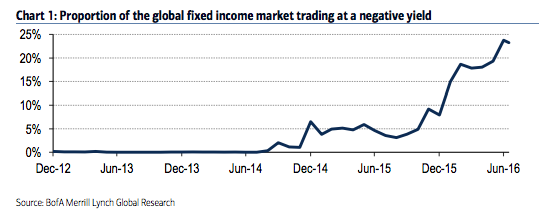

When x happens, yields fall — Rule 1? It’s not a search for yield, it’s a search for safety — Potential Rule 2? Two charts to make the point for us once again from the good folks at BofAML’s relative value department: Click to enlarge. You could also pop in here and have a look at Credit Suisse’s roughly similar argument (and the state of the negatively rate inspired corporate bond market). CS’s point has to do with two phases of negative rates in European fixed income, as demonstrated by the German yield curve, which say that a yield hunt has really not been the right strategy in EU fixed income — “Taken as a snapshot in time, negative (or very low positive) yields should of course see investors rotating out of such assets into higher yielding assets, and that has happened for short periods of time within the past 2.5 years. But implicitly yields are a hold-to-maturity concept, and actual returns can, for certain periods, deviate quite far from that implied by yields as we have seen in recent years.” Click to enlarge. And as BofAML say, while also noting the “best years for stocks in recent memory, 2009 (26.

Topics:

David Keohane considers the following as important: Credit Suisse, effective yield, Featured, high-yield, negative interest rates, negative rates, negative yield, newsletter, Safe Assets

This could be interesting, too:

investrends.ch writes UBS zahlt für CS-Steuerstreit mit US-Justizministerium weitere halbe Milliarde

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

| When x happens, yields fall — Rule 1?

It’s not a search for yield, it’s a search for safety — Potential Rule 2? Two charts to make the point for us once again from the good folks at BofAML’s relative value department: |

|

| You could also pop in here and have a look at Credit Suisse’s roughly similar argument (and the state of the negatively rate inspired corporate bond market). CS’s point has to do with two phases of negative rates in European fixed income, as demonstrated by the German yield curve, which say that a yield hunt has really not been the right strategy in EU fixed income — “Taken as a snapshot in time, negative (or very low positive) yields should of course see investors rotating out of such assets into higher yielding assets, and that has happened for short periods of time within the past 2.5 years. But implicitly yields are a hold-to-maturity concept, and actual returns can, for certain periods, deviate quite far from that implied by yields as we have seen in recent years.” |

And as BofAML say, while also noting the “best years for stocks in recent memory, 2009 (26.5% for S&P 500) and 2013 (32%), were both accompanied by higher rates, +162bp and +127bp on the [US] 10y respectively”:

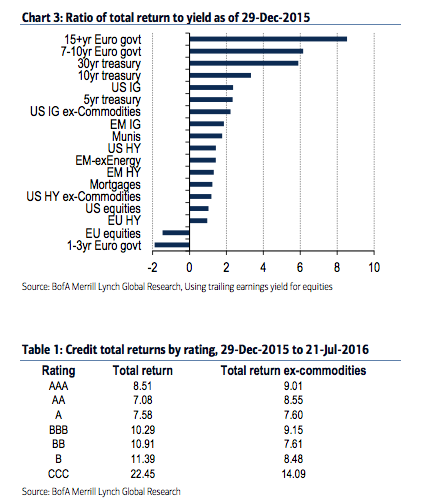

Our skepticism around the ‘yield chase’ narrative is driven by the dissonance between yields offered by various assets and realised returns since that time. Chart 2 shows the total return of various fixed income assets and equities as a function of their yield on 29-Dec-2015, the date of the recent peak in treasury yields. There is no discernable relationship between yield and return in the chart. Given a choice between extending duration and going down the risk spectrum to avoid negative yields, investors have overwhelmingly chosen the former. In our view, it is not so much that negative yields are driving investors into riskier assets, more so that they are being forced into a dwindling pool of ‘safe assets’. As an example, US IG yielded 3.7% back in December (3.44% ex-commodities), but returned less than half the performance of 30y US Treasuries, which themselves yielded a similar 3.04%, but with three times the duration.

Ratio of total return to yield as of 29-Dec-2015

Chart 3 illustrates how the ‘safest’ assets have returned many multiples of their promised yields relative to ‘riskier’ but higher yielding assets. Within credit as well, there has been nary a difference across ratings, particularly after accounting for commodities (Table 1). Other than the CCC sector, which is quite idiosyncratic, there is scarce evidence here of a reach for yield. If anything, it furthers our argument that it has been about the reach for safety.

Related links:

Ten per cent of respondents throw the word ‘never’ around quite casually… FT Alphaville

It’s a negative yielding world, we just get to scramble in it – FT Alphaville

Deutsche Bahn has become the first non-financial company (admittedly state owned) to issue debt with a negative yield – FT Alphaville

In ten years times, what will we think about negative yields? – Weldon Medium

Negative govvies, why would ya? FT Alphaville