An Alert for the Global Posse of Liquidity Junkies In the summer of 2015 and again in December-February this year, global stock markets were rattled by weakness in the yuan’s exchange rate vs. the US dollar. Yuan weakness is widely held to exacerbate pressures on other (already weak) emerging market currencies, but more importantly, it is seen as a symptom of accelerating capital flight from China. USD-CNY, daily; onshore yuan rate USD-CNY, daily (a rising price denotes yuan weakness) – slowly creeping toward Panicville again? Resistance is between 6.60 and 6.65 – we suspect that if that level is exceeded, all hell could break loose again. USD-CNY, daily; onshore yuan rate – click to enlarge. Why is it considered important whether or not China’s foreign exchange reserves are increasing or declining? Similar to Japan, China has become a major cog in the global fiat money Ponzi game, in which foreign central banks monetize US treasury bonds by recycling dollar-denominated trade surpluses. Now, it should be clear that the term “monetization” does not refer to the creation of additional US dollars in this case – those can only be created by the Fed and the US banking system.

Topics:

Pater Tenebrarum considers the following as important: Central Banks, China Money Supply M1, commodity currencies, Debt and the Fallacies of Paper Money, Featured, Lance Roberts, Monetization, newsletter, On Economy, SSEC daily, USD-CNY

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

An Alert for the Global Posse of Liquidity Junkies

In the summer of 2015 and again in December-February this year, global stock markets were rattled by weakness in the yuan’s exchange rate vs. the US dollar. Yuan weakness is widely held to exacerbate pressures on other (already weak) emerging market currencies, but more importantly, it is seen as a symptom of accelerating capital flight from China.

USD-CNY, daily; onshore yuan rateUSD-CNY, daily (a rising price denotes yuan weakness) – slowly creeping toward Panicville again? Resistance is between 6.60 and 6.65 – we suspect that if that level is exceeded, all hell could break loose again. |

Why is it considered important whether or not China’s foreign exchange reserves are increasing or declining? Similar to Japan, China has become a major cog in the global fiat money Ponzi game, in which foreign central banks monetize US treasury bonds by recycling dollar-denominated trade surpluses.

Now, it should be clear that the term “monetization” does not refer to the creation of additional US dollars in this case – those can only be created by the Fed and the US banking system. Rather, foreign CBs are boosting their domestic money supply when they buy dollars from their exporters – since they are paying for these dollars with domestic currency they create out of thin air.

In China the effect of dollar inflows on the domestic money supply is especially pronounced. In fact, in order to stem the pace of money supply and credit growth lest it get out of hand completely, the PBoC has imposed one of the highest minimum reserve requirements in the world and is regularly altering it to influence credit and money supply growth in the country.

By way of the minimum reserve requirement the PBoC intends to at least brake additional growth of the yuan money supply (beyond the growth caused directly by its USD purchases) to some extent, i.e., money supply growth which its fractionally reserved banks are generating by granting ever more inflationary credit.

It should be obvious though that the PBoC has actually remarkably little control over inflationary credit growth through its official “toolkit”, as the effect is only indirect. Luckily (from the perspective of the central planners), it can also simply issue orders to the (largely state-owned) big banks and can by and large be certain that it will be obeyed.

Achilles Heel

Market participants worry though about capital flows. Assorted liquidity junkies rightly see China’s forex reserves as an Achilles heel. The reason is that a decline in these reserves hampers the PBoC’s ability to manipulate money supply growth in an upward direction. This in turn is regarded as very important in order to keep various bubble activities intact – not only in China, but also in the rest of the world, e.g. through the effects China exerts on commodity prices.

