India has a new central bank head. North Korea detonated a nuclear device. The Turkish government may be eyeing the central bank for the next purge. Mexican Finance Minister Videgaray resigned. Incoming Mexican Finance Minister Meade announced new spending cuts. In the EM equity space as measured by MSCI, Colombia (+4.1%), Hong Kong (+3.9%), and China (+3.6%) have outperformed this week, while Thailand (-4.4%), Qatar...

Read More »Fiction, Fairy Tales, and Fiat

Originally Published at Money Metals Exchange Do young Americans today know anything about economics? No, they don’t, according to a study during the 2016 presidential primary season, which says lots of other Americans don’t either. The survey found 58% of millennials favor government-run socialism (statistically 6 out of 10), while a nearly identical number (64%) don’t want government interference in free markets. The...

Read More »FX Daily, September 9: Ahead of the Weekend

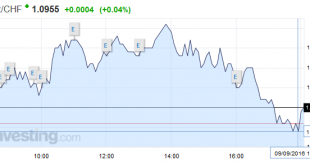

(Dublin business trip is ending, London next week, sporadic posts to continue) Swiss Franc Click to enlarge. FX Rates The US dollar is lower against all the major currencies this week as North American participants close it out. On the day, the dollar is consolidating swings yesterday and is narrowly mixed. Bond yields are higher and equities are mostly lower. The euro has finished lower the last three Fridays....

Read More »Swiss stocks fluctuate as central bank decisions dominate the landscape

SMI The Swiss Market Index, along with other European markets, fluctuated this week as central bank decisions dominated the landscape. Click to enlarge. Economic Data Equity markets advanced at the beginning of the week as chances of the Federal Reserve raising US interest rates later this month declined after a surprisingly weak report on the US service-sector earlier this week. The report followed data last week...

Read More »Basel to overtake Zurich as second-most attractive Swiss canton

Basel to overtake Zurich Basel City will leapfrog Zurich to become Switzerland’s second-most attractive location for businesses by 2020 as Swiss cantons cut corporate tax to bolster their appeal, according to Credit Suisse Group AG. Basel, home of Roche Holding AG and Novartis AG, will move up two places in the ranking of 26 cantons over the next four years, given a plan to reduce its tax rate to 13 percent from...

Read More »Swiss trains the most expensive in Europe

The following study shows that Switzerland’s trains are the most expensive in Europe. Effectively many tourists are shocked by the high Swiss prices. But there are objections: Nearly all Swiss train commuters possess either a half fare ticket or a monthly or yearly public transport ticket for their way to work. This reduces the high prices heavily. Moreover, the Swiss trains are the quickest and most punctual. For a...

Read More »Negative and the War On Cash, Part 2: “Closing The Escape Routes”

Submitted by Nicole Foss via The Automatic Earth blog, Part 1 Here. History teaches us that central authorities dislike escape routes, at least for the majority, and are therefore prone to closing them, so that control of a limited money supply can remain in the hands of the very few. In the 1930s, gold was the escape route, so gold was confiscated. As Alan Greenspan wrote in 1966: In the absence of the gold...

Read More »FX Daily September 9: Draghi Says Little, Door Still Open for More

[unable to retrieve full-text content]In the last two days, the euro moved upwards against CHF. Given that Swiss GDP was stronger than the one in the euro zone, this is surprising. But we must recognize that Draghi could be the reason. Inflation forecasts of 1.2% in 2017 and 1.8% in the euro zone would mean the ECB hikes rates maybe in 2018 or 2019. I personally do not believe it, given that wage inflation in Italy or Spain is clearly under 1%. This is lower than Swiss wage inflation of 0.8%.

Read More »Our Selfie Society Is Incompatible with Democracy

[unable to retrieve full-text content]Now that the U.S. is a neoliberal selfie society, we have the worst of all possible worlds in terms of a failed, doomed democracy. Each individual's liberty to do whatever you want, be whatever you want, go wherever you want, etc. (within the legal boundaries set by the state) is the core of the American Dream. The individual's civil liberties and right to the unlimited pursuit of happiness is sacrosanct.

Read More »How is Real Wealth Created?

[unable to retrieve full-text content]An Abrupt Drop. Let’s turn back to our regular beat: the U.S. economy and its capital markets. We’ve been warning that the Fed would never make any substantial increase to interest rates. Not willingly, at least. Each time Fed chief Janet Yellen opens her mouth, out comes a hint that more rate hikes might be coming.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org