewed investor concerns that the US Federal Reserve would raise...

Read More »Switzerland’s central bank offers a glimpse behind the curtain

The Swiss National Bank is offering a rare look into how it sets monetary policy. A video of SNB President Thomas Jordan and fellow members of the governing board shows them beginning their quarterly policy assessment discussing the state of the economy with about 30 people. According to the voiceover, the group comprises experts from different departments engaged in a question-and-answer session. [embedded content]...

Read More »US and Canada Jobs: Sill Strong Enough for a Rate Hike

United States The US grew 156k jobs in August, missing the median estimate by about 16k. U.S. Nonfarm Payrolls, September 7(see more posts on U.S. Nonfarm Payrolls, ). Unemployment Rate The July series was revised up by 16k. The unemployment and participate rate ticked up 0.1% to 5.0%… U.S. Unemployment Rate, September 2016(see more posts on U.S. unemployment rate, ). Source: Investing.com - Click to enlarge...

Read More »Algos, Barriers, Rumors: Some Theories On What Caused The Pound Flash Crash

As reported moments ago, just around 7:07pm ET, cable snapped and plunged by what some say may have been as much as 1200 pips, dropping from 1.26 to as low as 1.14 according to some brokers, before snapping back up. GBP/USD, October 7 - Click to enlarge What caused the move? While nobody knows the catalyst behind the flash crash yet, Bloomberg has compiled several potential explanations. “The GBP/USD slide could...

Read More »Something Strange Is Going On In Switzerland: “Is Someone Trying To Buy The Swiss National Bank”

By now it is well-known that as we profiled previously, one of the most ravenous buyers of US stocks in recent years, has been a central bank: the Swiss National Bank… Value of Swiss National Bank US Stocks Holdings(see more posts on Swiss National Bank, )Value of Swiss National Bank US Stocks Holdings - Click to enlarge … which has shown a particular appetite for AAPL stock: Swiss National Bank Top Holdings(see...

Read More »FX Daily, October 06: The Dollar is Firm in Quiet Market

Swiss Franc EUR/CHF - Euro Swiss Franc, October 06 2016. - Click to enlarge FX Rates The US dollar is advancing against the major and most emerging market currencies. Activity is subdued and ranges are narrow. We share four observations about the price action. First, the euro has been unable to sustain upticks even after Germany reported a jump in industrial orders three-times more than the median estimate (1.0%...

Read More »Swiss Consumer Price Index 0.1 percent MoM, -0.2 percent YoY

Swiss Consumer Price Index in September 2016 Consumer prices increase by 0.1% Neuchâtel, 06.10.2016 (FSO) – The Swiss Consumer Price Index (CPI) increased by 0.1% in September 2016 compared with the previous month, reaching 100.2 points (December 2015=100). Inflation was -0.2% in comparison with the same month in the previous year. These are the findings from the Federal Statistical Office (FSO). Switzerland...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org