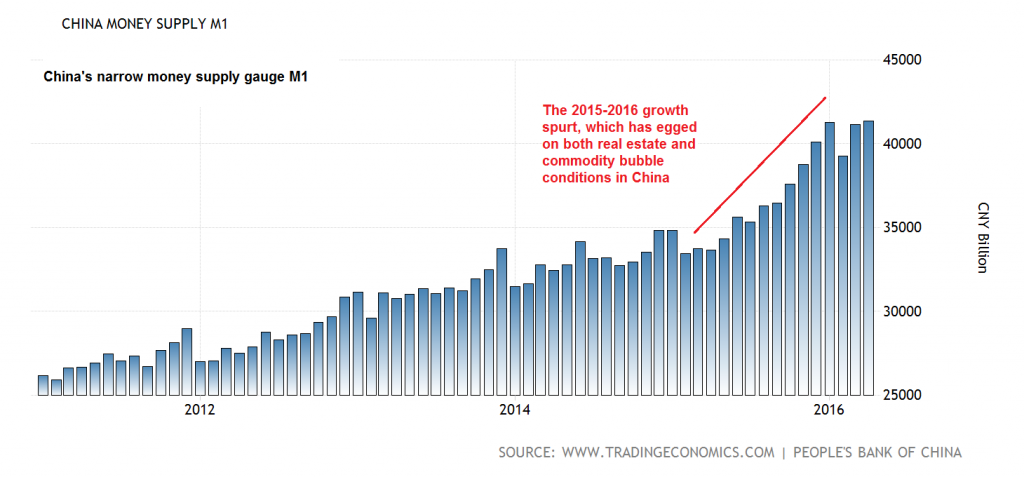

China money supply M1China’s narrow money supply M1. This may be one of the world’s most important data points for the global posse of liquidity junkies. As of April 2016, the situation is still fine from their perspective. |

As we have described in “The Pitfalls of Currency Manipulation”, China’s authorities have recently resorted to all sorts of tricks in order to mask the pace of the outflow of foreign exchange from China – primarily with the help of derivatives transactions (yuan forwards have been employed to surreptitiously support the exchange rate).

Such manipulations tend to work great in the short term, but they are also making devastating calamities in the long term far more likely. But we’re all dead in the long term anyway, so who cares, right?

So Far, the Seas Remain Calm

Although there has been a sharp pullback in some commodity prices of late (see e.g. the chart of steel rebar futures we showed yesterday), there are no signs of concern in other asset markets yet. Particularly stocks and junk bonds have held up quite well so far, although various stock markets have drifted even further apart in terms of performance. Traditionally this tends to be a warning sign (compare e.g. the Euro Stoxx 50 to the S&P 500).

The Shanghai Composite Index has essentially done nothing since its December-January nosedive. However, it has been quite strong overnight, rebounding from a slightly higher low. This may be a tentative sign that speculators in China are shifting back from commodities to stocks – although definitive conclusions would be premature at this stage.

SSEC dailyShanghai Composite, daily. Essentially moving sideways since the January low. |

In the US, stock market investors have completely ignored weakening corporate earnings, the looming threat of another rate hike, as well as the economy’s weakness. In spite of a recent improvement in data, it still seems to us as though the US manufacturing sector is already in recession.

As Lance Roberts explains here, the temporary improvement was very likely due to a mixture of seasonal adjustments and very mild winter weather. The most recent data releases are actually confirming this, as the downtrend in manufacturing survey data has resumed.

Still, given the recent calm in markets, one has to be open to the possibility that the previous correlation between the the yuan-dollar exchange rate and risk assets is fading and is therefore no longer as meaningful as it once was. However, we actually doubt that this conclusion is warranted.

The basic problem declining forex reserves in China pose to the markets remains the same after all – ergo, there is no obvious reason why markets should react differently to noticeable movements in the yuan exchange rate.

Conclusion

We would recommend to keep a very close eye on USD-CNY, as well as on various “commodity currencies” such as the Australian dollar, the Canadian dollar and the South African rand, which have lately begun to weaken again as well.

If these trends continue, they will definitely be reflected in commodity prices at some point, and this effect could then propagate to other markets – i.e., the opposite of the chain reaction that could be observed between early February and today.

We suspect that if the yuan breaks to a new low for the move (i.e., if USD-CNY breaks above lateral resistance in the 6.60 to 6.65 area), concerns about China’s reserves and exchange rate policy will be rekindled. The relative calm in “risk asset” markets could then very quickly give way to panic again.

Charts by: BarChart, TradingEconomics, BigCharts

Previous post Next post