We still expect US 10-year yield to end 2018 at around 3.0%, but risks of a rise to 3.5% have increased.The 10-year Treasury yield broke through the key 3% threshold last week– as we had expected it would at some stage in our central scenario. We are sticking to this central scenario, which sees the 10-year Treasury yield ending the year at around 3%, but with some spikes above this level in Q2 and Q3 due to inflation fears.The central scenario (to which we assign a 55% probability) for US sovereign bonds yields in 2018 is based on three macroeconomic factors: Inflation: which we expect to remain moderate in the US, with core Personal Consumption Expenditure (PCE, the Fed’s favourite measure) to remain around 2% y-o-y in 2018.Monetary policy: tightening to continue, with four US Federal

Topics:

Laureline Chatelain considers the following as important: Macroview, Rising Treasury yields, US 10-year Treasury outlook, US government bonds, US sovereign bonds yields

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

We still expect US 10-year yield to end 2018 at around 3.0%, but risks of a rise to 3.5% have increased.

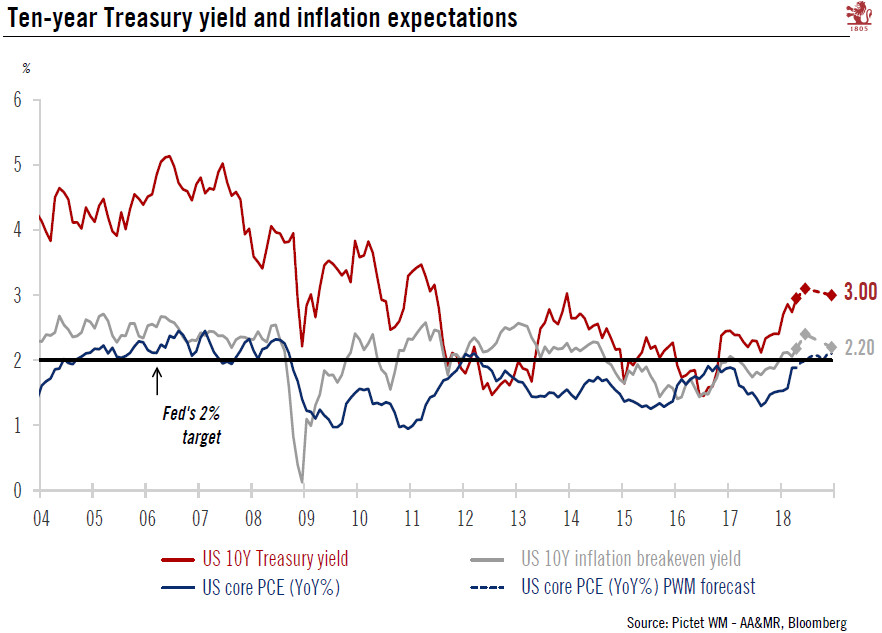

The 10-year Treasury yield broke through the key 3% threshold last week– as we had expected it would at some stage in our central scenario. We are sticking to this central scenario, which sees the 10-year Treasury yield ending the year at around 3%, but with some spikes above this level in Q2 and Q3 due to inflation fears.

The central scenario (to which we assign a 55% probability) for US sovereign bonds yields in 2018 is based on three macroeconomic factors:

- Inflation: which we expect to remain moderate in the US, with core Personal Consumption Expenditure (PCE, the Fed’s favourite measure) to remain around 2% y-o-y in 2018.

- Monetary policy: tightening to continue, with four US Federal Reserve (Fed) rate hikes in 2018 (so three more still likely to come) and gradual balance sheet reduction.

- Fiscal policy: fiscal easing and tax reform should boost 2018 US GDP growth to 3%.

Based on these three factors, we expect the Treasury yield curve to continue to flatten as short-term yields rise more as a result of the Fed’s hikes than long-term yields, leaving the 10-year Treasury yield around 3% by the end of the year. Such flattening has taken place in previous hiking cycles. However, the risk of an alternative scenario in which the ten-year Treasury yield ends the year around 3.5% has increased from 25% to 35%.

In this alternative scenario, inflation would exceed and remain above the Fed’s 2% target, leading to renewed inflation fears. This could halt the US yield curve’s flattening. The Philips curve – the inverse relationship between the unemployment rate and the rate of inflation – would wake up, leading to a durable rise in US wage growth above 3%. This would push long-term inflation expectations higher, leading the 10-year Treasury yield to rise to around 3.5. A further increase in the price of oil could also lead to rising inflation expectations as the 10-year Treasury inflation breakeven yield has been positively correlated to oil prices.

All in all, we expect the 10-year Treasury yield to move higher in the coming months, whether our central or upside scenario prevails. As the risk remains tilted to the upside for yields, we remain bearish on US government bonds. The risk-reward profile of a long-duration US Treasuries position does not look attractive, so we favour a rather short-duration stance, especially as short-term yields have risen significantly this year and offer some interesting carry.