M&A activity has started the year strongly, especially in Europe, with cash-only deals to the fore as funding conditions continue to tighten.So far this year equity returns have been fairly disappointing and market volatility has significant increased compared with 2017. However, disappointment has been driven neither by poor economic conditions nor by a worsening of company fundamentals, and mergers and acquisitions (M&A) remain supportive. The acceleration of M&A in some regions illustrates that investor sentiment is not that pessimistic, which should help equity markets in the coming months.M&A activity kicked off this year strongly. Since January, 41 deals above USD1bn have been announced in the US, 30 in Europe and 20 in emerging markets (EM). Annualising those figures shows an

Topics:

Jacques Henry considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

M&A activity has started the year strongly, especially in Europe, with cash-only deals to the fore as funding conditions continue to tighten.

So far this year equity returns have been fairly disappointing and market volatility has significant increased compared with 2017. However, disappointment has been driven neither by poor economic conditions nor by a worsening of company fundamentals, and mergers and acquisitions (M&A) remain supportive. The acceleration of M&A in some regions illustrates that investor sentiment is not that pessimistic, which should help equity markets in the coming months.

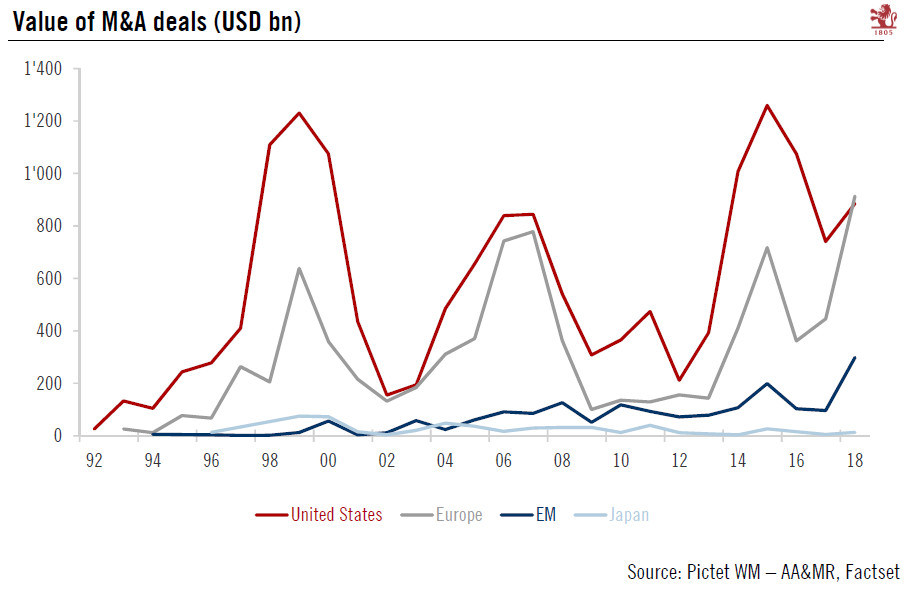

M&A activity kicked off this year strongly. Since January, 41 deals above USD1bn have been announced in the US, 30 in Europe and 20 in emerging markets (EM). Annualising those figures shows an increase relative to 2017 in all these regions, with the strongest acceleration in Europe and EM. Annualised M&A represents today 4% of market capitalisation in the US and 9% in Europe. The aggregate value of deals has also been impressive—USD284bn in the US, USD293bn in Europe and USD96bn in EM.

The premium paid by acquirers has been generous, at around 30% of market value in the US and over 40% in Europe, significantly higher than the 2017 average. Valuations have been close to 13x EV/EBITDA in the US. The biggest deals have been in healthcare, both in the US and Europe, followed by tech in the US and consumer discretionary in Europe.

Long-term interest rates have increased so far this year, both for sovereigns and for corporates, impacting the kind of M&A deals being undertaken. Cash-only deals have increased over last year, suggesting more debt financing to beat rises in interest rates.

Historically, big deals are more likely to fail in Europe than in the US. On average, since 1992, 19% of announced deals have eventually failed globally or were never finalised (20.6% in Europe, and 17.5% in the US). The way mega deals are treated by the authorities from one region to another goes some way to explaining the difference in the ‘failure rate’.

In Japan, domestic M&A activity has always been tepid, with the volume of deals representing less than 1% of market cap since 2012. Promoting M&A has not been one of Abenomics’ targets, even though corporate mergers could be a way to improve efficiency and deal with excess cash on balance sheets. Nonetheless, Japanese companies remain highly active in M&A outside Japan, having acquired companies worth USD97bn since the beginning of the year.