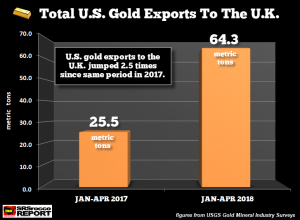

Gold Exports To London From U.S. Surge 152% In 2018

– U.S. gold exports to UK (primarily) London jumped over 150% from 25.5 metric tons to 64.3 mt in the first four months of 2018 (yoy)– Largest countries receiving U.S. gold exports are China/ Hong Kong, Switzerland and the UK

– U.S. gold exports to London (UK) alone nearly as much as total U.S. gold production

– Gold flowing from weak hands in West to strong hands in the East

As U.S. gold exports to Hong Kong and China fell 25% in the first four months of the year, London picked up the slack. According to the USGS, U.S. gold exports to London more than doubled from January to April, compared to the same period last year (see chart).

Interestingly, the amount of gold

Articles by Steve St. Angelo

If It Didn’t Abandon The Gold Standard, U.S. Empire Would Have Collapsed…

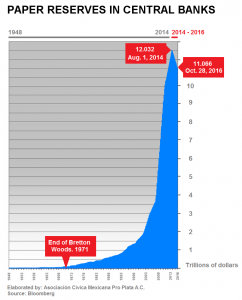

February 19, 2017The U.S. will never go back on a gold standard. The notion that a U.S. Dollar backed by gold would solve our financial problems is pure folly. Why? Because, if the U.S. Empire didn’t abandon the gold standard in 1971, it would have collapsed decades ago.

Unfortunately, some of the top experts in the precious metals community continue to suggest that revaluing gold much higher, to say…. $15,000-$50,000 an ounce, would bring confidence back into the Dollar. Not only will this not happen, it wouldn’t save the Dollar even if it did.

Why? Well, that is the $10.5 trillion question, isn’t it? I provided that exact $10.5 trillion figure for good reason… which I will get to shortly, but the innate value of the U.S. Dollar died decades ago and will never come back. Basically, it is a DEAD MAN WALKING.

However, the market hasn’t figured that out yet, but it will. It is just a matter of time, and time is running out.

Hugo Salinas Price Was The Motivation For Writing This Article

As I mentioned in prior articles, Hugo Salinas Price has been keeping an eye on International Reserves for many years. In his recent article, A Reversal In The Trend Of International Reserves, he stated the following:

International Reserves peaked on August 1, 2014, at $12.

Read More »U.S. Imports Record Amount Of Gold From Switzerland In July

September 24, 2016U.S. Gold Imports from Switzerland Monthly

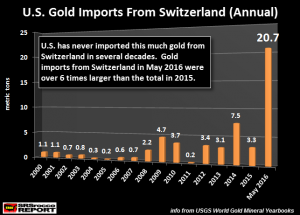

It seems as if the tide has changed as the U.S. imported a record amount of gold from Switzerland in July. Normally, the flow of gold from the United States has been heading toward Switzerland. For example, when the U.S. exported a record 691 metric tons (mt) of gold in 2013, Switzerland received 284 mt, which accounted for 41% of the total. Compare that to the paltry 3 metric tons of gold imported from Switzerland that very same year.

However, something has changed in the market dynamics as the U.S. imported a record 23.8 mt of gold from Switzerland in July:

As I stated in my previous article, WHAT’S GOING ON?? Record Swiss Gold Flow Into The United States: the Swiss exported 20.7 mt of gold in May 2016, up considerably from its monthly average 0.4 mt. Even though gold imports from Switzerland declined the next month to only 13.1 mt in June, they were still much higher than their monthly average going back until Jan. 2015.

But, as we can see… U.S. gold imports from Switzerland jumped 82% in July to 23.8 mt compared to June. There has been speculation in the precious metals community as to why the Swiss are now exported gold to the United States.

Record Swiss Gold Flow Into The United States

July 26, 2016Submitted by the SRSrocco Report

Record Swiss Gold Flow Into The United States

There was a huge trend change in U.S. gold investment in May. Something quite extraordinary took place which hasn’t happened for several decades. While Switzerland has been a major source of U.S. gold exports for many years, the tables turned in May as the Swiss exported a record amount of gold to the United States.

How much gold? A lot. The Swiss exported 50 times more gold in May than their monthly average (0.4 mt) since 2015:

As we can see, the Swiss gold exports to the United States are normally less than 0.5 metric ton a month. And for many months there weren’t any gold exports. However, something big changed in May as Swiss gold exports surged to 20.7 mt (665.500 oz).

U.S. Gold Imports From Switzerland

The overwhelming majority of gold flows from the U.S. have been exports to Switzerland and the United Kingdom (U.K.):

Top U.S. Gold Exports 2001-2013

Furthermore, as I have mentioned in precious articles, the U.S. has been exporting more gold than it produces and imports. However, this changed in May as the Swiss exported more gold to the U.S. in one month than they have every year going back until 2000:

U.S.