The euro area economy’s loss of momentum in Q1 derived largely from temporary factors. We remain construction on the cyclical outlook.Euro area real GDP expanded by 0.4% q-o-q in Q1, or 1.7% in annualised terms, according to Eurostat’s flash estimate. This comes after an upwardly revised figure of 0.7% q-o-q in Q4 2017. Although this first estimate could be subject to statistical revisions, it confirms that the euro area economy lost some momentum in Q1.This Q1 flash estimate confirms that most business confidence surveys overestimated growth at the beginning of the year, with the ‘true pace’ of economic expansion lying somewhere in between estimates based on available soft and hard data.Looking ahead, the latest data suggest that the slowdown of recent months has likely halted: soft

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: Euro area GDP growth, euro area GDP growth momentum, euro area Q1 GDP, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The euro area economy’s loss of momentum in Q1 derived largely from temporary factors. We remain construction on the cyclical outlook.

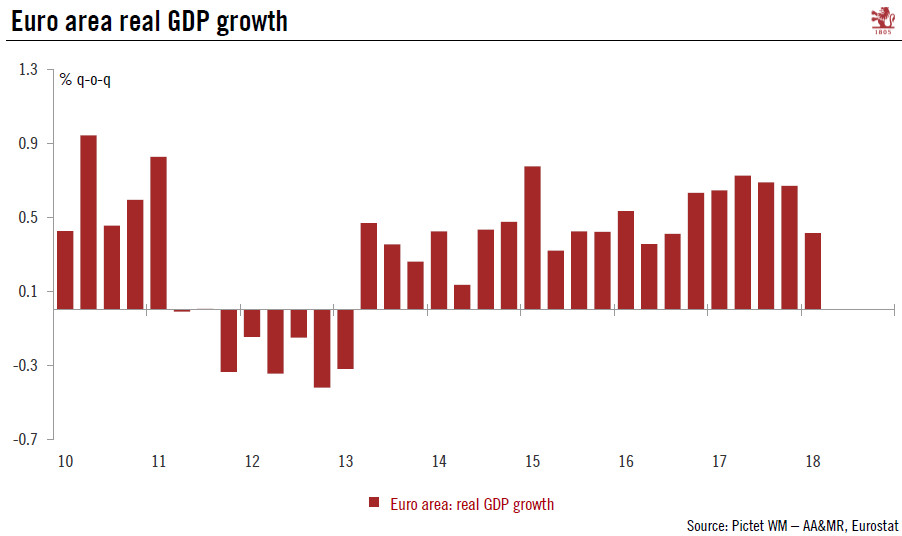

Euro area real GDP expanded by 0.4% q-o-q in Q1, or 1.7% in annualised terms, according to Eurostat’s flash estimate. This comes after an upwardly revised figure of 0.7% q-o-q in Q4 2017. Although this first estimate could be subject to statistical revisions, it confirms that the euro area economy lost some momentum in Q1.

This Q1 flash estimate confirms that most business confidence surveys overestimated growth at the beginning of the year, with the ‘true pace’ of economic expansion lying somewhere in between estimates based on available soft and hard data.

Looking ahead, the latest data suggest that the slowdown of recent months has likely halted: soft indicators (purchasing managers indexes, European Commission economic sentiment) stabilised in April at levels consistent with the euro area economy growing at a healthy rate well above 2%.

Euro area real GDP now stands 6.1% above its pre-crisis level. The carryover effect for 2018 reached 1.4%, meaning that even with zero growth in the remaining three quarters of 2018, euro area GDP would grow by 1.4% on average this year. Based on high-frequency data and some country specific releases, domestic demand was the main driver of growth in Q1.

The implications of the growth slowdown on ECB staff projections should remain limited, in our view. The staff is likely to forecast a rebound in Q2 while leaving their medium-term outlook broadly unchanged. As a result, the staff’s 2018 GDP growth projection may be revised only marginally lower, from 2.4% to 2.3%, in line with our own forecast. The onus should remain on core inflation as regards the timing of the ECB’s next policy decision.

Overall, we remain constructive on the euro area cyclical outlook. Fundamentals supporting households and business spending remain consistent with a robust, broad-based economic expansion this year, if at a slightly slower pace than last year. We forecast euro area GDP growth of 2.3% in 2018, after 2.5% in 2017.