The US dollar is trading with a heavier bias to start the month of June. Weaker stocks and firmer bonds has seen the yen rise the most, while sterling’s losses have been extended after an ICM telephone survey showed a small lead for those favoring Brexit. The Swiss Franc was one of the strongest performers. Click to enlarge. The Nikkei fell 1.6%, the largest loss since May 2 and snaps a five-day advance. The delay in the sales tax was confirmed. This second delay now puts it out into late 2019. The economic data from Japan was mixed. Capital expenditures in Q1 were stronger than expected (4.2% vs. 2.4%), and this warns of upside risks upside revisions to Q1 GDP (June 8) after it had already surprised to the upside. On the other hand, Q2 is off to a soft start. The May manufacturing PMI stands at 47.7 (up from 47.6 in the preliminary estimate), but still off from 48.2 in April. May’s decline was the fifth consecutive month. The average from Q1 was 50.5. The US dollar fell to JPY109.65, after seeing a high near JPY111.45 at the start of the week. The 20-day moving average is at JPY109.40. The greenback has not closed below this average since May 13. Below there is a band of support between JPY109.00 and JPY109.20. A break of that support signals a move toward JPY108.50.

Topics:

Marc Chandler considers the following as important: EUR, Featured, FX Daily, FX Trends, GBP, JPY, newsletter, USD

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

|

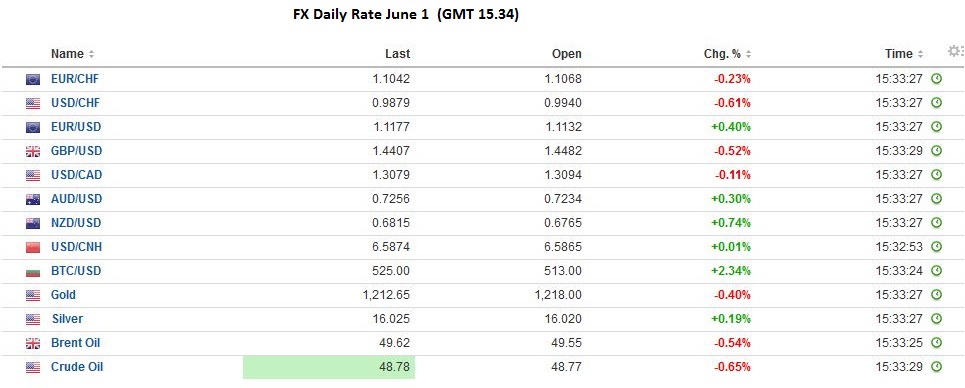

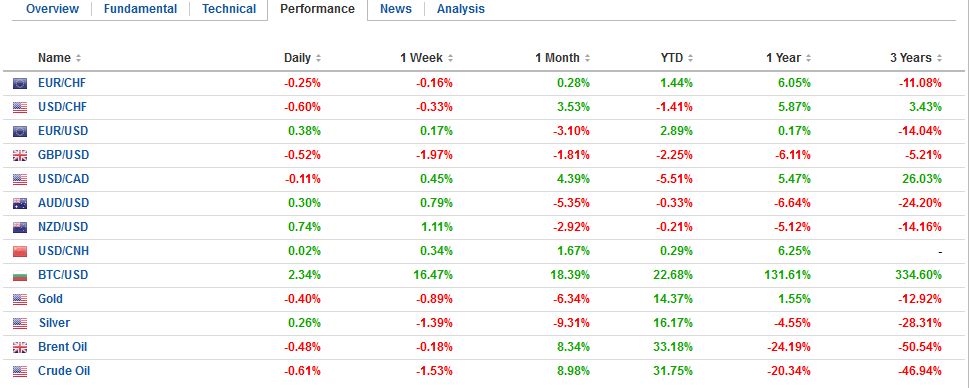

The US dollar is trading with a heavier bias to start the month of June. Weaker stocks and firmer bonds has seen the yen rise the most, while sterling’s losses have been extended after an ICM telephone survey showed a small lead for those favoring Brexit.

The Swiss Franc was one of the strongest performers.

|

|

The Nikkei fell 1.6%, the largest loss since May 2 and snaps a five-day advance. The delay in the sales tax was confirmed. This second delay now puts it out into late 2019. The economic data from Japan was mixed. Capital expenditures in Q1 were stronger than expected (4.2% vs. 2.4%), and this warns of upside risks upside revisions to Q1 GDP (June 8) after it had already surprised to the upside.

