Over the past 10 days, the euro has declined significantly against the US dollar. On 26 April, the EUR/USD rate moved below the low of its 1.21501.2550 trading range, which had been in place since 18 January. Reasons for this decline can be found in the growth differential and monetary policy divergence. Indeed, moderation in leading indicators (from elevated levels) in the euro area and a cautious ECB (given muted underlying inflationary pressures) have weighed on the single currency recently. In the meantime, soft data remains buoyant in the US and the Fed has become increasingly hawkish. Significant long euro positioning among short-term investors has not helped either. Regarding the growth differential, we remain

Topics:

Luc Luyet considers the following as important: 2) Swiss and European Macro, Featured, Macroview, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Over the past 10 days, the euro has declined significantly against the US dollar. On 26 April, the EUR/USD rate moved below the low of its 1.21501.2550 trading range, which had been in place since 18 January.

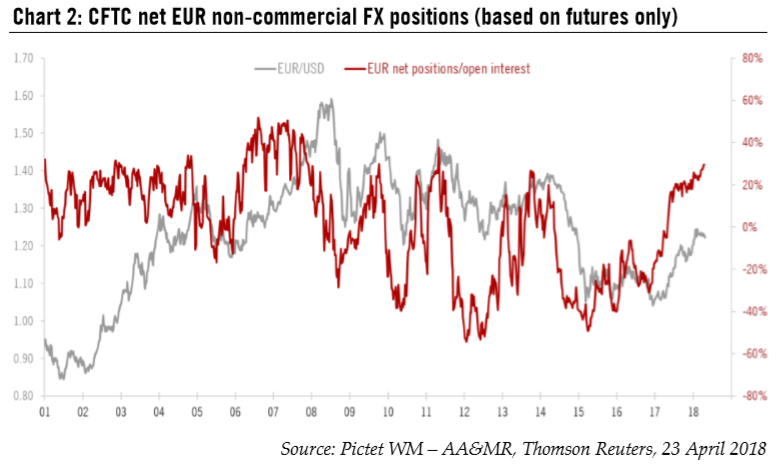

Reasons for this decline can be found in the growth differential and monetary policy divergence. Indeed, moderation in leading indicators (from elevated levels) in the euro area and a cautious ECB (given muted underlying inflationary pressures) have weighed on the single currency recently. In the meantime, soft data remains buoyant in the US and the Fed has become increasingly hawkish. Significant long euro positioning among short-term investors has not helped either.

| Regarding the growth differential, we remain confident about the cyclical recovery in the euro area. Indicators are still consistent with robust, broadbased economic expansion this year, if at a slightly slower pace than in 2017. We expect euro area GDP growth of 2.3% in 2018 compared with 2.5% in 2017. In the US, Q2 GDP growth is likely to be strong after a softish Q1 reading, and there is no sign of an imminent slowdown in the growth outlook.

Overall, while the growth differential should prove positive for the US in the short term, the low probability of a sharp slowdown in the euro area (contrary to what is implied by recent hard data) and some moderation in the US after a likely sharp rebound in Q2 GDP should mean this factor is neutral for the EUR/USD rate in the next 12 months. As for monetary policy, the muted underlying inflationary pressure in the euro area has made the ECB prudent whereas the risk of economic overheating in the US following the Trump tax cuts has made the Fed more hawkish. This dynamic is supportive of the greenback relative to the euro but is unlikely to last. Indeed, according to our central scenario, we expect a more visible upward adjustment in core inflation in the euro area at the start of Q4 2018. This should make the ECB even more confident than it is about tightening monetary policy. In the US, market expectations have been pricing in a more hawkish Fed since the end of October last. The scope for further upward adjustments to rate expectations in the US relative to our scenario seems now rather limited (see chart 1). We could soon enter a phase when medium-term market expectations start to plateau. Overall, monetary policy divergence is seen as becoming positive for the euro relative to the dollar in the medium term as there is more scope for upward market repricing of the ECB’s monetary stance than of the Fed’s. |

Expectations for Fed Funds Rate vs. Fed ‘dot plot’, May 2018 - Dec 2019 |

Scope for short-term overshootingThe break of the tight range within which the EUR/USD had been trading in the early part of this year is taking place at a time when speculative long euro positioning is at very elevated levels (see chart 2). The combination of these two technical elements, coupled with a likely disappointment in April euro area inflation (data will be released on 3 May), could mean the EUR/USD rate falls below our three-month projection of USD1.20 in the short term. That being said, we see the recent strength of the US dollar as temporary and likely to peak around the middle of the year. So we continue to consider any further short term dollar strength as a medium-term selling opportunity given our 12-month projection of USD1.28 per EUR. |

CFTC Net EUR Non-commercial FX Positions (based on futures only), 2001 - 2018 |

Tags: Featured,Macroview,newsletter