Duped and Distorted

DUBLIN – When you start thinking about what money is and how it works, you face isolation, shunning, and possible incarceration. The subject is so slippery – like a bead of mercury on a granite counter top – you become frustrated… and then… maniacal.

You begin talking to yourself, because no one else will listen to you. If you are not careful, you may be locked up among the criminally insane.

We’ve been thinking about money for the last couple of months. It has become our favorite subject. That is why people edge away from us at parties. Our family finds novel ways to change the subject.

“Whoa… sorry to interrupt, Dad… but isn’t that a flying saucer?”

Undaunted, we press on. We think we’re onto something important. We have come so far; we might as well go the whole way.

Economist George Gilder’s new book, The Scandal of Money, came as an unexpected reinforcement. He has been thinking about money, too. But he seemed fairly normal in Las Vegas last week. No facial tics. No babbling or paranoid delusions.

Gilder has come to much the same conclusions from a different direction. It is not real money. It only pretends to be. It has duped the entire world – and distorted the entire global economy. |

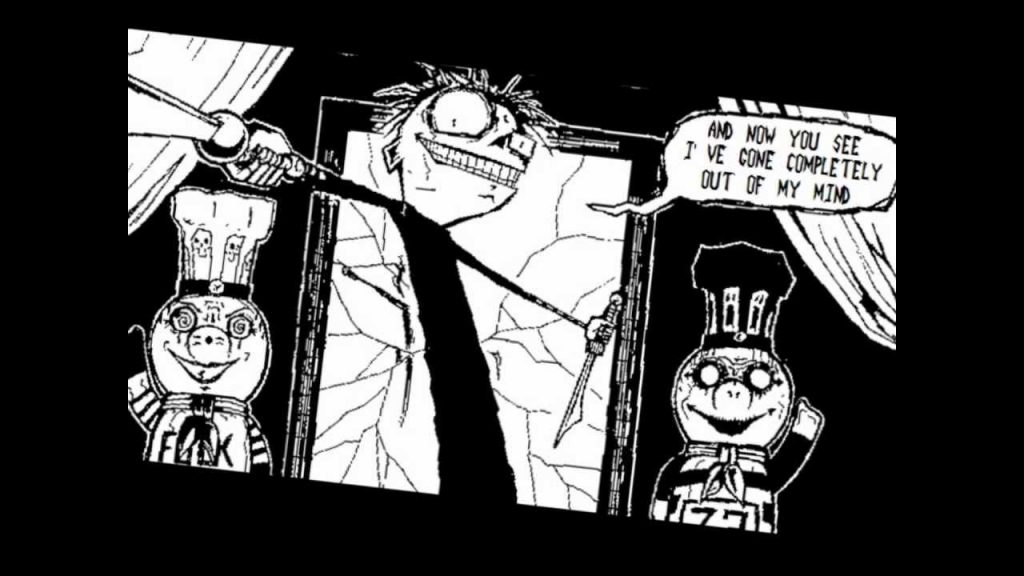

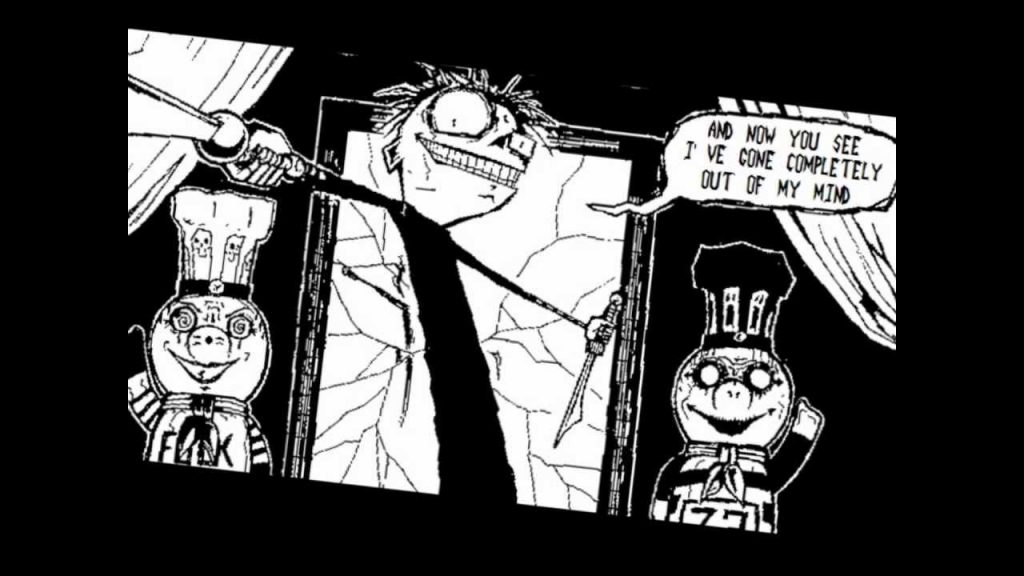

What thinking about money can do to you Illustration by Jhonen Vasquez |

Neither Cash nor Gold

We’ve already connected most of the dots. Today, we draw a new line from this new dollar to the impoverishment of the middle class. It explains why even Donald J. Trump – a man with none of the qualities you would normally look for in a chief executive – is the Republican presidential nominee.