On the other hand, Q2 is off to a soft start. The May manufacturing PMI stands at 47.7 (up from 47.6 in the preliminary estimate), but still off from 48.2 in April. May’s decline was the fifth consecutive month. The average from Q1 was 50.5.

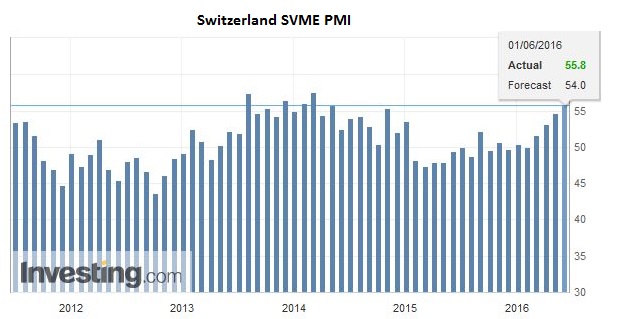

Switzerland

The Swiss SVME PMI is mostly driven by the industrial sector, hence with the machinery and electronics industry. They compete strongly with the Germans, and got shocked by the end of the peg.

Surprisingly they have outperformed in recent months. The Swiss PMI is the strongest of the all PMIs in this post.

continued by Marc Chandler

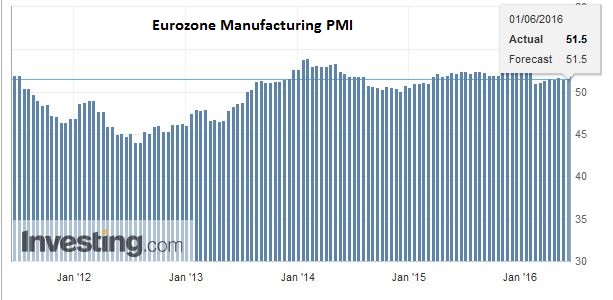

EurozoneThe May manufacturing PMIs are the main economic news from Europe. The eurozone PMI was unchanged from the preliminary reading of 51.5, which is off 0.2 from April’s 51.7 reading. The April report matched the average of Q1. However, on a trend basis, there has been a gradual decline since the beginning of the year, despite small upticks in February and March.

The main country breakdown shows the loss of momentum is widespread. Germany’s is at 52.1 from 52.4 of the flash reading, but it remains a bright spot within Europe. It is the third monthly increase and stands above the Q1 average of 51.2. France ticked up to 48.4 from the flash’s 48.3. It is third month below the 50-boom/bust level. Despite the weakness in PMI, which averaged below 50 in Q1, GDP for the Jan-March period was 0.6%, matching its best quarter since 2013.

Italy and Spain also disappointed. The Italian manufacturing PMI fell to 52.4 from 53.9. It was not expected to fall as much. It peaked at the end of last year at 55.6 and is now below the Q1 average (53.0). Spain;’s manufacturing PMI dropped to 51.8 from 53.5. It is the lowest reading since last October. It averaged 54.3 in Q1.

|

Japan

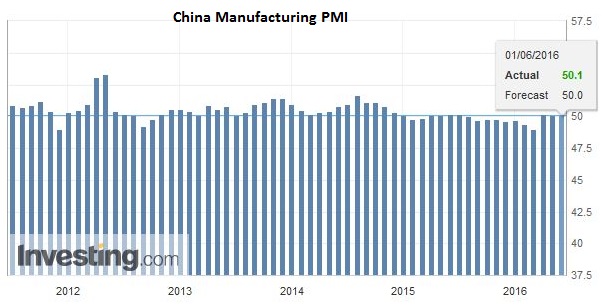

ChinaSecond, China’s official PMIs showed some stabilization taking place in the world’s second-largest economy. The manufacturing PMI was steady at 50.1, while the service sector slipped to 53.1 from 53.5. The Caixin manufacturing PMI eased to 49.2 from 49.4. The dollar approached the year’s high against the yuan before reversing lower. If the greenback’s recent gains against the other major currencies are pared today, it would not be surprising if the yuan is “fixed” higher tomorrow.

|