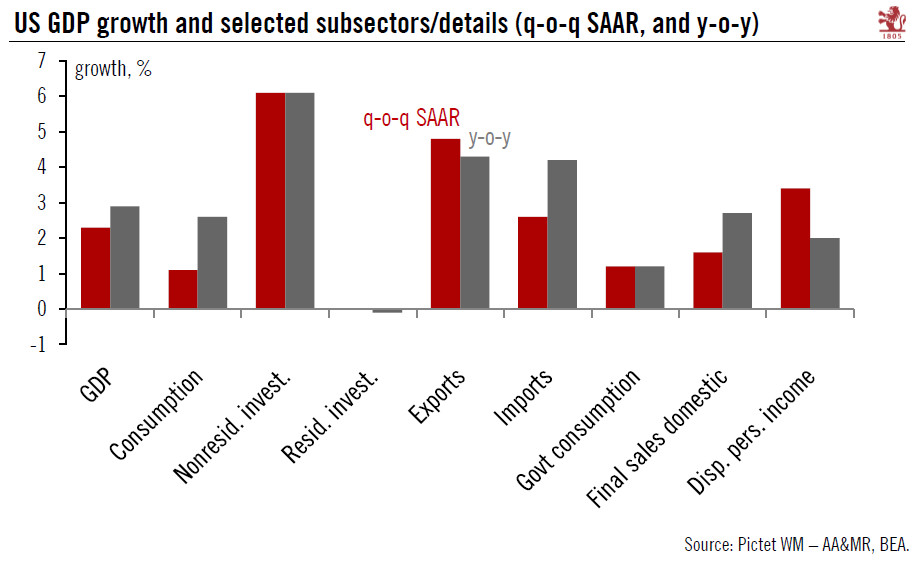

Economic growth in the US slowed in Q1, but we expect a sharp rebound in Q2 as household consumption and corporate investment pick up.US Q1 GDP grew 2.3% q-o-q SAAR, slowing from 2.9% in Q4. Part of the deceleration was due to ‘residual seasonality’, we think, and was therefore technical.We expect US private consumption to rebound sharply in Q2, and, with investment growth likely to stay firm, we think Q2 GDP growth could head towards 3.5-4.0%.The Q1 employment cost index wage reading was solid at 0.8% q-o-q, accelerating from 0.6% in Q4. This is in line with our view that wage growth will continue to improve but remain under control. Wage growth should gently head towards 3.0% y-o-y later this year, in our view.We still expect three additional Fed rate hikes this year (with the next one

Topics:

Thomas Costerg considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Economic growth in the US slowed in Q1, but we expect a sharp rebound in Q2 as household consumption and corporate investment pick up.

US Q1 GDP grew 2.3% q-o-q SAAR, slowing from 2.9% in Q4. Part of the deceleration was due to ‘residual seasonality’, we think, and was therefore technical.

We expect US private consumption to rebound sharply in Q2, and, with investment growth likely to stay firm, we think Q2 GDP growth could head towards 3.5-4.0%.

The Q1 employment cost index wage reading was solid at 0.8% q-o-q, accelerating from 0.6% in Q4. This is in line with our view that wage growth will continue to improve but remain under control. Wage growth should gently head towards 3.0% y-o-y later this year, in our view.

We still expect three additional Fed rate hikes this year (with the next one at the Fed’s June meeting) and two more next year.