The phenomenon is teased up for us by one of our own dear readers, who writes:

“Dear Mr. Bonner, you are brilliant. But you are missing a very important piece of the puzzle. As someone that had the unique experience of watching a whole economy transformed from a free market economy to Communism (the state centralized economy Cuban experiment under Fidel Castro and his cronies), I can testify that ultimately neither cash nor gold matter.

There is no shortage of paper money in Cuba. But there is nothing to buy with it. All the money in the world and all the gold in the world cannot buy you a cup of coffee, if no-one is willing to produce it.”

Yes, exactly. Money is not wealth. It only measures the stuff that you can buy with it. No stuff? Then money is worthless. Imagine a man at the North Pole. He is starving and freezing to death.

You give him a Ben Franklin. What is it worth? Zero. Give him a gold coin? Same thing. Good money honestly measures output. It is the output that is the real wealth. And if you want wealth, you have to produce.

That is the meaning of Say’s Law: You buy stuff with stuff, not money. Bad money, however, tricks up the whole system. |

Believe it or not, France was once home to numerous great economists, and Jean-Baptiste Say was one of them (by contrast, nowadays the country’s most prominent economists tend to be Marxists like Thomas Pikkety). A major implication of Say’s law is that if one wants to consume, one must first produce. Today’s economic planners are as a rule trying to put the cart before the horse and keep being surprised that it doesn’t work. Engraving via Wikimedia Commons |

Populist Rage

How badly the system has been tricked up was the unintended subject of a recent article in the Financial Times.

“Populist rage puts global elites on notice,” writes the ever-elite, Parasitocracy mouthpiece Mr. Martin Wolf.

Poor Mr. Wolf. He conveniently misses the real cause of the “rage” – the phony money system put in place by the elite. He shows no interest in our perverse money system, but has begun foaming at the mouth anyway.

The gist of Mr. Wolf’s warning is that the elites had better take notice. “Real income stagnation over a longer period than any since 1945 is a fundamental fact,” he continues.

During the most recent end of that period – from 2005 to 2014 – for example, almost 100% of Italian households have seen their real incomes fall or remain flat. In the U.S., 80% of households have experienced the same fate. Britain, France, and the Netherlands are only slightly better. |

Establishment mouthpiece Martin Wolf, who ironically has been screaming for more money printing at every opportunity (for a few examples over the years, see e.g. “The Helicopter Wolf at the Door”, “The Money Cranks are Loose” or “Establishment Quacks Call for More Money Printing”). It has been known since the publication of Richard Cantillon’s seminal treatise Essai sur la Nature du Commerce en Général that introducing additional money created ex nihilo into the economy will (among other things) lead to wealth redistribution, as new money doesn’t reach all economic actors evenly or simultaneously (the essay can be read for free here). Written in 1730, and considered “the cradle of political economy” by Jevons, it somehow seems to have escaped the attention of the FT’s chief economics commentator – who, not to put too fine a point to it, is a complete money crank. Allegedly he once said that there was a “need for new ideas”, but the economic recipes he himself promotes have produced nothing but failure for ages. In fact, the crude inflationism supported by Mr. Wolf and a whole host of modern-day central planners is just about the hoariest economic idea there is. Its practical implementation predates the misguided economic theories trying to provide it with a “scientific” fig leaf by many centuries. Let us not forget, inflationism inter alia brought down the Roman Empire. If Mr. Wolf wants to save his precious elites, he should actually consider refraining from calling for more of the same. Photo credit: Financial Times |

| Since 1980, employment in manufacturing – the source of good wages for the middle and lower classes – has fallen in all the major developed economies, including Germany and Japan. In most of them, it has been roughly cut in half.

We’re not sure if it were these facts themselves, or the dreaded populist rage… but after reciting them, poor Mr. Wolf begins eating the rug:

“Prolonged stagnation, cultural upheavals and policy failures are combining to shake the balance between democratic legitimacy and global order.

“The candidacy of Mr. Trump is a result. Those who reject the chauvinist response must come forward with imaginative and ambitious ideas aimed at reestablishing that balance.

“Our civilization itself is at stake.”

|

Now we know who did this! A linguistic aside: according to Jonathon Green’s Dictionary of Slang, the expression “chewing the carpet” is 1950s US slang, defined as ‘to lose emotional control, to have a temper tantrum‘. It is thought that Hitler was actually the source of the expression, as he displayed very odd behavior at times, which testified to his highly imbalanced state of mind. According to John Toland’s Hitler biography, incidents of Hitler literally chewing the edge of a carpet in a blind rage were indeed witnessed by several members of his inner circle at the “Eagle’s Nest” near Berchtesgaden in Bavaria (if you see someone doing that, try to make sure he doesn’t come to power). Photo credit: Phoenix 21 LLC |