With moderate inflation momentum in Japan, we expect the BoJ to keep its monetary policy unchanged in 2018, although the possibility of a policy adjustment in 2019 might be rising.At its latest monetary policy meeting on April 27, the Bank of Japan (BoJ) decided to keep its current monetary easing programme intact.Under its yield curve control (YCC) policy, the BoJ applies a negative interest rate of -0.1% to the policy-rate balances in the current accounts held by financial institutions at the Bank, and the BoJ will continue to purchase Japanese government bonds (JGBs) so that 10-year JGB yields remain at around 0%. Regarding asset purchases, the BoJ’s guideline of increasing its holdings by about JPY80 trillion per year remains unchanged, although the actual amount of purchases by the

Topics:

Dong Chen considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

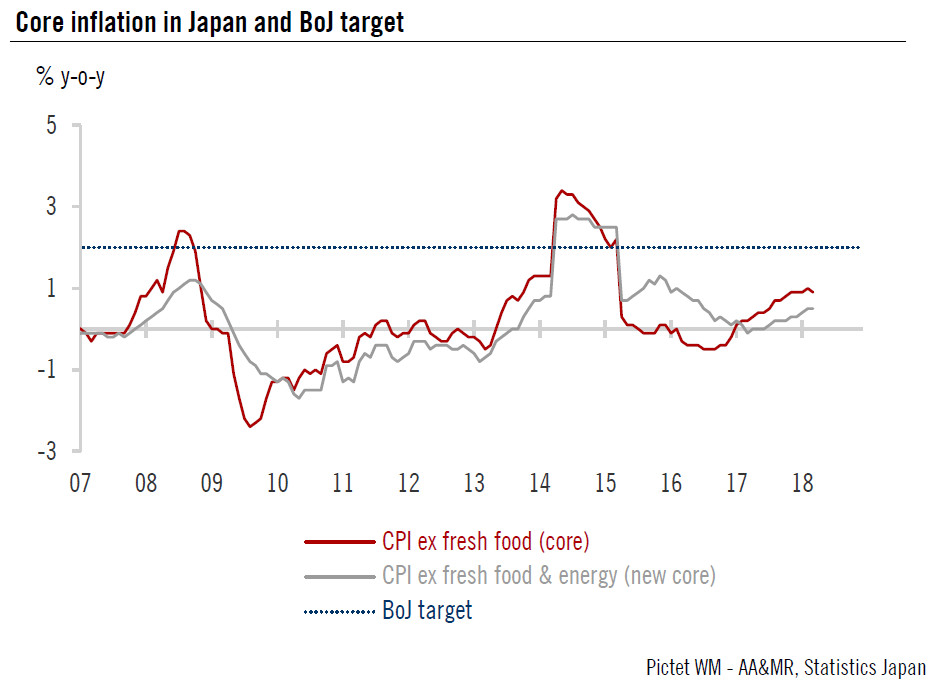

With moderate inflation momentum in Japan, we expect the BoJ to keep its monetary policy unchanged in 2018, although the possibility of a policy adjustment in 2019 might be rising.

At its latest monetary policy meeting on April 27, the Bank of Japan (BoJ) decided to keep its current monetary easing programme intact.

Under its yield curve control (YCC) policy, the BoJ applies a negative interest rate of -0.1% to the policy-rate balances in the current accounts held by financial institutions at the Bank, and the BoJ will continue to purchase Japanese government bonds (JGBs) so that 10-year JGB yields remain at around 0%. Regarding asset purchases, the BoJ’s guideline of increasing its holdings by about JPY80 trillion per year remains unchanged, although the actual amount of purchases by the Bank has decreased quite significantly in recent quarters. In addition, the Bank will continue to purchase exchange-traded funds and Japan real estate investment trusts (J-REITs) at a rate of about JPY6 trillion and JPY90 billion per year, respectively.

Regarding the economic and inflation outlook, the tone of the BoJ’s report is quite similar to previous ones, with a slight dovish bias when it comes to economic growth going forward.

With the tightening labour market (there are 1.6 jobs for every job applicant in Japan), the average nominal cash earnings of Japanese workers grew 1.3% y-o-y in February, compared to average growth of 0.4% in 2017. If wage growth remains buoyant, it will put pressure on inflation going forward. However, while inflation is rising, but the rise may be slow and gradual. We do not expect Japan’s core inflation to move significantly above 1.0% in the near future.

All in all, the status quo at the BoJ is in line with the market consensus as well as our own expectations. With the JGB yield curve firmly under the BoJ’s control and no pronounced side effects from monetary easing, the central bank does not seem to face any significant pressure to end its stimulus policy in the near term. However, if wage pressure continues to mount and translates into more sustained inflation momentum, the case for a BoJ exit from monetary easing will grow stronger. This means the likelihood of a move toward policy normalisation in 2019 could be rising, perhaps starting with an adjustment in the BoJ’s yield curve targets.